iv. Grant Anticipation Revenue Vehicles (GARVEEs)

A Grant Anticipation Revenue Vehicle or GARVEE is a debt financing instrument authorized under 23 U.S.C. 122. GARVEEs allow a State, a political subdivision of a State, or a public authority to pledge future Federal-aid highway funds to support the costs related to an eligible debt financing instrument, such as a bond, note, certificate, mortgage, or lease. States can utilize GARVEEs for a wide array of debt-related costs, including interest payments, retirement of principal, and any other cost incidental to the sale of an eligible debt instrument, incurred in connection with an eligible debt financing instrument. GARVEEs essentially enable debt-related expenses to be paid with future Federal-aid highway apportionments. Although not available to private entities, they can facilitate the formation of public-private partnerships by making financing available for transportation projects in a way that could attract greater private sector involvement.GARVEEs can provide an immediate and reliable source of funds that would make a project more attractive to the private sector. In addition, by providing access to this additional funding, GARVEEs can enable States to move forward on a large number of projects within a compressed time period. These projects create a short-term need for additional staff and management of these projects. Since it would not be cost-effective for most States to hire additional staff that would only be needed for a short time, the private sector can be called upon to provide these additional resources during the most active design and construction phases of the projects.

In general, projects funded with the proceeds of a GARVEE debt instrument are subject to the same requirements as other Federal-aid projects with the exception of the reimbursement process. Instead of reimbursing construction costs as they are incurred, the reimbursement of GARVEE project costs occurs when debt service is due. It is important to note that, in order to issue GARVEE bonds, States or the issuing entity must have the appropriate State authorizations related to debt issuance. States have the flexibility to tailor GARVEE financings to accommodate State fiscal and legal conditions.

The GARVEE financing mechanism generates up-front capital for major highway projects at tax-exempt rates and enables a State to construct a project earlier than it could using traditional pay-as-you-go grant resources. With projects in place sooner, costs are lower due to inflation savings and the public realizes safety, reduced congestion, and economic benefits. By paying via future Federal highway reimbursements, the cost of the facility is spread over its useful life, rather than just the construction period. GARVEEs can expand access to capital markets, as a supplement to general obligation or revenue bonds.

Candidates for GARVEE financing are typically large projects (or a program of projects) that have the following characteristics:

∙ The costs of delay outweigh the costs of financing;

∙ Other borrowing approaches may not be feasible or are limited in capacity;

∙ They do not have access to a revenue stream and other forms of repayment are not feasible; and

∙ The sponsors are willing to reserve a portion of future year Federal-aid highway funds to satisfy debt service requirements.

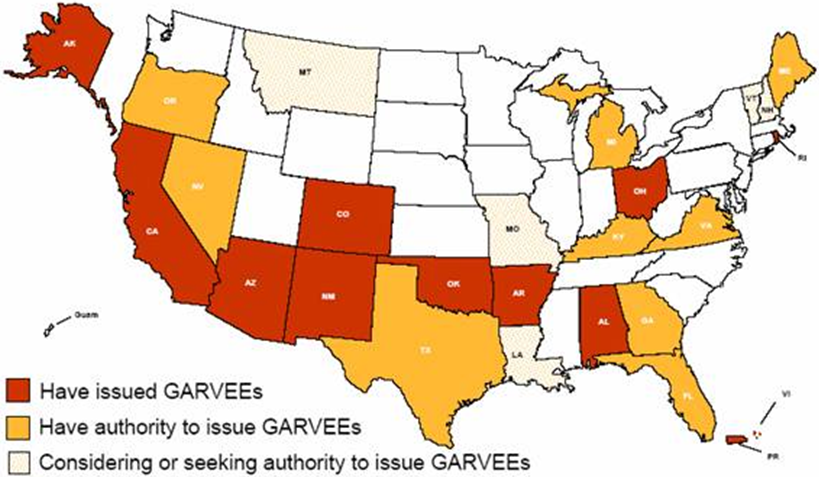

States are finding GARVEEs to be an attractive financing mechanism to bridge funding gaps and accelerate construction of major corridor projects. As of June 2004, 10 States and the Virgin Islands have issued just over $5 billion in GARVEE bonds. Figure 2.4 illustrates what States have issued GARVEEs, what States have the authority to issue GARVEEs, and considering or seeking the authority to issue GARVEEs as of June 2004. Ohio, the first State to leverage Federal dollars through GARVEEs, sold five GARVEE issues in the FY 1998-2004 period, totaling $439 million. The proceeds of these issues are helping to finance Spring-Sandusky corridor improvements, the new Maumee River Bridge, and the Southeast Ohio Plan.

Figure 2.4

GARVEEs: State Participation as of June 2004

GARVEE financing has raised some concerns about the degree to which the commitment of future Federal-aid highway dollars is mortgaging the future. Financing large projects by borrowing against the future can be an effective element of a State's transportation plan. However, borrowing imprudently can do damage in future years when major portions of Federal apportionments are used to pay back the GARVEE bonds and the market for smaller projects shrinks.[16] Recognizing this issue, most of the States with GARVEE enabling legislation have limits on the amount of GARVEE debt, such as a maximum amount that can be issued or coverage requirement tests.