2. State Infrastructure Banks (SIBs)

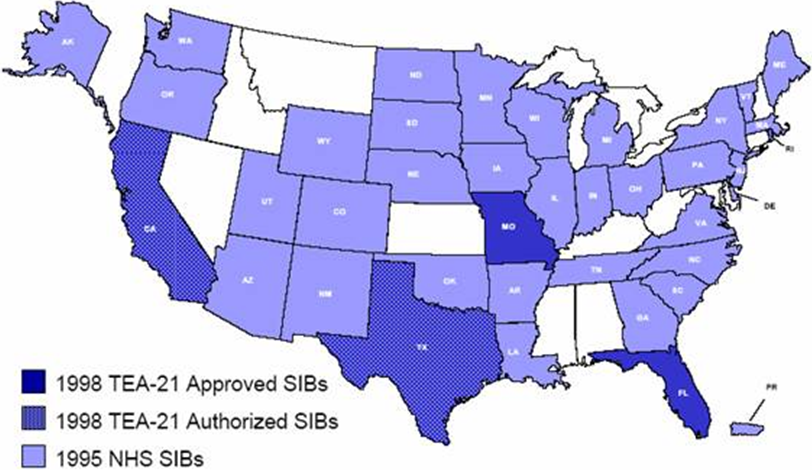

State Infrastructure Banks (SIBs) are revolving funds administered by States that support surface transportation projects. A SIB functions much like a bank by offering loans and other credit products to public and private sponsors of title 23, United States Code, highway construction projects or title 49, United States Code, transit capital projects. Federally capitalized SIBs were first authorized under the provisions of the NHS Act.[18] The pilot program was originally available to only 10 States, and was later expanded to include 38 States and Puerto Rico (See Figure 2.5).[19] The TEA-21 established a new pilot program for the States of California, Florida, Missouri, and Rhode Island. Texas was subsequently added to the TEA-21 pilot program.[20] The initial infusion of Federal funds and State matching funds was critical to the start-up of a SIB, but States have the opportunity to contribute additional State or local funds to enhance capitalization. For the two SIBs authorized by TEA-21, Federal funds do not lose the Federal character when reused or revolved to a subsequent project. Retaining their Federal character means that Federal grant requirements apply to loans made from these reused or revolved funds. For the 39 federally-approved SIBs under the NHS Act, Federal grant requirements do not apply to reused or revolved funds.

Figure 2.5

State Infrastructure Banks: Pilot Program Participation as of March 2004

SIB assistance may include loans (at or below market rates), loan guarantees, standby lines of credit, letters of credit, certificates of participation, debt service reserve funds, bond insurance, and other forms of non-grant assistance. As loans are repaid, a SIB's capital is replenished and can be used to support a new cycle of projects.

SIBs can also be structured to leverage additional resources. A "leveraged" SIB would issue bonds against its future revenues, increasing the amount of funds available for loans.

SIBs complement traditional funding techniques and serve as a useful tool to meet project financing demands, stretching both Federal and State dollars. The primary benefits of SIBs to transportation investment include:

∙ Flexible project financing, such as low interest loans and credit assistance that can be tailored to the individual projects;

∙ Accelerated completion of projects;

∙ Reduced congestion and travel delays;

∙ Incentive for increased State and/or local investment;

∙ Enhanced opportunities for private investment by lowering the financial risk and creating a stronger market condition; and

∙ Recycling of funds to provide financing for future transportation projects.

Additionally, using SIB funding increases efficiency in investment because it loosens Federal constraints on a State's choice of projects, because the Federal funds used to capitalize the SIB are available to fund any project eligible under title 23, United States Code.[21] With fewer restrictions on its decisions, a State is free to choose projects with the highest overall economic returns and not just the highest returns within each category of Federal aid, as traditional financing would require.[22]

While the authorizing Federal legislation establishes basic requirements and the overall operating framework for a SIB, States have customized the structure and focus of their SIB programs to meet State-specific requirements.

A variety of types of financing assistance can be offered by a SIB, with loans being the most popular form of SIB assistance. As of March 31, 2004, 32 States had entered into 373 loan agreements with a dollar value of almost $4.8 billion.