i. What is PPP?

A PPP is a long-term arrangement between a public authority and a group of private sector firms, in which the latter is responsible for financing the design and build of new facilities, and then providing certain services within them once the construction works are completed. For example, in a hospital PPP, an NHS body will contract with the private sector to design, build and finance a new hospital. Once the hospital building is delivered, the private operator will maintain the facility and deliver a range of "non-core" services - such as catering and cleaning - for a period of 25-30 years.

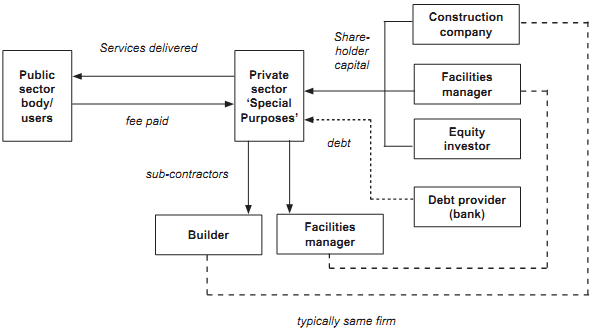

When undertaking a PPP, a public authority carries out a competitive procurement process, with a number of private consortia bidding against each other on the basis of price and quality to undertake the project. Each consortium involves a mix of investors, such as construction and facilities management companies and private equity institutions. On signing the contract for the project with the public authority, the members of the winning consortium create a "Special Purpose Vehicle" (SPV) - a new private sector business that exists solely to deliver the project.

The SPV enters into sub-contracts with one or more firms (usually its own shareholders) to deliver the project. Finance is also raised from the shareholders, and 'senior debt' is raised from banks or the capital markets. In the standard SPV financial structure, senior debt will provide 90% of the finance required, with loans and equity capital from the shareholders making up the remaining 10%. The public and private organisations involved in a typical PPP, their roles in the project and the financing arrangements between them, are illustrated in Figure 1 below.

Figure 1 The contractural structure of a typical PPP project

|