Inflation Hedging

Our review of some project financial models indicates that there are likely to be a number across Scotland in which there is a level of unitary charge indexation in excess of that required to cover the operating costs of the project company. This 'excess indexation' could be hedged using an RPI swap, which will produce an additional project revenue stream and hence provides the potential to allow a reduction in the unitary charge. However this hedge could only be introduced with the agreement of the shareholders in the project and therefore the benefit would probably require to be shared with these parties. The number of projects which involve 'excess indexation' are expected to be relatively small and therefore the size of the potential public sector benefit is expected to be small.

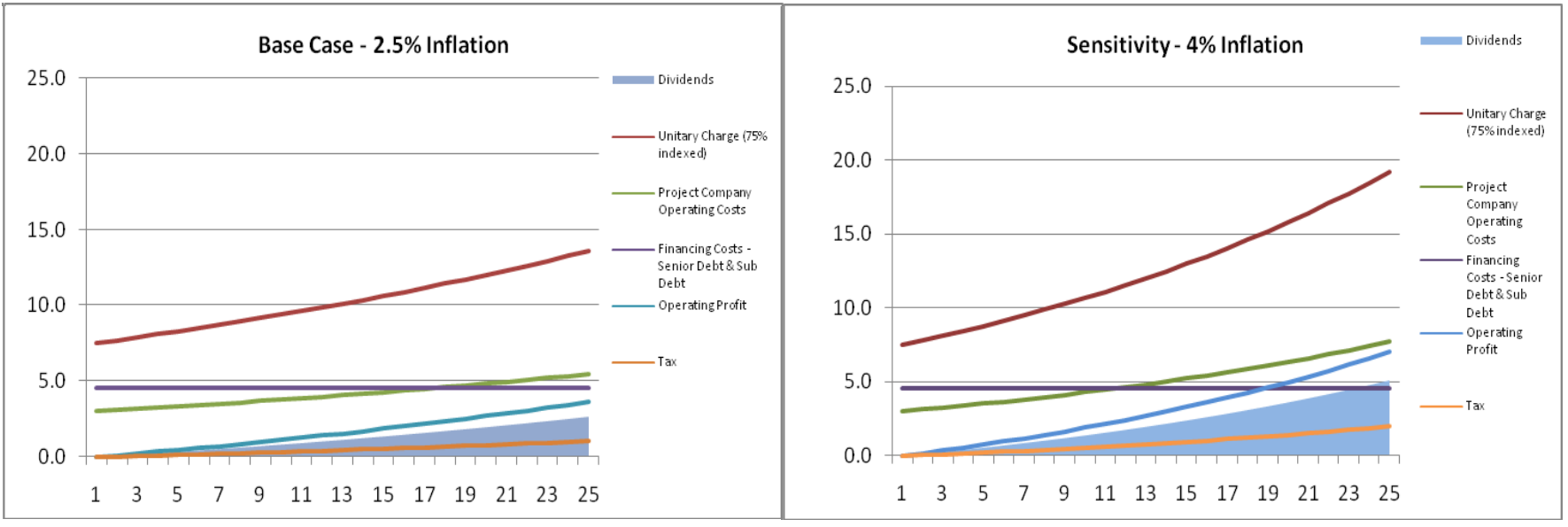

| Box 5 - Excess Indexation Where a public body has granted a higher level of unitary charge indexation than is required by the project company to meet its (indexing) costs and no form of RPI swap has been put in place ('excess indexation'), then the equity return will tend to improve, if inflation turns out to be higher than the base case assumption (generally taken to be 2.5% - as in the example below). Conversely if inflation turns out to be lower than the base case assumption, then the equity return will be lower than expected. The link between higher inflation and higher equity return is shown in the graphs below. The left hand graph would be the expectation of returns at the financial close of the project. (in this example it shows cumulative nominal dividends of £29.7m), given a base case inflationary assumption of 2.5%. The right hand graph shows the impact on dividends from a rise to a 4% average inflation rate, which leads to an increase in dividends to £53.9m. A fall in actual inflation to a 1% average would reduce cumulative dividends to £10.5m. Therefore excess indexation leads to greater variability in equity returns linked to the actual level of inflation. There may be merit to include an RPI swap to both increase the stability of the project and bring in a additional revenue stream to the project which could be used to bring a unitary charge saving to the public sector, which would have to be shared with investors.

|

The total level of unitary charge payable under all Scottish PPP contracts in 2011 / 12 is estimated to be £912m. If Scottish Water, Scottish Prison Service and transport projects are excluded, the revised figure is £634m (or largely health and local authority projects). On average about 40% of the Unitary Charge cost is for operating costs (FM , lifecycle, insurance, project company costs) - coming to a total of £254m. We believe that 2% is a conservative estimate for savings and benefits that could be realised from improved contract management - equating to around £5m per annum. In addition to this we believe there may be an additional opportunity to realise savings with regard to both the staffing cost for contract monitoring through a shared service approach and from greater levels of inflation hedging. In total therefore we estimate a potential saving of at least £5.5m per annum from this area of activity should be realisable.