Budgets and treatment of transaction in budgets

5.19 Separately, the budgets of central government departments are set to ensure that overall public expenditure limits, as measured with reference to the national accounts produced by the ONS, are protected, as the classification by ONS of a JV may ultimately affect the budget of a sponsoring department including those introduced at local authority level. Where a department is involved in any way with sponsoring, approving or funding a JV it will wish to be involved in decisions relevant to its classification.

5.20 The relationship between the ONS statistical classification, financial accounts and the HM Treasury budget setting process is not straightforward. Both the national accounts and the financial accounts use an assessment of control that one entity has over another when considering how to describe that relationship. It must be noted however that they are different frameworks, produced under different standards and for different purposes. As such, a direct relationship cannot be automatically inferred and care must be taken to understand the implications of the new body for each of the financial accounts and the national accounts.

5.21 From a departmental point of view the main issue will usually be the impact of the new entity, if any, on its budgetary limits, meaning that the ONS decision is usually considered as key.

5.22 The treatment of a public sector body within HM Treasury's budgeting framework is determined by the national accounts classification. Details of the budgetary treatment for different types of public sector bodies can be found in HM Treasury's Consolidated Budgeting Guidance.49

5.23 Since JVs are normally 'market bodies' the expected classification within national accounts would be either be public or private non-financial corporation.

5.24 The public sector participant will not record the transactions of the JV directly within its budget. Instead the participant would record its transactions with the JV, such as interest and dividends from the JV, or loans and subsidies to the JV. These will all score in budgets regardless of the overall classification of the body classification.

5.25 Whilst the majority of transactions will score in the same way in budgets whether the JV is a public corporation or a private sector body, any debt owed by the JV will score differently. If a private sector JV borrows money from the market it will have no impact on budgets. If a public corporation borrows money it will be a cost in the capital budget of the sponsor department; this cost is intended to reflect the fact that the debt will increase public sector net debt. Local authorities' debt is subject to the prudential borrowing regime, the debt of a local authority public corporation should be treated in the same way as borrowing by any other local authority subsidiary.

5.26 The net assets of departments are subject to a cost of capital charge/credit (COCC).50 This is the opportunity cost of government holding assets rather than undertaking an alternative investment. Whilst the nominal rate of COCC is 3.5%, where the asset is an investment in a public corporation or a commercial operation then the charge should be increased to reflect better the risk and expected return. In the case of a JV the charge will be payable on equity or loan investments in the venture.51 Local government is not subject to cost of capital charging.

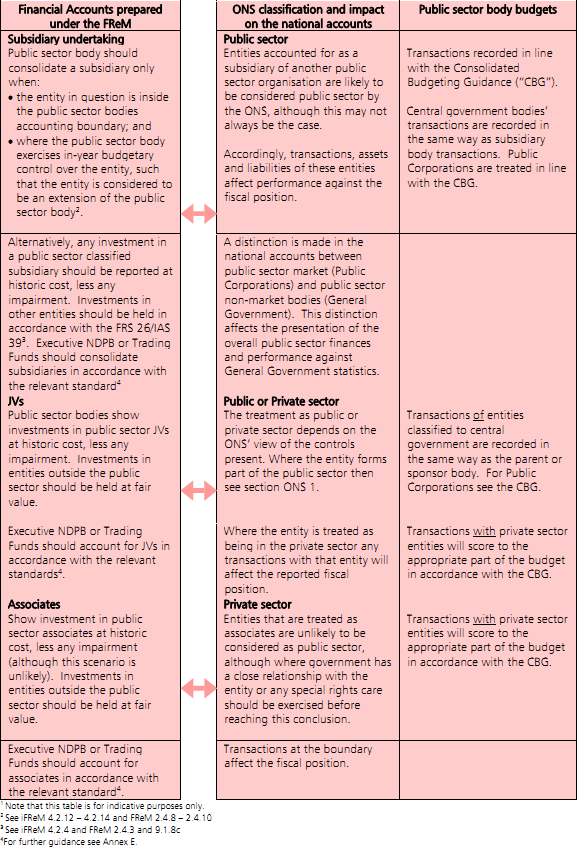

5.27 Table 5.B overleaf sets out the indicative relationship between the financial accounting determination of an entity, the likely ONS classification and the budgetary treatment as well as setting out the key issues to consider under each of the frameworks.

____________________________________________________________________________________________________

49 Latest version of the Consolidated Budgeting Guidance available from www.hm-treasury.gov.uk/d/consolidated_budguid010208.pdf.

50 Cost of capital charges are treated as part of the Departmental Expenditure Limit (DEL).

51 See HM Treasury Consolidated Budgeting Guidance for details on setting cost of capital rates.