Public Private Partnership financing

2.18 The Department of Finance and Deregulation's Finance Management Guide No.16 advises that a PPP may provide advantages compared to other forms of procurement such as:

• it can contain incentives for the public and private sector partners to achieve the optimal allocation of the risks associated with the provision of public services. The optimal allocation occurs when risks are borne by the partner most capable of managing them;

• it can allow the public sector to focus on delivering the core service it is required to provide, while the private sector partner supplies the supporting infrastructure and service;

• it can facilitate better life cycle planning by transparently recognizing the costs and risks associated with the whole life of the required service; and

• it can effectively implement the 'payment for performance' principle by placing the private sector's remuneration at risk, contingent on their ability to meet the public sector's requirements.25

2.19 Finance's Guide further advises that PPPs should be used where they can offer superior value for money relative to other procurement methods.26

2.20 Public private partnership (PPP) financing arrangements are comparatively rare in Defence. As noted in paragraph 1.13, three out of 22 Defence projects referred to the Committee between mid 2004 to mid 2007 have been or are expected to be financed in this way.

2.21 The following documentation is available to Defence project officers developing a project using a PPP funding arrangement:

• Defence Private Financing Manual, updated July 2006;

• Department of Finance and Deregulation 27 Finance Management Guides 16 to 21 - guides to Public Private Partnerships, all updated December 2006; and

• Defence Corporate Services and Infrastructure Group, Private Financing of Infrastructure Draft Feasibility Documentation, updated December 2003.

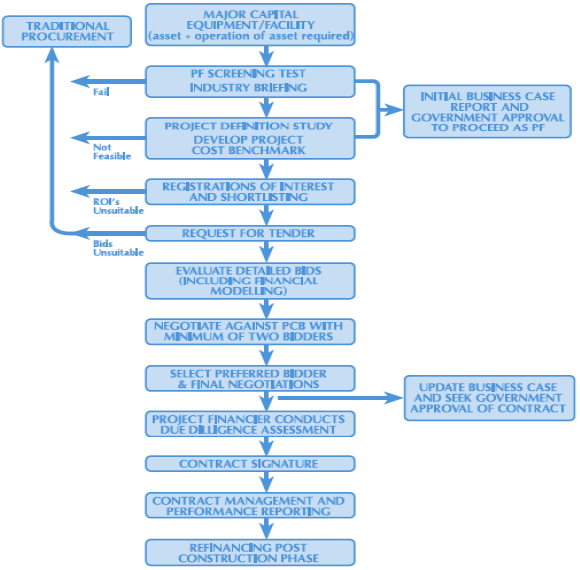

2.22 The Defence Private Financing Manual provides process flow information to assist project officers preparing documents for PPPs. The process flow includes the identification of points at which a PPP financing option might not be deemed suitable, and traditional procurement (that is, direct procurement) is then used (see Figure 2.2).

Figure 2.2

Defence Private Financing Procurement Flow Chart

Source: Defence

2.23 Information relating to PPP initiatives is not maintained in the Infrastructure Management System. To ensure that asset development policy and processes are maintained in one site, to be used by all Defence capital works project officers, the Infrastructure Management System could be improved by incorporating information about this method of procuring and managing capital works projects. This would help to ensure that corporate knowledge and guidelines relating to all capital works projects are documented and centrally stored. Defence advised that it is planning to undertake this body of work.

_______________________________________________________________________

25 Department of Finance and Deregulation Financial Management Guide No. 16, Introductory Guide to Public Private Partnerships, December 2006. p. 2.

26 Value for money refers to the best available outcome after taking account of all benefits, costs and risks over the whole life of the procurement.

27 These guides were issued by the department under its former title of Department of Finance and Administration.