3.1 The Portfolio

The EIB's PPP exposure may be traced back to the loans made in 1987 to Eurotunnel (France/UK), in 1989 for the Orlyval project (France), and in 1992 for the Second Severn Crossing project (U.K.). These projects offered the Bank the opportunity to learn a number of valuable lessons. At the same time, project-finance lending techniques were being developed through the Bank's involvement with private-sector project finance deals in power industry in the U.K. and elsewhere. A breakdown of the Bank's portfolio by sector can be found in Appendix I.

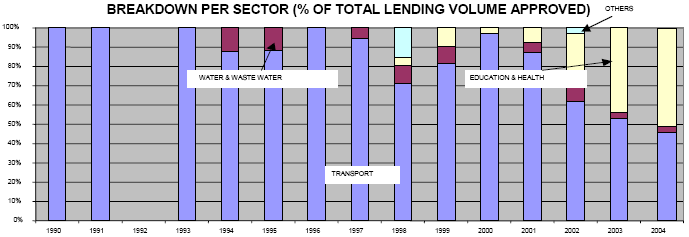

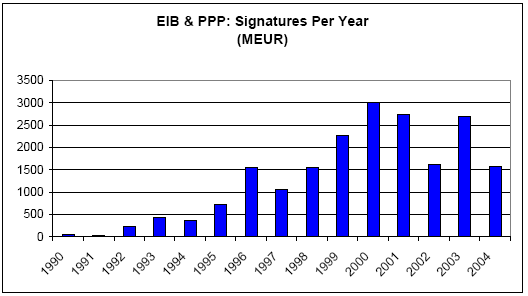

The main growth in the portfolio began with loans to projects under the UK Private Finance Initiative (PFI). The UK PFI dates back to 1992, but has developed rapidly since 1997 and similar schemes have been adopted in many other EU Member States. The Bank is now lending to PPP projects in Belgium, Denmark, Germany, Spain, France, Greece, Ireland, Italy, Netherlands, Austria, Poland, Portugal and the U.K., as well as in non-Member States, e.g. China and South Africa. The EIB is one of the largest individual lenders to PPPs, by volume, within the EU. An outline of the growth in the Bank's PPP operations, and a breakdown by sector is presented below. Further information can be found in "The EIB's role in Public-Private Partnerships (PPPs)".

EBI & PPP: Signatures Per Year (MEUR)

BREAKDOWN PER SECTOR (% OF TOTAL LENDING VOLUME APPROVED)