3.1 Developing a Cash Flow Model

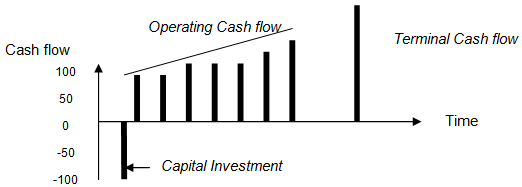

Significant importance is placed on the analysis of a project's cash flow, as it is this cash flow that is used to service any debt obligations. Thus that is why the first step in completing a financial appraisal is the development of a cash flow model. Cash flow models are set up on a case-by-case basis and can either be very simply or incredibly complex depending on the type and size of the project. The following components (see Figure 3 -1) are critical to the development and analyses of any model - Capital Investment, Net Cash Flows, Terminal Cash Flow, Discount Rate, and Assumptions.

Figure 3 -1

Cash Flow