Accountability in a sound corporate governance framework

It has been increasingly recognised, in both the private and public sectors, that appropriate corporate governance arrangements are a major factor in corporate success. A key element of corporate governance in both the private and public sectors is risk management. An effective corporate governance framework assists an organization to identify and manage risks in a more systematic and effective manner. A corporate governance framework, incorporating sound values, cost structures and risk management processes can provide a solid foundation on which we can build a cost effective, transparent and accountable public sector. As one expert opinion puts it:

…corporate governance is the organisation's strategic response to risk.52

PPPs have given rise to additional challenges and demands in this respect for the public sector because the parameters of risk are far different from those involved in traditional approaches to the provision of public infrastructure and services. Indeed, the potential liabilities accruing to governments may be significant. The governance arrangements that will facilitate the effect transfer of risk and operational control to a private sector entity while reserving the capacity for the public sector entity to protect the public interest and enforce government policy objectives need to be clearly established at the outset.

Indeed, the policies issued by various jurisdictions on the use of private financing and PPPs require a test of transparency and accountability to be satisfied in order for the proposal to be successful.53 At the federal level, it is useful to reiterate that the Commonwealth Principles for the use of private financing identify transparency and accountability, together with value for money, as the three core principles for assessing whether private financing should be the preferred procurement method used.

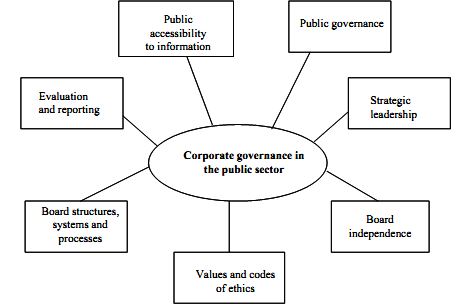

As has been observed by the Chartered Institute of Public Finance and Accountancy in the United Kingdom, no system of corporate governance can provide total protection against management failure or fraudulent behaviour.54 However, sound corporate governance arrangements do form the basis of a robust, credible and responsive framework necessary to deliver the required accountability and bottom line performance consistent with an organization's objectives. Figure 1 provides one model of the various components of corporate governance in the public sector.

Figure 1 Components of public sector governance

Source: Victoria

n Public Accounts and Estimates Committee 2002, Issues Paper: Inquiry into Corporate Governance in the Victorian Public Sector, Melbourne, April, p. 8.

The increasing involvement of the private sector in the delivery of public services is challenging traditional notions of accountability, an issue that is central to good governance.55 As the Commonwealth Principles state:

The potential for private financing to alter traditional risk allocation also requires close attention to how existing accountability arrangements impact on the relationship between agencies and contractors.

Corporatisation, privatisation and partnership arrangements commonly involve the transfer of direct control of an organisation responsible for delivering public services to a board of directors. As the Victorian Public Accounts and Estimates Committee has recently observed, accountability for Government spending can be at risk if arrangements involve parties who are not directly accountable to a Minister and not subject to parliamentary scrutiny.57 The Committee further observed that the standards and practices of good corporate governance are important elements for not only ensuring these boards operate as expected but also in preventing fraud and corruption.58

In this increasingly complex environment, one of the most important components of robust accountability is to ensure that there is a clear understanding and appreciation of the roles and responsibilities of the relevant participants in the governance framework namely, the organisation's stakeholders and those who are entrusted to manage resources and deliver required outcomes. The absence of clearly designated roles weakens accountability and threatens the achievement of organisational objectives. Any uncertainty experienced by private and/or public participants in this respect can create confusion both as to who is accountable for what and the various relationships with stakeholders.