Value for money in public-private partnership decisions

A value for money (VfM) analysis evaluates future cash flows to determine whether a capital project is best suited to a traditional public-procurement option or a public-private partnership.

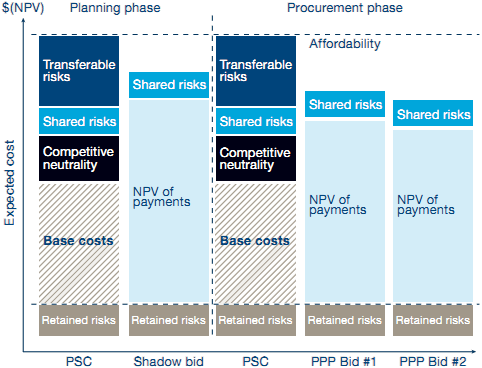

Conducted by multiple independent third parties with specialized operations, costing, and engineering expertise, a VfM assessment measures relative financial benefit. It also provides an audit trail that ensures public transparency (see Figure 4).

Figure 4: VfM analysis measures relative financial benefit

The public-sector comparator (PSC), a major component of VfM analysis, is a hypothetical, risk-adjusted cost estimate for a project, were that project to be financed, owned, and implemented by the public sector. Employing financial and statistical modeling techniques to estimate costs, it provides a baseline measure against which to compare future bids as well as a benchmark to measure value for money.

VfM analysis allocates, analyzes, quantifies, and simulates risk to better understand the project's risk profile, as illustrated in Figure 4: retained risks are retained by the public sector, shared risks are shared by the public and private sectors in a PPP option, and transferable risks are transferred to the private sector in a PPP option.

The base costs in Figure 4 represent the actual costs before risk-on a net present value (NPV) basis-to the public sector, including design, construction, operations, maintenance, and asset rehabilitation. Competitive neutrality accounts for differences between the PSC and private procurement. For example, the public sector traditionally does not purchase insurance to cover routine operating risks; instead it pays the costs only if any routine operating risks actually occur. NPV of payments represents the payments the government would make to the private sector during a PPP transaction. These payments cover the design, construction, operations, maintenance, and rehabilitation of the assets. In the shadow bid and the PPP bids, transferable risks are included in the NPV of payments.

Figure 4 assesses value for money at two different stages of a PPP decision: planning and procurement. The PSC estimates the cost for the public sector to build and operate the asset, while the shadow bid represents a hypothetical estimate of comparable private sector costs. If the shadow bid shows a lower cost than the PSC during planning, then actual bids are received and compared against each other and the PSC during procurement.

VfM analysis allows well-informed, accurate, full-cost pricing early in a project. It also encourages competition from bidders, who are aware that a genuine benchmark exists that they will have to beat. By clarifying project requirements and risks, as well as offering a standard for decision making for the duration of procurement, the PSC can serve as a negotiating tool during the bidding stage of a PPP.

A requirement for all projects in the UK since the early 1990s, the public sector comparator is now standard practice in much of Australia. However, no uniform global method exists to calculate VfM analysis or simulate the public-sector comparator; standards vary by country.

small to manage." She also learned that "all politics is local," adding that people with specific, local issues can sometimes use the PPP approach to reinforce their positions. Bird said there was no major controversy surrounding the Canada Line project itself-it had been in regional and local transportation plans for decades. However, the PPP approach was new in the community and generated considerable debate at the regional government level; the regional government was a significant funding partner. In particular, Bird said, some public-sector unions tried to make PPPs an issue because they oppose private involvement in any services they believe are the government's responsibility. The unions "got some traction at the local level, but ultimately, nothing sufficient to detour the project," she said. Indeed, a few weeks after the opening of Canada Line, Bird reports a positive reaction from the public as well as ridership that is tracking at or ahead of anticipated levels.19

___________________________________________________________________________

19 Interview with Jane Bird, CEO of Canada Line Rapid Transit Inc., September 2, 2009.