The structure of regulatory authority

| The overall structure of the regulatory authority varies from one country to another and also by sector within a country. There can also be various institutional arrangements with respect to regulatory authorities and responsibilities that may include: the concerned ministry, a special cell within the ministry, regulation by contract, and an independent regulator with discretionary power. | Structure of the regulatory authority |

Often, countries rely mainly on regulation by contract, particularly in the early years of PPP development. This is also a common form of regulatory arrangement in the roads sector. In such a case, a contract administrator monitors compliance with the contract agreement. 37 Although investors may often prefer such arrangements because of low discretionary powers on the part of regulator, if necessity arises, such contracts may be difficult to adjust or renegotiate without the assistance of an independent regulator with high level of discretionary power.

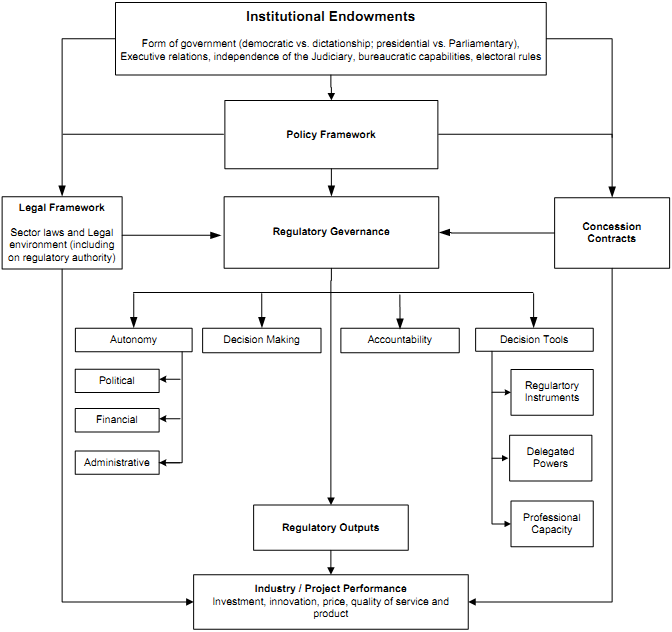

Figure 11. Regulatory governance in PPPs

| Source: | Adapted from Paulo Correa, et al, 2006. Regulatory governance in infrastructure industries - assessment and measurement of Brazilian regulators, The World Bank and PPIAF, p.8. |

| In view of the special characteristics of some sectors such as energy and communications, an empowered independent regulator would be better suited to deal with the complex regulatory issues. Such independent regulators are becoming more common in the water sector also. Many countries in the Asia-Pacific region have now established independent regulators for their energy, telecommunication and water sectors. For example, independent regulators have been established in the telecommunication sector in Bangladesh, Hong Kong, China, the Philippines, India, Thailand; in the energy sector in Australia, Bangladesh, India, Thailand; in the water sector in India (states of Andhra, Gujarat, Tamil Nadu) and the Philippines. | Why independent regulator |

The continuity of rules and credibility of government are key issues in PPP development. Investments in infrastructure facilities have a high political content as they have strategic importance, can have profound effects on development in general, and involve large numbers of consumers and as such have certain service obligations to consumers. For political convenience, governments may often change the rules of operation in the industry after investments are made. They may also impose extra costs on project companies, or impose additional obligations that have substantial resource costs. As most infrastructure assets cannot be easily transferred to alternative activities (in other words, has a high degree of specificity), investors are compelled to adjust to such changed situation, which may affect their business case and results into lower returns to their investment. The establishment of an independent regulator can help to ensure continuity of rules and credibility of government. Investors, however, may have wary of any high levels of discretionary power granted to independent regulatory agencies.

| When regulatory risks are considered high, private investors are discouraged from investing in new infrastructure facilities. They may also delay any refurbishment and modernization of existing facilities. Investment decisions are made with high risk premiums in a situation of high risks. This in turn results in high prices of the services. The establishment of independent regulators is a solution to these problems. By delegating powers to independent regulators, the government can assure private investors that it would not be able to arbitrarily change any rules or intervene in the market after investments are made. The continuity or stability of rules and credibility of the regulators are the main characteristics of an independent regulatory environment. | Characteristics of independent regulatory environment |

The scope of independent regulatory agencies may vary. There may be separate regulators for a single industry such as electricity, water and telecom. They can also be established for a single sector, for example, an energy regulator responsible for both electricity and fossil fuel or an ICT regulator for telecom, Internet and cable services. There can also be a single multi-sector regulator for all the utilities: energy, ICT, water and sewerage.

Whether established for an industry, sector or for multi-sector, the independent regulatory institutions however, cannot always ensure regulatory independence. Political convenience can often undermine regulatory independence. Even when independent regulatory institutions have been established with legal mandates for tariff-setting and other regulatory decisions, governments can still influence the action of regulators or pressure to modify or overturn their decisions, particularly those related to tariff-setting (governments are sensitive to popular resentment against price increases), market entry of new service providers, and dispute resolution.

There is also another form of institutional arrangement - regulatory functions are outsourced to third parties. Consultants or expert panels undertake or assist with tariff reviews, setting service standards, monitoring, arbitration, etc. This arrangement, however, may also complement the other arrangements mentioned above. For example, a regulator may outsource some support functions like independent reviews.

| MAJOR ISSUES CONCERING REGULATORY GOVERNANCE… • There is a need to regulate a service provider to ensure that services provided reflect the adequate level and meets the desired standard or quality. Regulatory control is also needed to ensure sustainable development in an infrastructure sector, and to deal with natural monopolies and market failures associated with network industries. • The PPP programme performance in terms of size of investment, innovation, and price and quality of service largely depend on the effectiveness of regulatory governance, particularly those related to economic matters. • Often the rules of operation in the industry are changed by the government after investments are made. Faced with this kind of regulatory risks, firms are discouraged from investing in infrastructure projects. The continuity of regulatory rules is a major concern in PPP development. • The establishment of independent regulators and delegating authority to them can be helpful to ensuring continuity of regulatory rules. By delegating powers to independent regulatory agencies, the government assures private investors that it would not be able to arbitrarily change any rules or intervene in the market after investments are made. • The stability of rules and credibility of the regulators are the main characteristics of an independent regulatory environment. The existence of autonomous independent regulators with the required authority and technical capacity can have a strong positive influence on PPP development. |

___________________________________________________________________________

37 Many countries, however, tend to rely on regulatory contracts, such as concessions, with pre-specified tariff setting regimes, administered within a tradition of civil law and various provisions for contractual renegotiation or arbitration.