i. Project Cycle and Cash Flow

The capital structure for PPP projects is not static as capital requirements and cash flow vary depending on the stage of the project development. Some sponsors may be required to provide a significant amount of equity capital at the beginning of a project during the construction phase when the risk is high. 16 Once the construction is complete, the construction risks associated with it have been overcome, and the cash flow begins to materialize, the expensive equity or debt capital can be refinanced using cheaper debt capital thus lowering the total cost of capital.

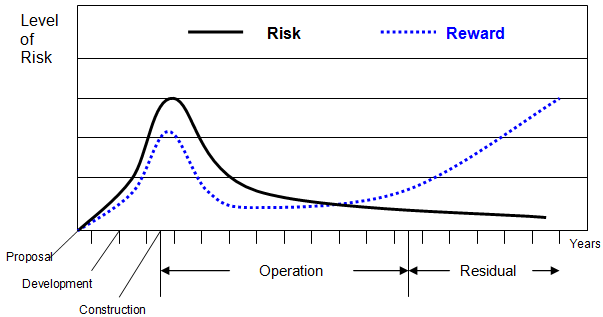

Figure 2 - 2 highlights the relationship between risk and return during the project phase. The highest level of risk exists during the construction phase of a project when construction delays and cost overruns can have serious consequences to a projects success. It is during this phase that investors require the highest return on their capital to compensate for the risk, thus the higher cost of capital. Once construction is over and the cash flow from operations has begun, project risks drop off substantially and it is possible for sponsors to refinance at a much lower cost.

Figure 2 - 2

The Project Development Cycle

Risk versus Reward 17

_______________________________________________________________________________

16 Risk will be defined and explained in Chapter 4.

17 Risk/Return profile, derived from "Overview of Transportation Public-Private Partnership Project Financing", courtesy of Lehman Brothers December 16, 2003 - http://ncppp.org/councilinstitutes/texas_presentations/howard.pdf