d) Swaps

To protect themselves against fluctuations in interest rates and currency exchange rates, sponsors may be required by the lenders to enter into hedging contracts such as swaps. A swap is an agreement whereby two parties agree to exchange currencies, interest payments or commodities at preset future dates. These are financial devices used to reduce losses as a result of future price movements.

• Interest rate swaps

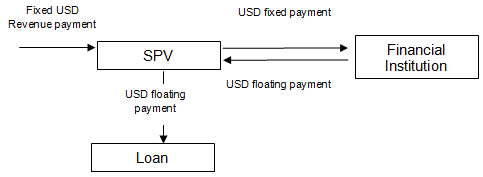

Interest rate swaps can be used to mitigate risks that can occur when an interest payment mismatch occurs. For example, if a project is financed based on a floating rate, as are many long-term financings, but the revenues are based on a fixed revenue stream the project, or SPV, is exposed to interest rate volatility. The SPV can enter into an interest rate swap, where it pays a fixed payment rate to a financial institution and in exchange receives a payment based on a floating rate. The diagram below shows the cash flows associated with such swaps. Since the company's debt service on its floating-rate loan is matched by the floating-rate cash flow received from financial institution under the swap, the company is left with a fixed-rate obligation. As a result, the interest rate swap has enabled the SPV to eliminate the risk caused by any interest rate volatility and effectively achieved fixed-rate funding for the project.

Figure 4 - 2

Interest Rate Swap

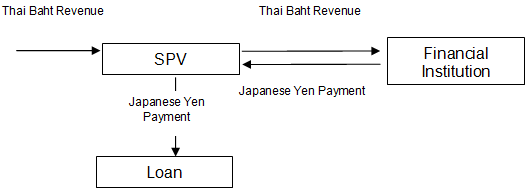

Currency swaps, like interest rate swaps, allow two parties to exchange payments on specific dates at predetermined rates. However, instead of fixed and floating interest rate payments currency swaps involve the exchange of different currencies.

For example, when a liability, such as a loan, is in one country currency but the revenues are in another it causes a currency mismatch exposing the parties to risk caused from exchange rate movements. A currency swap will enable the SPV to swap its local currency revenues for foreign denominated revenues, and like the interest rate swap, the cash flows can be structured to exactly match the loan amounts. As a result future volatility in income resulting from the currency mismatch on this particular loan is eliminated.

Figure 4 - 3

Currency Swaps

Currency and Interest swaps can also be combined in situations where the loan payment is in both a foreign currency and is based on a floating rate.