Concessions

| In this form of PPP, the Government defines and grants specific rights to an entity (usually a private company) to build and operate a facility for a fixed period of time. The Government may retain the ultimate ownership of the facility and/or right to supply the services. In concessions, payments can take place both ways: concessionaire pays to government for the concession rights and the government may also pay the concessionaire, which it provides under the agreement to meet certain specific conditions. Usually such payments by government may be necessary to make projects commercially viable and/or reduce the level of commercial risk taken by the private sector, particularly in the initial years of a PPP programme in a country when the private sector may not have enough confidence in undertaking such a commercial venture. Typical concession periods range between 5 to 50 years. | Basic features |

|

|

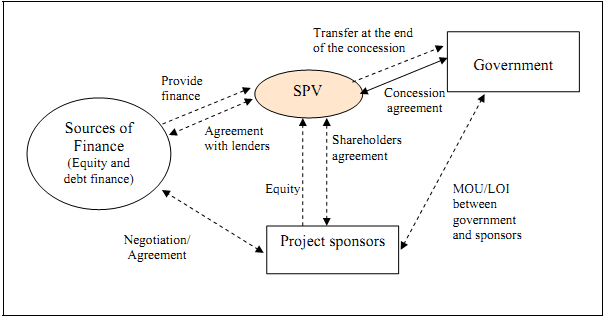

Figure 7 shows the typical structure of a concession contract. It may be noted that in a concession model of PPP, an SPV may not always be necessary. An SPV may be necessary for a BOT type of concession however.

The main pros and cons of this model include the following:

| Pros: • Private sector bears a significant share of the risks • High level of private investment • Potential for efficiency gains in all phases of project development and implementation and technological innovation is high | Pros and cons |

|

|

Cons:

• Highly complex to implement and administer

• May have underlying fiscal costs to the government

• Negotiation between parties and finally making a project deal may require long time

• May require close regulatory oversight

• Contingent liabilities on the government in the medium and long term Concessions may be awarded to a concessionaire under two types of contractual arrangements:

• Franchise

• BOT type of contracts

These concession types are explained below.

Franchise

| Under a franchise arrangement the concessionaire provide services that are fully specified by the franchising authority. The private sector carries commercial risks and may be required to make investments. This form of private sector participation is historically popular in providing urban bus or rail services. Franchise can be used for routes or groups of routes over a contiguous area. | Basic features |

|

|

Figure 7. Concession contract

Build-Operate-Transfer

| In a Build-Operate-Transfer or BOT (and its other variants namely Build-Transfer-Operate (BTO), Build-Rehabilitate-Operate-Transfer (BROT), Build- Lease-Transfer (BLT)) type of arrangement, the concessionaire undertakes investments and operates the facility for a fixed period of time after which the ownership reverts back to the public sector. In this type of arrangement, operating and investment risks can be substantially transferred to the concessionaire. | Basic features of BOT |

|

|

| However, in a BOT type of model the government has explicit and implicit contingent liabilities that may arise due to loan guarantees provided and default of a sub-sovereign government and public or private entity on non-guaranteed loans. By retaining ultimate ownership, the government controls policy and can allocate risks to those parties best suited to bear them or remove them. | Liabilities of government |

|

|

| The concessionaire’s revenue in a BOT project comes from managing and marketing of user facilities (for example, toll revenue in a toll road project) and renting of commercial space where possible. Concessions for BOT projects can be structured on either maximum revenue share for a fixed concession period or minimum concession period for a fixed revenue share, a combination of both, or only minimum concession period. | How a BOT deal is structured |

|

|

| In a BOT concession, the concessionaire may be required to establish a special purpose vehicle (SPV) for implementing and operating the project. The SPV may be formed as a joint venture company with equity participation from multiple private sector parties and the public sector. In addition to equity participation, the government may also provide capital grants or other financial incentives to a BOT project. However, it is also quite common that the government may not have any equity participation in a BOT project company. | Government involvement in a BOT project |

|

|

BOT is a common form of PPP in all sectors in Asian countries. The Bangkok Mass Transit System Public (BTS), the elevated train system in Bangkok, is an example of BOT project. The project was implemented under a 30-year BOT concession agreement between the concessionaire and Bangkok Metropolitan Administration (the city Government). A large number of BOT port and road projects have been implemented in the region. 16 The BOT model is often used to exploit the existing the assets and raise capital resources for modernisation and capacity addition to the existing infrastructure. The Indian Railway is applying this concept for the modernisation of several large city railway stations under the BOT model.

Under the Build-Rehabilitate-Operate-Transfer arrangement, a private developer builds an add-on to an existing facility or completes a partially built facility and rehabilitates existing assets, then operates and maintains the facility at its own risk for the contract period. BROT is a popular form of PPP in the water sector. Many BROT water sector projects have been implemented in China, Indonesia and Thailand.

Port Klang in Malaysia is a good example of BROT in the transport sector. It is also one of the earliest successful PPP projects in the region. Under a 21-year contract, an award was made in 1986 to a private operator, Port Klang Container Terminal to manage and develop container facilities at the port. The Siam Reap Airport in Cambodia is an example of BROT in the airport sector.

A key distinction between a franchise and BOT type of concession is that, in a franchise the authority is in the lead in specifying the level of service and is prepared to make payments for doing so, whilst in the BOT type the authority imposes a few basic requirements and may have no direct financial responsibility.

___________________________________________________________________________

16 The Nhava Sheva International Container Terminal (NSICT) is an interesting example of efficiency gains through a BOT project in the port sector. In 1997, the Jawaharlal Nehru Port Trust (JNPT), India signed an agreement with a consortium led by P&O Australia for development of a two-berth container terminal on BOT basis for 30 years at a cost of US$ 200 million. P&O completed the project before schedule and commenced operations at the new terminal in 1999. Form the first year of operation the terminal is handling much more traffic than expected. Private participation also resulted in an impressive efficiency gains. Efficiency indicators such as average turnaround time of ships and output per ship-berth-day at the terminal were comparable to other efficiently operated ports in the region (the average turnaround time in 2003-04 for ships and containers were 2.04 and 1.84 days, respectively, which were far superior to corresponding indicators for other comparable terminals in the public sector).