Private ownership of assets

| In this form of participation, the private sector remains responsible for design, construction and operation of an infrastructure facility and in some cases the public sector may relinquish the right of ownership of assets to the private sector. | Basic features |

| It is argued that by aggregating design, construction and operation of infrastructure services into one contract, important benefits could be achieved through creation of synergies. As the same entity builds and operates the services, and is only paid for the successful supply of services at a pre-defined standard, it has no incentive to reduce the quality or quantity of services. Compared with the traditional public sector procurement model, where design, construction and operation aspects are usually separated, this form of contractual agreement reduces the risks of cost overruns during the design and construction phases or of choosing an inefficient technology, since the operator’s future earnings depend on controlling costs. The public sector’s main advantages lie in the relief from bearing the costs of design and construction, the transfer of certain risks to the private sector and the promise of better project design, construction and operation. | Why better design may be expected |

|

|

The main pros and cons of this model are summarized as follows:

| Pros: • Private sector may bear a significant share of the risks • High level of private investment • Potential for efficiency gains and innovation is very high | Pros and cons |

|

|

Cons:

• Complex to implement and manage the contractual regimes

• May have underlying fiscal costs to the government

• Negotiation between parties and finally making a project deal may require long time

• Regulatory efficiency is very important

• There may be contingent liabilities on the government in the medium and long term

There can be three main types under this form:

• Build-Own-Operate type of arrangement

• Private Finance Initiative (a more recent innovation)

• Divestiture by license or sale

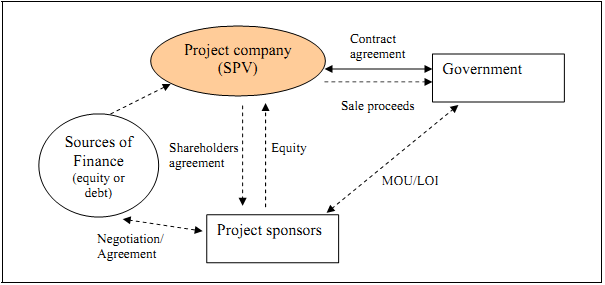

Figure 8 shows a typical structure of this type of PPP model. The three types of private ownership of assets models are discussed below.

Figure 8. Private ownership of assets

Build-Own-Operate

| In the Build-Own-Operate (BOO) type and its other variants such as Design-Build-Finance-Operate, the private sector builds, owns and operates a facility, and sells the product/service to its users or beneficiaries. This is the most common form of private participation in the power sector in many countries (examples are numerous). For a BOO power project, the Government (or a power distribution company) may or may not have a long-term power purchase agreement (commonly known as off-take agreement) at an agreed price from the project operator. | Basic features |

|

|

| Many BOO projects have also been implemented in the transport sector. Examples include, Kutch and Pipavav Railways in India (joint venture BOO projects); Xiamen Airport Cargo Terminal in China and Sukhothai Airport in Thailand; and in the port sector, Wuhan Yangluo Container Port in China and Balikapapan Coal Terminal in Indonesia. | Examples of BOO projects |

|

|

| In many respects, licensing may be considered as a variant of the BOO model of private participation. The Government grants licences to private undertakings to provide services such as fixed line and mobile telephony, Internet service, television and radio broadcast, public transport, and catering services on the railways. However, licensing may also be considered as a form of “concession” with private ownership of assets. Licensing allows competitive pressure in the market by allowing multiple operators, such as in mobile telephony, to provide competing services. | Licensing |

|

|

| There are two types of licensing: quantity licensing and quality licensing. By setting limits through quantity licensing, the government is able to moderate competition between service providers and adjust supply between one area and other. Quality licensing however, does not place any restriction on number of providers or the amount of service produced but specifies the quality of service that needs to be provided. The government may get a fee and a small share of the revenue earned by the private sector under the licensing arrangement. | Types of licensing |

|

|

Private Finance Initiative

| In the Private Finance Initiative (PFI) model, the private sector similar to the BOO model builds, owns and operates a facility. However, the public sector (unlike the users in a BOO model) purchases the services from the private sector through a long-term agreement. PFI projects therefore, bear direct financial obligations to government in any event. In addition, explicit and implicit contingent liabilities may also arise due to loan guarantees provided to lenders and default of a public or private entity on non-guaranteed loans. | Basic features |

|

|

In the PFI model, asset ownership at the end of the contract period may or may not be transferred to the public sector. An SPV may not be always necessary in this type of arrangement. A PFI contract may be awarded to an existing company. However, for financing purpose, the lenders may require establishment of an SPV. The PFI model also has many variants.

