Legal Restrictions on Transportation Funds

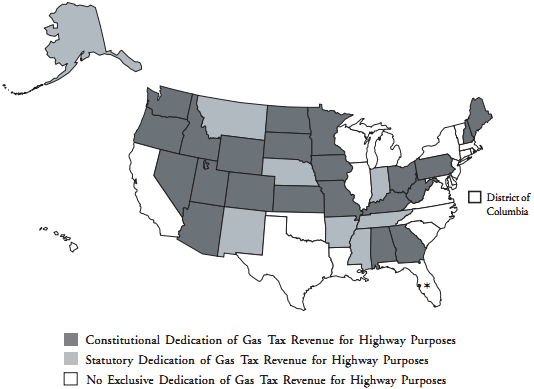

The use of transportation revenue by the states often is restricted by a variety of constitutional and statutory provisions. A key restriction relates to use of gas tax revenue. Thirty states restrict use of gas tax revenues to highway and road purposes only. Of these, 22 states have constitutional restrictions and eight states have statutory restrictions (see figure 1). These restrictions are derived from the concept that the gas tax is a user fee and, therefore, should be linked to spending on highway and road projects.21 The other 20 states allocate part of such revenues to other transportation spending. An unusual dedication in Texas law allocates one-fourth of gas tax revenues to the Permanent School Fund to provide aid to the public school system.22

Figure 1. Use of Gas Tax Revenue for Highways |

|

*The Florida constitution designates fuel tax revenues for highway purposes, but statute apportions some to mass transportation. Source: Fueling Transportation Finance: A Primer on the Gas Tax, The Brookings Institution, March 2003. |

In 2005, South Dakota eased its restriction on spending from the state highway fund, allowing expenditures for public transportation.

One consequence of gas tax use restriction is that it limits states' ability to spend on transit. From 1998 to 2001, only 11 states spent more than 5 percent of gas tax revenues on transit,23 and only 4 percent of states spent more than 15 percent of gas tax receipts on transit. If states do not use gas tax revenue for transit, it often is difficult for them to receive federal funds for transit projects due to federal matching requirements. Funding for transit in Rhode Island, South Carolina and Tennessee is totally funded by gas tax revenue.24 Gas tax assists with public transportation funding in 15 states.

Another restriction issue relates to distribution of gas tax receipts within states. The 2003 Brookings report on the gas tax concluded that gas tax distribution in some states appears to penalize cities and urban areas.25 In many states-such as Colorado, Ohio, Missouri and Washington-urban areas are "donors" of gas tax revenue to other regions. Distribution formulas in some states date to the time when the state highway network was under construction and greater investment needs existed in rural areas.26 Other states apportion funds evenly among all counties. Such formulas hurt the heavily populated, congested urban areas. Washington has acted to change the formula to more accurately reflect current needs, and California uses a formula based on tax receipts, registered motor vehicles and in each county. 27