2.1 CAPITAL EXPENDITURE OVER THE NEXT DECADE

New South Wales will invest $9.9 billion in 2006-07.

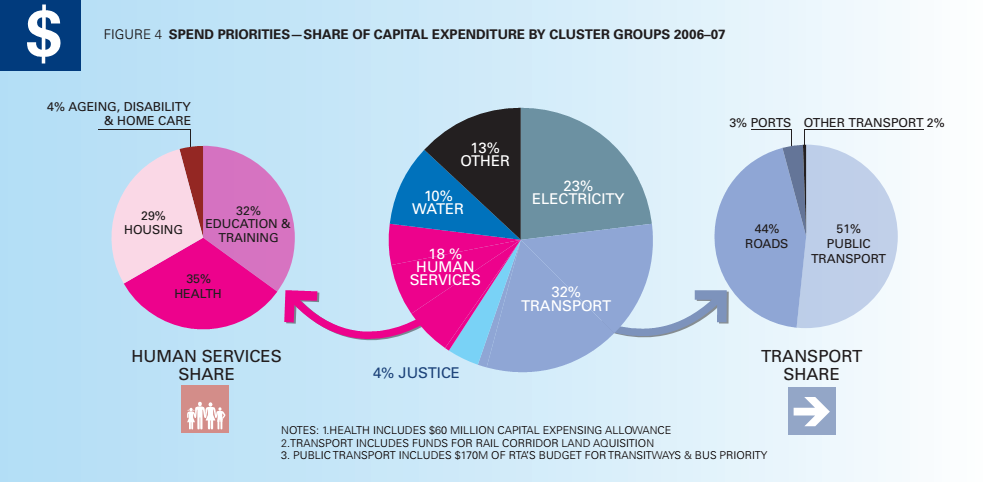

- The growth in capital expenditure is driven primarily by priority spending areas of health, mental health, disability services, transport, water and electricity.

- Capital expenditure in 2006-07 is the largest in real terms over the last forty years.

- The current New South Wales capital budget is the largest in real dollars per capita.

- Over the four-year Budget cycle to 30 June 2010, the State's capital expenditure is expected to total up to $41.3 billion. This capital expenditure is a 45 per cent increase or $12.8 billion greater than the $28.5 billion undertaken in the previous four years.

- Major transport programs encompassing improvements to bus, rail and ferry services mean that the State's capital investment in public transport will exceed investment in roads. Investment in rail, new rail carriages, the acquisition of rail corridors, bus priority measures and Transitways totals $1.6 billion, while investment in roads by State and Commonwealth Governments amounts to $1.4 billion.1

- Capital expenditure in health has been in excess of $600 million per annum and is expected to exceed these levels because of pressure from ageing and longevity.

THE CURRENT NSW CAPITAL BUDGET IS IN REAL DOLLARS

| TABLE 1 NSW GOVERNMENT CAPITAL EXPENDITURE SUMMARY TO 2009-10 | ||||||

|

| 2005-06 | 2006-07 | 2007-08 | 2008-09 | 2009-10 |

|

| GENERAL GOVERNMENT SECTOR | $3,788 | $4,387 | $4,528 | $4,782 | $4,590 |

|

| PUBLICTRADING ENTERPRISE SECTOR | $4,309 | $5,559 | $5,933 | $5,987 | $5,576 |

|

| STATE CAPITAL PROGRAM † | $8,093 | $9,941 | $10,455 | $10,764 | $10,161 |

|

|

| † TOTAL STATE CAPITAL EXPENDITURE MAY NOT TOTAL GENERAL GOVERNMENT EXPENDITURE AND PTE SECTOR ACQUISITIONS BECAUSE OF INTER-SECTORAL PURCHASES WHICH CANCEL OUT ON CONSOLIDATION. SOURCE: NSW TREASURY, NSW BUDGET STATEMENT 2006-07, BUDGET PAPER NO 4, OVERVIEW |

| ||||

|

|

|

| ||||

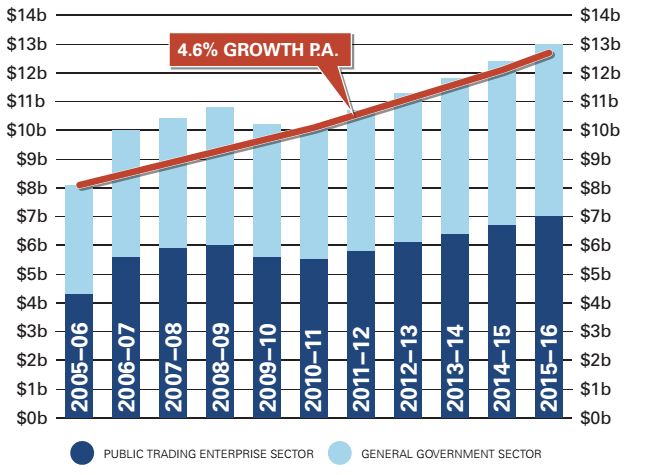

As capital expenditure grows over time, it is important to manage growth in line with funding sources.

- Trend revenue growth from State taxes and Commonwealth grants is likely to be around 5 per cent per annum based on analysis over the last 20 years. user charges tend to grow in line with inflation and population growth, 3.3 per cent. to be sustainable, debt should not increase faster than Gross State Product, which is growing at around 5.5 per cent (nominal).

- Together this implies that a sustainable trend growth in capital expenditure is around 4.6 per cent per annum in nominal terms over the next decade.

- There will be years, such as 2006-07, when infrastructure growth exceeds this rate; there will also be years when growth is below the 4.6 per cent trend growth rate.

- Capital expenditure will need to be kept at around this growth rate to ensure average capital expenditure growth is both adequate and sustainable over the next decade.

FIGURE 3 CAPITAL EXPENDITURE TREND 2005-06 TO 2015-16 SOURCE: NSW LONG-TERM FISCAL PRESSURES MODEL NSW TREASURY & ACCESS ECONOMICS NOTE: FORWARD ESTIMATES TO 2009-10 AND NSW LONG-TERM FISCAL PRESSURES MODEL FOR PROJECTION PERIOD TO 2015-16. THE LEVEL OF PUBLIC TRADING ENTERPRISE CAPITAL EXPENDITURE CAN BE LUMPY BETWEEN YEARS DUE TO LARGE INFRASTRUCTURE PROJECTS |

THE LARGEST PER PERSON

_________________________________________________________________________________________________________________________________________________

1 'RTA's total capital expenditure budget is $1.6 billion for 2006-07. This includes bus priority measures and Transitways.