| The annuity model for financing of national highways in India is an example of the PFI model. Under this arrangement a selected private bidder is awarded a contract to develop a section of the highway and to maintain it over the whole contract period. The private bidder is compensated with fixed semi-annual payments for his investments in the project. In this approach the concessionaire does not need to bear the commercial risks involved with project operation. Private infrastructure development in Japan in this region is done mainly via the PFI model. | Example of PFI projects |

|

|

Apart from building economic infrastructure, the PFI model has been used also for developing social infrastructure such as schools, government offices, community facilities and hospital buildings, which do not generate direct “revenues”. 17

| Box 4: The PFI programme in the education sector in the U.K. PFIs in the education sector have been used extensively in the UK, where virtually all new schools and tertiary education institutions are being built under PFI arrangements, rather than traditional procurement methods. The PFI refers to a strictly defined legal contract for involving private companies in the provision of public services, particularly public buildings. Under a PFI program, a capital project such as a school, hospital or housing estate, is designed, built, financed and managed by a private sector consortium, under a contract that typically lasts for 30 years. Contracts can be structured differently. The most commonly used structure is DBFO. Under DBFO, a private sector partner (usually a consortium of companies) takes on the provision and long-term operation of a facility in line with the given specification. The private consortium is paid regularly from public money, based on its performance throughout the contract period. If the consortium misses performance targets, its payment is reduced. Transport makes up the lion’s share of PFIs in the UK. Education represents around 3 percent of the value of PFIs undertaken to date in the UK. By the end of 2003, 102 education PFI deals had been signed, with a value of approximately US$ 3.621 billion. The largest education PFI was the Glasgow Schools Project, with a value of US$ 400 million. | |

| Source: | The World Bank, Higher Education Policy Note: Pakistan - An assessment of the medium-term development framework. |

Divestiture

| This third type of privatization is clear from its very name. In this form a private entity buys an equity stake in a state-owned enterprise. However, the private stake may or may not imply private management of the enterprise. True privatization, however, involves a transfer of deed of title from the public sector to a private undertaking. This may be done either through outright sale or through public floatation of shares of a previously corporatized state enterprise.18 | Basic features |

|

|

| Full divestiture of existing infrastructure assets is not very common (Agusan and Barit hydroelectric power plants in the Philippines are examples). However, there are many examples of partial divestiture. Such examples include Beijing and Wuhan airports and Shanghai Port Container Co. in China. | Examples |

|

|

What model is to select?

The answer to this question needs careful assessment of many things.

Each model has its own pros and cons and can be suitable to achieve the major objectives of private-private partnership to a varying degree. Special characteristics of some sectors and their technological development, legal and regulatory regimes, and public and political perception about the services in a sector can also be important factors in deciding the suitability of a particular model of PPP.

There is no single PPP model that can satisfy all conditions concerning a project’s locational setting and its technical and financial features. The most suitable model should be selected taking into account country’s political, legal and socio-cultural circumstances, maturity of the country’s PPP market and the financial and technical features of the projects and sectors concerned.

As an example, for a new project, a BOT type of model may be quite feasible in a matured PPP market while a PFI or BOO type of models could be more appropriate in a developing/untested market.

| MAJOR ISSUES CONCERNING PPP MODELS… • A wide spectrum of PPP models has emerged. These models vary by ownership of capital assets, responsibility for investment, assumption of risks and duration of contract. However, there is no single PPP model that can satisfy all conditions concerning a project’s locational setting and its technical and financial features. The most suitable model should be selected taking into account country’s political, legal and socio-cultural circumstances and the financial and technical features of the projects and sectors concerned. • Clear policy guidelines of government are necessary on type of partnerships for different types of projects. Governments consider different types of PPP models and their general guidelines taking into account the appropriateness of models in a given context. The guidelines in respect of PPP models can be specified in the government’s PPP policy framework or in the country’s legal instruments. • Recognizing the complexities of some type of PPP models such as the BOT model, attention may be placed on more practical forms of private participation aimed at increasing the efficiency of existing assets through improved operation and modernization. In case of new projects with high commercial risk, models or contractual provisions that allow lesser burden on the private sector is more realistic, particularly in the early years of PPP development in a country. |

___________________________________________________________________________

17 For example, in the United Kingdom of Great Britain and Northern Ireland, Japan and Republic of Korea.

18 Corporatization occurs when an infrastructure entity (for example, a port or a railway authority) is transformed from its statutory role as a governmental department or a quasi-independent entity subject to the conditions of the relevant sectoral Act (such as the Ports or Railways Act) to a fully commercialized but government-owned body under some form of legislation such as a Companies Act. The aim of corporatization is to increase the organizational flexibility and financial viability of the service provided by an entity by giving it an existence that is legally separate from that of government.

As an example, Indian Railways has moved down the path of commercialization and corporatization. A number of public sector undertakings have been formed for this purpose. These include Container Corporation of India Ltd (CONCOR), Kankan Railway Corporation Ltd and Railtel Corporation of India Ltd.