B. PPP models

| A wide spectrum of models has emerged to enable private sector participation in providing infrastructure facilities and services. The models vary from short-term simple management contracts (with or without investment requirements) to long-term and very complex BOT form, to divestiture. These models vary mainly by: | How the partnership relationship in PPPs vary |

• Ownership of capital assets

• Responsibility for investment

• Assumption of risks, and

• Duration of contract.

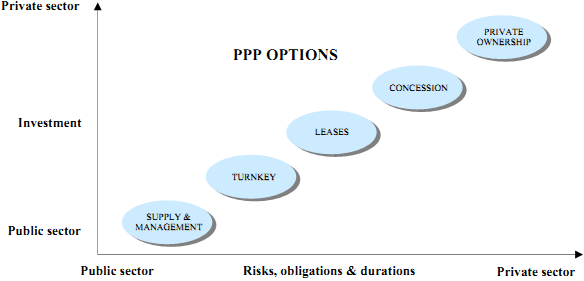

| The PPP models can be classified into five broad categories in order of generally (but not always) increased involvement and assumption of risks by the private sector. The five broad categorisations are: | Broad types of PPP models |

• Supply and management contracts

• Turnkey projects

• Affermage/Lease

• Concessions

• Private ownership of assets.

| The basic features of these five broad categories of PPP models are shown in figure 3. Each model has its own pros and cons and can be suitable to achieve some of the objectives of private participation. Special characteristics of some sectors and their technological development, legal and regulatory regimes, and public and political perception about the services in a sector may also be factors in deciding the suitability of a particular form of private participation. For example, management contracts are common for existing assets in the water and transport sectors, affermage/lease in the transport sector, concessions in the transport and telecommunication sectors, and turnkey and private ownership of assets in the power sector. | Basic features of PPP models |

Figure 3. Basic features of PPP models

A categorization of the PPP/PSP models is shown in table 2.12 While the spectrum of models shown in the table are possible as individual options, combinations are also possible such as a lease or (partial) privatization contract for existing facilities which incorporates provisions for expansion through Build-Operate-Transfer. In fact, many contracts of recent times are of combination type. Examples of combination type include The Shanghai Container Terminal Company Limited (between the Port Authority and Hutchinson Whampoa in Shanghai, China), International Container Terminal Services, Inc. (in Manila, Philippines), and Delhi International Airport Limited (under an Operation-Maintenance- Development Agreement between GMR-Fraport Consortium and Airports Authority of India in New Delhi, India). These long-term lease/concession combination contracts involve operation and management and significant investments in existing public assets.

The Port Kelang Container terminal deal in Malaysia is also an example of the combination type of PPP that involved leasing of existing infrastructure facilities at the port and Build-Rehabilitate-Operate-Transfer (BROT) for further infrastructure development. The terminal facility was located on land that could not be legally sold to any private company. In order to circumvent this problem, the Port Authority leased the land to the private company for 21 years for the express purpose of operating a container terminal13.

Table 2. Classification of PPP/PSP models

| Broad category | Main variants | Ownership of capital assets | Responsibility of investment | Assumption of risk | Duration of contract (years) |

| Supply and management contract | Outsourcing | Public | Public | Public | 1-3 |

| Maintenance management | Public | Public/Private | Private/Public | 3-5 | |

| Operational management | Public | Public | Public | 3-5 | |

| Turnkey | Public | Public | Private/Public | 1-3 | |

| Affermage/Lease | Affermage | Public | Public | Private/Public | 3-20 |

| Lease* | Public | Public | Private/Public | 3-20 | |

| Concessions | Franchise | Public/Private | Private/Public | Private/Public | 3-7 |

| BOT** | Public/Public | Private/Public | Private/Public | 15-30 | |

| Private ownership of assets (PFI type) | BOO/DBFO | Private | Private | Private | Indefinite |

| PFI*** | Private/Public | Private | Private/Public | 10-30 | |

| Divestiture | Private | Private | Private | Indefinite |

* Build-Lease-Transfer (BLT) is a variant.

** Build-Operate-Transfer (BOT) has many other variants such as Build-Transfer-Operate (BTO), Build- Own-Operate-Transfer (BOOT) and Build-Rehabilitate-Operate-Transfer (BROT).

*** The Private Finance Initiative (PFI) model has many other names. In some cases asset ownership may be transferred to, or retained by the public sector.

___________________________________________________________________________

12 The use of various categorization terms in the table, and arrangements that go by these terms do not always have the same features as set out in the table or mentioned in the discussion afterwards.

13 Havelka, Zdenek sen. and Zdenek Havelka, June (1990), Privatization of Transport in Developing Countries, GTZ, Eschborn, pp. 196-209.