Discounts rates and the PSC

Costs and benefits must be expressed on a net present value (NPV) basis. This requires discounting the cashflows of the project over its lifetime using an appropriate discount rate.

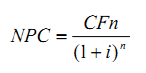

The general formula for calculating the net present cost (NPC) of the PSC is:

|

|

|

|

where

CF is the period cashflow;

i is the discount rate; and

n is the number of periods in which the cashflows occur.

Discounting is essential to determine the value of the PSC relative to the best bid, in current dollars. The PSC and the bid cashflows are discounted at the same rate.

Assume for example that the procurement of a hospital requires a capital investment of $120m in years 1 - 2, and operating expenses of $15m per year thereafter for 25 years. The private supplier contract requires the operator to build the facility with its own capital and commence providing services in year 3, for which the operator will receive a periodic payment. The best private sector bid is $22 million per year. Table 3 below summarises the comparison.

Table 3 NPV Analysis

|

| NPV ($m) | 1 | 2 | 3 |

| 25 |

| Private sector bid

| 297 269 | 100 0 | 20 0 | 15 22 | 15 22 | 15 22 |

| VFM | 28 |

|

|

|

| |

Discounted at a real rate of say 5% pa, the private sector option delivers the service at approximately 10% less than the public sector option.

The discount rate that will be used to discount project cashflows can be expressed on a nominal or real basis. If a nominal basis is selected, the effect of price inflation must be expressly incorporated into the analysis. Inflation can be ignored if real discount rates are used.

Preferably nominal, rather than real costs, should be used in the PSC, which is consistent with standard practice for project evaluation in Australia. These costs will generally include the impact of inflation, which can be significant for projects extending over several years, in some cases up to 50 years. However, appropriate adjustments should be made to cost values that are expected to change at a different rate to the general inflation level. For example, the cost of technology has changed over time at well below the increase in the general price level. Realistic assumptions must be made as to the behaviour of all relevant costs according to the particular variables driving that cost.