Meeting infrastructure needs is an ongoing challenge for states

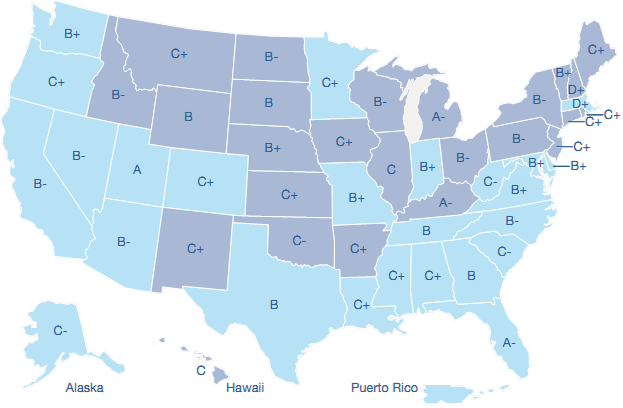

Figure 1: Quality of infrastructure and PPP legislation

| A-D: Infrastructure quality grades assigned by The Pew Center on the States |

Source: PricewaterhouseCoopers analysis based on data from The Pew Center on the States and the Federal Highway Administration

Figure 2: American Recovery and Reinvestment Act of 2009 total infrastructure distribution by state

Budget |

| State |

Less than $180M |

| DE, DC, HI, VT, NH, ME, RI, WY, ND, AK |

$180-$420M |

| ID, SD, NV, WV, MT, UT, NE, NM, CT, OR, KS, AR, MS, IA, CO |

$420-$690M |

| KY, LA, MD, MA, SC, OK, WA, MN, AL, AZ, WI, TN, MO, NJ, IN |

$690M-$1B |

| VA, NC, MI, GA, IL, OH |

More than $1B |

| PA, NY, FL, TX, CA |

Source: www.recovery.gov

"PPPs represent an intersection of cutting-edge finance, political and labor relations skills, real estate sophistication, and operating business skills. It is harder than it looks from the sidelines. But when it works, it's a win-win."

-Leonard Shaykin,

LambdaStar Infrastructure Partners

While the economic crisis could delay some potential PPPs in the short term, it is placing significantly more pressure on financially strapped public officials to avoid tax increases and seek alternative ways of funding infrastructure improvements. "We need to fill the void as the gasoline tax becomes a declining revenue source," says Peggy Catlin, deputy executive director of the Colorado Department of Transportation. "Private-sector financing through PPPs is one way to get the job done. PPPs aren't a silver bullet but should definitely be considered as an option."4

John Veech, managing director at Morgan Stanley Infrastructure Partners, the global infrastructure investment fund sponsored by Morgan Stanley, agrees. He says, "It's really a question of what are the goals and objectives of the state or municipality. Some infrastructure assets should be run by government; others make more sense being run by the private sector."

Veech confirms what other investors have said about the growing appetite in the US for investment in public-private partnerships through infrastructure funds or, in some cases, direct investments by pension funds. Among the appealing factors of PPPs for pension funds, endowments, and other investors are: assets of longer duration with a reasonably high element of current cash flow; the realization of a nice mix of current-and, ultimately, total-return on investment; relative stability compared with other investments such as real estate, private equity, and venture capital; and some inflation protection built into the revenue stream.

"There is strong to very strong interest among the investment community" in public-private infrastructure partnerships, Veech says. "In a world of volatility in the public markets, infrastructure investments provide relative stability."5

___________________________________________________________________________

4 Interview with Peggy Catlin, deputy executive director of the Colorado Department of Transportation, August 13, 2009.

5 Interview with John Veech, managing director at Morgan Stanley Infrastructure Partners, November 4, 2009.