Case study 7: The North Luzon Expressway (NLEX) project, Philippines

The project involved the rehabilitation, expansion, operation and maintenance of an existing 84 km road that connected Metro Manila to central Luzon. The Toll Regulatory Board of the Philippines awarded the 30-year toll road concession to Manila North Tollways Corporation (MNTC) on a rehabilitate-build-operate-transfer basis. It is a 4- to 8-lane divided highway completed on time and within budget and started operation in 2005. Currently, about 150,000 vehicles use the toll road.

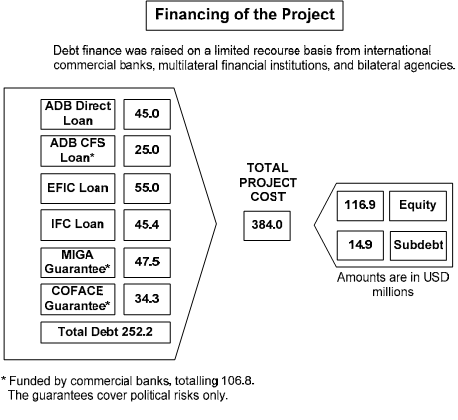

MNTC, the project company, is a joint venture of four companies namely, First Philippine Infrastructure Development Corporation, Philippine National Construction Corporation, Egis S.A. of France, and Leighton Asia Ltd. of Australia. The project had a value of US$ 384 million, of which the four companies together had a total equity contribution of US$ 116.9 million. The debt finance was raised on a limited recourse basis from international commercial banks, multilateral financing institutions and bilateral agencies. The Asian Development Bank, EFIC, IFC and commercial banks provided US$ 252.2 million as debt and the rest US$ 14.9 million came as subordinate date. The financing structure of the project is shown in figure 14. The debts provided by the commercial banks (US$ 106.8 million) were guaranteed under the credit guarantee programmes of the ADB, MIGA and Coface.

The basic terms of the contract included the following:

• MNTC would mobilise the necessary funding on its own without government financial guarantee;

• MNTC would build the tollway and bear the full construction risk;

• MNTC would operate, manage and maintain the toll road for 30 years without any funding support from the Government;

• The project roads are owned by the Government;

• The concessionaire (MNTC) would bear the full commercial risks, and if revenues are not sufficient, the Government would not bail out MNTC; and

• MNTC would collect tolls at the authorized toll rates and the approval adjustment formula to recover the project investment.

Obligations of the concessionaire:

• Rebuild, modernize and operate the tollroad according to specified standards and levels of service;

• Raise financing without government guarantee;

• Complete the construction within the time required;

• Maintain the roadway and the toll collection system properly; and

• Return the toll road to the government at no cost.

Obligations of the government:

• Provide right-of-way at government cost;

• Issue all permits, licenses and approvals;

• Implement the agreed toll rates;

• Recognize lenders’ step in rights;

• Compensate MNTC if it decides to withdraw unilaterally; and

• Compensate MNTC if government fails to implement the agreed toll rate formula.

The toll rates are set by the government for each class of vehicles and are adjusted every two years according to an agreed formula. An adjustment index is calculated based on changes in the following items:

1. The total amount of outstanding debt to finance the project;

2. The rates of inflation in both the Philippines and the U.S.; and

3. The peso/dollar exchange rate.

The existing rates are multiplied by the rate adjustment index to establish the new toll rates for each class of vehicles. The tollway is divided in two major sections for the convenience of toll collection. The open section within the Metro Manila region charges a flat charge based vehicle class. The rest of the system is the closed system where toll is distance-based. Charging is based on class of vehicle and distance travelled.

Note: | The case study was developed based on a presentation made by Alfredo E. Pascual of the Asian Development Bank at a seminar organized by the Asian Development Bank Institute on 19-22 November, Tokyo, Japan, and on information from other sources. |

Figure 14. Financing arrangement for the North Luzon Expressway Project, Philippines | |