Case study 4: Port Klang, Malaysia

The container terminal situated within Port Klang is located about 50 km south of Kuala Lumpur. The entire port facility including the terminal was managed by the Port Klang Authority, a wholly owned government enterprise. It was a profitable concern of the port authority. The Government decided to privatize the terminal as a part of the Government’s privatization programme. One of the main reasons behind the decision for privatization was that the facility was operating at a low efficiency by international standards.

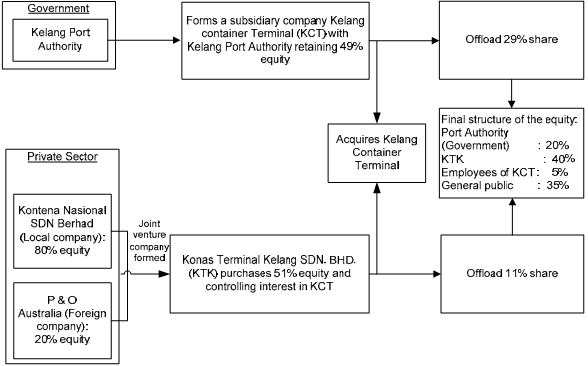

According to the privatization plan a new company called Klang Container Terminal (KCT) was established. Initially KCT was wholly-owned by the Port Authority. This was done to facilitate the issuance of shares by the new company, which could be sold to a private sector buyer. The Port Authority invited bids to sell 51 per cent shares of the newly formed company KCT. The rest 49 per cent was retained by the Port Authority. It was decided that once KCT was well established there would be a public offering to sell part of the shares held by the Government and the private buyer. According to the plan, after selling the shares through public offering, the distribution of equity held the shareholders would be as follows:

Port Klang Authority: | 20 per cent |

New Private buyer: | 40 per cent |

Employess of KTC: | 05 per cent |

General public: | 35 per cent |

Source: | Based on information provided in Havelka, Zdenek sen. and Zdenek Havelka, June (1990), Privatization of Transport in Developing Countries, GTZ, Eschborn, pp. 196-209. |

| Figure 13. The privatization process of the Port Klang Container Terminal |

There was a legal constraint in the privatization process. The land on which the terminal was located could be legally sold to a private party. This problem was circumvented by stipulating that KTC would lease the land from the Port Authority for 21 years for the express purpose of operating a container terminal.

There was significant improvement in productivity of the container terminal. Although it is generally agreed that competition and regulation are more important determinants of economic performance than ownership, the Port Klang case appears to demonstrate that an ownership change without reforms in market structure can also result in significant efficiency gains.