i. Debt Service Coverage

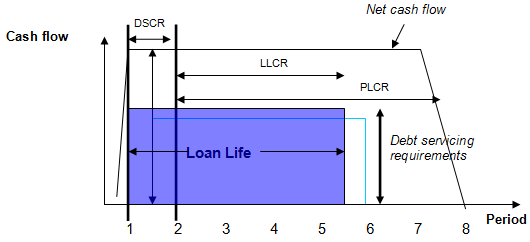

As illustrated in Figure 3 -2 below, cash flow in relation to debt coverage can be calculated over three time periods. (i) historical (DSCR), (ii) remaining life of the loan (LSCR), and (iii) life of the whole project (PLCR)

Figure 3 - 2

Project Cash Flow

The Debt Service Coverage Ratio (DSCR) is an historical measure that calculates the cash flow for the previous period in relation to the amount of loan interest and principal payable for that same period. As it is an historic measure, it will only indicate financial difficulties after the event, but by tracking it, lenders will be able to identify trends. Box 3 - 4 below, an extract from the cash flow analysis included in Appendix 1 - Financial Models, shows DSCR over three periods. DSCR is equal to the cash flow available for debt servicing divided by the amount of the debt service. At a minimum, the ratio should be equal to 1 as that demonstrates that the project is earning enough income to pay its debt obligations.

| Box 3 - 4 | ||||||||

| Period | ||||||||

| 0 | 1 | 2 | 3 | |||||

| Cash flow available for debt servicing (CF) | £0 | £10,158,463 | £10,158,463 | £12,565,658 | ||||

| Debt Service (DS) | £0 | £8,551,304 | £8,551,304 | £9,241,611 | ||||

| 0.00 | 1.24 | 1.19 | 1.36 | |||||

| | ||||||||

The Loan Life Coverage Ratio (LLCR), unlike DSCR, is not historical but rather forward looking as it provides a snapshot of interest coverage on a given date based on the Net Present Value (NPV)34 of the projected cash flows from that date until retirement of the loan relative to the loan outstanding on that particular date.

The Project Life Coverage Ratio (PLCR), like LLCR is also a forward-looking ratio. However, it provides a snapshot of interest coverage on a given date based on the NPV of the projected cash flows from that date until the end of the project (rather than the end of the loan), relative to the loan outstanding on that particular date. This ratio enables lenders to assess whether or not there is sufficient cash flow, after the loan is scheduled for retirement, to be able to service the debt in the event that the debt needs to be restructured.

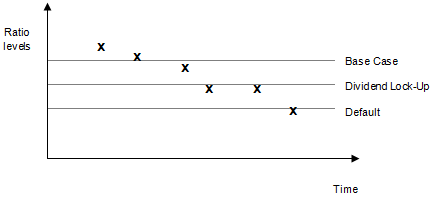

Though three coverage ratios have been discussed, many financiers will usually only focus on the DSCR and set three levels - base case, dividend lock-up, and default (see Figure 3 - 3) - to monitor a project. Coverage ratios above the base case and between the base case and dividend lock-up level are usually not a concern for lenders, though they will generally watch for trends. Once a coverage ratio falls below the dividend lock-up level, equity holders will be restricted from withdrawing funds to pay dividends until the ratios are at or above the base case level. If the ratios continue to fall towards the default level, lenders may take a more active approach in their dealing with management as they seek to better understand and rectify the downward trend in order to prevent a default35.

Figure 3 - 3

Cash flow and coverage ratios

Coverage ratio requirements are dependent on a number of factors and are generally a reflection of actual or perceived risk. Ratio requirements will differ between different sectors due to the varying degrees of cash flow predictability and decreased market risk36. They can also vary depending on the level of competition between lenders wishing to be involved in a project. That is, the more competition to finance a deal, the more financiers may be willing to lower coverage limits. According to Pollio37 (p.114), the "conventional rule of thumb is that coverage ratios should be at least twice the contractual debt service payments". However, that is in fact only a guideline, and as highlighted in Box 3 - 5, different organizations will set their own requirements.

|

| ||||||

| Natural Resources | Roads User-pays | Power | Water | |||

| DSCR min | 1.25 | 1.25 | 1.25 | 1.20 | ||

| LLCR min | 1.75 | 1.50 | 1.35 | 1.30 | ||

| PLCR min | 2.00 | 1.80 | 1.50 | 1.40 | ||

|

| ||||||

_______________________________________________________________________________

34 See Glossary

35 See Glossary

36 Partnerships Victoria Guidance Material Contract Management Guide June 2003 www.partnerships.vic.gov.au/domino/web_notes/PartVic/PVSite.nsf/Frameset/PV?OpenDocument

37 Pollio, G., "International Project Analysis and Financing" 2002 University of Michigan Press