Road tolls and risk allocation between public and private partners

The value and number of PPP deals is only one, quantitative, aspect of PPPs. The allocation of risk between the private and public sector is another important feature to be considered as it affects the underlying incentive structure of PPP contracts.

Unfortunately, little data on risk allocation between the public and private sector is available. However, looking at the most common toll types that are used as payment mechanisms in road PPPs allows some insights in how risk allocation evolved during the financial crisis. In particular, traffic risk depends primarily on the performance of the economy, changes in behaviour of users when new transport facilities are offered and the competition from other means of transport. We consider three toll types:

- Real toll (i.e., toll roads) arrangements, with the private partner fully exposed to demand (traffic) risk.

- Shadow toll arrangements, under which the private partner is reimbursed based on traffic usage - however payments are made by the public sector procuring agency.

- Availability payments made on the basis of the availability of the transport system; the demand risk is typically born by the public sector.

- A combination of the above ("mixed").

Note that a change in payment structures does not necessarily equate to a change in risk allocation between the public authority and the private partner. The level of exposure of the private partner to traffic risk under a shadow tolling arrangement can vary extensively, as it depends on the particular conditions of the arrangement. For instance the concessionaire's marginal revenue may decrease as traffic volumes increase to avoid government over-spending.

"Mixed" tolls include a number of constellations whose payment structures may vary considerably in terms of risk allocation between the public authority and the private partner.11 In particular, minimum revenue guarantees, minimum traffic guarantees or other government support mechanisms (i.e., cash subsidies, up-front payments) may heavily affect the risk allocation between the public and private sector and therefore the incentive structure of a PPP contract.

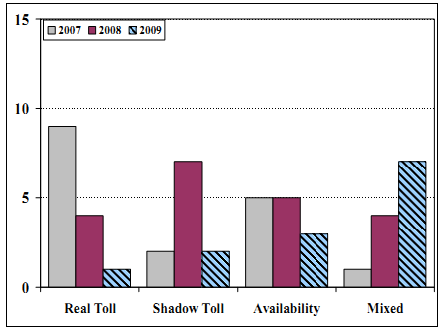

Figure 14 considers all EU road projects (including bridges and tunnels) between 2007 and 2009, for which we could collect information on the toll type in use. Overall, the sample includes 50 deals.

Figure 14. Number of deals by payment mechanism for PPP roads, bridges and tunnels in the EU.

Sources: EPEC research, various commercial databases and internet sources.

Figure 14 shows that while real tolling systems nearly disappeared in 2008-09; they have been replaced to some extent by mixed mechanisms. Shadow toll and availability based constructions also fell.

Thus, there was a tendency towards more complex, "mixed" payment mechanisms in road PPPs in Europe in the course of the recent financial crisis. As explained above, one should be careful in drawing conclusions from this graph about the risk allocation between the public and private sector, as individual contracts under the "mixed" category may vary considerably in the allocation of risk between public and private partners.

_________________________________________________________________

10 Note that the 2008 total figure may be distorted - as will be the sectoral distribution graph - by the major £2.6 billion UK defence Strategic Air Tanker deal (FSTA), which alone accounts for over 15% of the 2008 figure. The closest comparable project in 2009 is the £ 1.3 billion M25 Road PPP.

11 The following examples highlight the variety of contracts that fall under the mixed category.The German A-Model of PPP roads borrows from the real toll approach, with revenues flowing to the project company from tolls collected from lorries. However, most highway projects would also include up-front grants or discounts on toll revenues.

In Portugal, the initial toll roads were structured as real or shadow tolls, under which the private partner took most of the demand risk. This changed in 2009 when Portugal implemented a revenue model featuring a combination of availability payments and service charges, with the proportions of each differing depending on the projected traffic levels on each road.

In the period 1990-2006, a large majority of roads in Spain had a real toll payment structure. However the government decided not to transfer demand risk to the private sector in its latest (2009-10) infrastructure program for roads. As such, concessionaires will be repaid via availability payments