iv. Cost of Capital

The actual cost of capital also factors into the decision making process, as the cost of equity is greater than the cost of debt and therefore there is an incentive by sponsors to maximize the use of debt capital. However, those costs can fluctuate and are dependent on a number of factors.

Risk and recourse - For a financier, risk is the chance of an event occurring which would cause actual project circumstances to differ from those assumed and which would in turn effect a project's ability to generate cash flow. Furthermore, different issuers have different priority and recourse to assets and cash flow. Therefore, the required return on investment or the cost of capital will be dependent on how the investor perceives the risk of a project and their order of priority to any assets or cash flow in the event of default, as illustrated in Figure 2 -1.

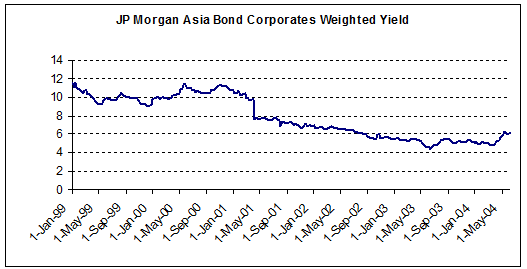

Timing - Timing is an important factor as it can affect the cost of capital as well as the availability of funds. Figure 2 - 3 highlights the reduction in corporate bond yields over a period of five-years. Though a detailed analysis is beyond the scope of this paper, factors contributing to this reduction can include a reduced perception of risk within the region, an increase in available funds, and/or an increase in the credit quality of the bonds issued. Regardless, the fact remains that the yield (or cost of capital) on debt issued in 1999 was 12% whereas in 2004 corporate debt financing was substantially lower at approximately 6%.

Figure 2 - 3

Corporate Bond Yields

Jan. 1999 - May 2004

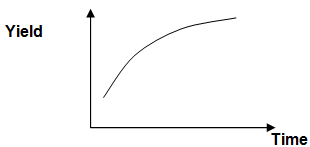

Term of the Loan - In theory, the longer the term of a loan the greater the cost as the longer-term loans are seen to be riskier due to the increased possibility of unforeseeable events. The Normal Yield Curve as shown in Figure 2 - 4 illustrates the relationship between the yield on bonds and time. The curve illustrates that the yield on a bond increases over time to account for the increased risk that comes with the unpredictability of the future.

Figure 2 - 4

Normal Yield Curve

Credit quality of the project26 - The credit quality refers to a project's ability to generate enough revenue to meet its debt obligation. The riskier the project appears to be the lower the credit quality and thus the higher the cost of capital. Depending on the source of capital, some lenders such as insurance companies or pension funds may require an independent credit rating.

_______________________________________________________________________________

26 See Appendix 5 - Moody's Rating Methodology for a review of the criteria used by Moody's rating service