A. PPP structure

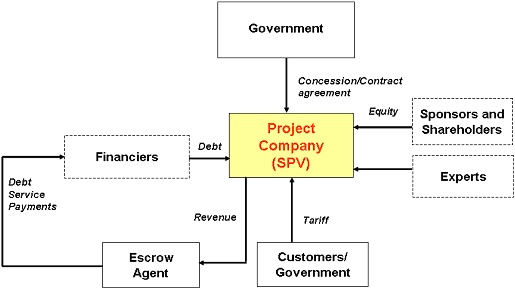

| A typical PPP structure can be quite complex involving contractual arrangements between a number of parties including the government, project sponsor, project operator, financiers, suppliers, contractors, engineers, third parties (such as an escrow agent8), and customers. The creation of a separate commercial venture called a Special Purpose/Project Vehicle (SPV) is a key feature of most PPPs. The SPV is a legal entity that undertakes a project and all contractual agreements between various parties are negotiated between themselves and the SPV. SPVs are also a preferred mode of PPP project implementation in limited or non-recourse situations, where the lenders rely on the project’s cash flow and security over its assets as the only means to repay debts. Figure 2 shows a simplified PPP structure. The actual structure of a PPP however, depends on the type of partnerships as may be seen in discussion presented later. | SPV and its advantages |

Figure 2. Typical structure of a PPP project9

| The SPV is usually set by the private concessionaire/sponsor(s), who in exchange for shares representing ownership in the SPV contribute the long-term equity capital, and agree to lead the project.10 The Government may also contribute to the long-term equity capital of the SPV in exchange of shares. In such a case, the SPV is established as a joint venture company between the public and private sectors and the government acquires equal rights and equivalent interests to the assets within the SPV as other private sector shareholders. | Joint venture |

| Sometimes governments want to ensure a continued interest (with or without controlling authority) in the management and operations of infrastructure assets such as a port or an airport particularly which have strategic importance, or in assets that require significant financial contribution from the government. In such a case, a joint venture may be established. A joint venture is an operating company owned by a government entity and a private company (or multiple companies including foreign companies if permitted by law), or a consortium of private companies. Often, the SPV is formed as a joint venture between an experienced construction company and a service operations company capable of operating and maintaining the project. | Why joint venture |

Other than its strategic, financial and economic interest, the government may also like to directly participate in a PPP project. The main reasons for such direct involvement include:

• To address political sensitivity and fulfil social obligations

• To ensure commercial viability

• To provide greater confidence to lenders

• To have better insight to protect public interest.

| Depending on government policy, the private sector company may or may not be allowed to hold the majority stake in a joint venture. For example, considering strategic importance of ports, private stakes in ports in China were limited to a maximum of 49 percent. However, the Government of India has allowed 74 per cent of the stakes in the joint venture companies for Delhi and Mumbai airports to be held by the private sector. In another example from India, the Pipavav Rail Corporation Ltd a 50:50 joint venture between Indian Railways and Pipavav Port Ltd was set up to construct, maintain and operate a 270-km long railway line connecting the Pipavav port in Gujarat to Surendranagar Junction on the Western Railway.11 | Examples of joint venture |

___________________________________________________________________________

8 An escrow agent (normally a financial institution) is appointed by the project company and the lenders for managing an account called escrow account. The escrow account is set up to hold funds (including project revenues) accrued to the project company. The funds in the account are disbursed by the escrow agent to various parties in accordance with the conditions of the agreements. An escrow account is also used to hold a deposit in trust until certain specified conditions are met.

9 The box on the right side labelled “expert” represents various participating groups in a PPP project including engineers (designer), contractor (builder), operator and insurer. Similarly, the box on the left side labelled “financiers” includes various parties investing in a project comprising equity and debt financiers which may include domestic and foreign banks and financial institutions, bi-lateral and multi-lateral donor agencies, development banks, and similar other agencies.

10 An SPV is a commercial company established under the relevant Act of a country through an agreement (also known as memorandum of association) between the shareholders or sponsors. The shareholders agreement sets out the basis on which a company is established, giving such details as its name, ownership structure, management control and corporate matters, authorized share capital and the extent of the liabilities of its members. The authorized share capital is the maximum amount of equity capital, measured at par value, that a company is allowed to raise by issuing shares to existing or potential shareholders (or investors).

The shareholders of a company may be granted special privileges on matters such elections to the company’s board, the right to purchase new shares issued by the company and the right to share in distributions of the company’s income. It is, however, important to mention here that in the event of liquidation of the company, the shareholders’ rights to a company’s assets are subordinate, or “junior” to the rights of the company’s lenders. See also Chapter IV.

11 Mohammad Jamshed (2008), Container transportation by railways in India: Challenges and initiatives, Transport and Communications Bulletin for Asia and the Pacific, No. 77, United Nations publication, Sales No. E.08.II.F.10, pp. 25-46, available at <http://www.unescap.org/ttdw/PubsDetail.asp?IDNO=194>.