i. Pooling

Using a State Bank model27 derived from the United States, some Indian states developed a pooled financing mechanism to structure a bond issue that could then be used to finance smaller infrastructure projects (see Box 2 - 6 & Box 2 - 7). The pooling together of projects can create a portfolio like structure, where the default risk is reduced as debt payments are secured by a number of different cash flows, not just one.

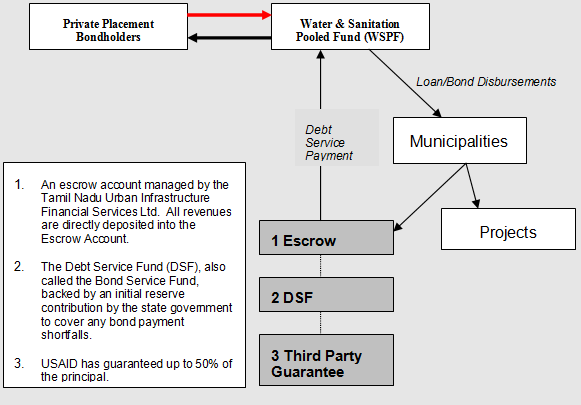

Box 2 - 6 The Water and Sanitation Pooled Fund (WSPF), the first pooled financing in India, was registered under the Indian Trust Act. Subsequently, 14 ULB water and sanitation projects were pooled and Rs 304.1 million was raised via a private placement. Investors included various banks and the Provident Fund Trust. The bonds paid a 9.2% interest rate and had a 15-year maturity.

|

Box 2 - 7 The TNUDF was created in 1996 as a PPP between the Government of Tamil Nadu and three Indian financial institutions (ICICI, HDFC and IL&FS) and backed with a line of credit from the World Bank. The fund lends to Urban Local Bodies (ULBs), statutory boards, and private corporations involved with the development of local infrastructure projects. In order to finance projects, the TNUDF issued a bond in 2000, the first with no state guarantee and based only on municipal cash flows. The structure of the TNUDF is similar to that of the WSBF described above, in that its fund management is set up with an Escrow Account, DSF, and a third party Guarantee. However, unlike the WSBF which had identified 14 projects prior to the bond issue, the TNUDF is unsecured and is raising funds prior to identify projects. |

_______________________________________________________________________________

27 State Banks are state sponsored intermediaries that borrow from the capital markets and are designed to support borrowing by smaller municipalities. State Bank issued bonds are secured by loan repayments from a pool of local borrowers, as opposed to one locality, which helps to further reduce risk for investors and therefore interest rate for borrowers.