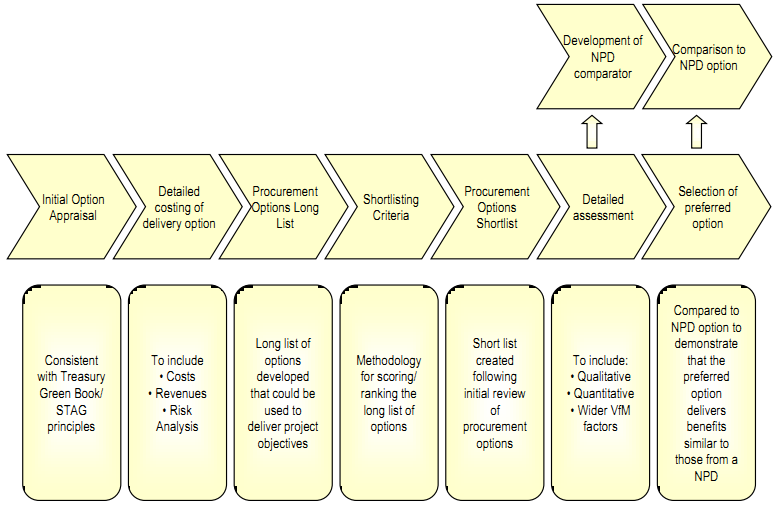

Process

E.7 Prior to the evaluation of the procurement route and detailed VfM assessment, an option appraisal using Green Book principles will have been undertaken on the long-listed options.

E.8 Authorities would then apply agreed criteria to rank options (e.g. benefits / flexibility etc) and create a shortlist of preferred options. It would be expected that the options identified, given the sector, cover large infrastructure procurements.

E.9 Then undertake a high level NPD consideration:-

• This will be at the project level (typically rail projects will be considered complex and therefore there should potential scope to explore use of NPD in whole or in part).

• On the assumption that the high level NPD assessment as detailed in Appendix A of the SFT VfM guidance indicates that NPD should be explored, then undertake more detailed VfM assessment, utilising SFT NPD VfM guidance as an appropriate comparator as described in the background above.

• Compare the preferred procurement route with a NPD option.

• Attempt to demonstrate, where possible, that the preferred procurement route provides similar or preferential benefits to those achieved through a NPD project e.g.

- Detailed risk transfer including the effective management of risks associated with construction and delivery;

- The private sector has the expertise to deliver and there is good reason to think it will offer value for money;

- That the project allows outputs to be set by the public sector;

- That the nature of the contract allows greater price certainty;

- That the value of the project is sufficiently large to ensure that procurement costs are not disproportionate;

- That the technology and other aspects of the sector are stable, and not susceptible to fast paced change;

- That planning horizons are long term, with assets intended to be used over long periods into the future; and

- There are robust incentives on the private sector to perform.

[E.10]

E.10.1 Provide an introduction and overview of the scope of the overall project, however funded e.g. it requires design, construction, operation, maintenance, revenues etc

E.10.2 Undertake a detailed review of the costs and revenues as part of the development of the business case and cost benefit ratio. The development of a business case and cost benefit ratio will demonstrate the project option represents VfM. This element requires full consideration of:-

• input costs (construction, lifecycle, maintenance, operation) - as well as phasing of these

• revenues

• bespoke risk / Optimism Bias / contingency elements

• price base and outturn delivery dates as well as economic and financial assumptions

• indication of potential sensitivities in respect of the above (particularly in respect of indexation)

- The next stage will be to select a procurement route that represents Best VfM.

E.10.3 Develop a detailed procurement strategy and VfM assessment of the preferred option(s)

• This assessment will compare the differing risk and cost impacts of each of the shortlisted procurement options in order to develop a robust audit trail to justify the selection of the preferred procurement option.

• This may include an assessment of the whole project or some of its component parts (for example, unlikely to include revenue risk transfer)

• Compare procurement route / methodology against SFT NPD VfM guidance assessment areas (Qualitative / Quantitative / Wider Factors), thereby using VfM guidance to justify indicative procurement route

• Factors to consider:

- Detailed Qualitative Assessment

o Viability - these considerations focus on whether there are issues that require that the infrastructure and services within the project to be provided by the public sector directly as opposed to private sector involvement, and, can the project requirements be captured in an output specification and /or contract based approach. Thus the procuring body must sure that an operable contract with built in flexibility can be constructed, and that any strategic and regulatory issues that impact on the public sector can be overcome

o Desirability - these considerations focus on the relevant benefits of private sector delivery against cost / risk transfer. Thus the procuring body must be satisfied that private sector involvement brings sufficient benefits that would outweigh the expected higher cost of capital and potential higher cost of services associated with remunerating the private sector for taking a certain level of defined / undefined risk

o Achievability - these considerations focus on the likely level of market interest to invest and does the public sector have the management expertise to manage the procurement and how costly will it be to procure (e.g. transaction costs of public and private sectors). Thus the procuring body must ensure that there is sufficient client side capability to deliver the project and that projects will be attractive to the market

Tailor the SFT NPD VfM Assessment guidance pro-formas for specific assessment of NPD vs the selected procurement route and rank outcome

• Other wider option specific VfM factors to consider:

- Risk identification / pricing / management (including interfaces between public and private, different contracts)

- Costs

- Economies of scale

- Funding availability

- Covenant / counter party issues

- Affordability / phasing

- Market issues (e.g. impact on competition, sole supplier)

- Accounting treatment (of government / procuring bodies (if different))

- Timetable impacts of different procurement routes

- Long term certainty vs flexibility

- Externalities

• Quantitative Assessment should also be undertaken. Note, this may be "high level" indicative quantitative elements

- Inputs costs applied as described in 2 above

- Use bespoke NPD models in comparison to financial model / cashflows of actual selected procurement route, or selected procurement route could be compared to conventional procurement (CPAM)

- Different risk quantifications for different procurement routes would be expected (including differences in retained risks between options)

- Potential not to undertake quantitative VfM testing if qualitative outputs of tested route are very persuasive

- Outturn costs must be used

The affordability implications of differing procurement routes are fundamental to decision making. Therefore appropriate affordability analysis must be demonstrated. Similarly, balance sheet issues must be reviewed.

• A review of the high level risk allocation matrix (and written summary) of alternative procurement options should be undertaken (for example chosen procurement route vs NPD).

- show how time / cost / delivery risk is treated and exposure to which parties under contractual structure

- how will performance / availability be measured

- also demonstrate contractual structure and how contract operation would work in practice

- demonstrate how interface risks will be managed

• There should be general consideration of the impact of any future increased size of project on the assessments undertaken and the procurement route selected.

• Weighting and scoring of elements between qualitative and quantitative elements and wider VfM factors are to be determined by the client

• Further analysis of how private finance can be levered into the procurement route strategy, through for example:-

- construction financing

- turn key payments

- portion of availability payments

- combination of above

- partnering (contracting) / risk sharing approaches

should be undertaken, as well as any subsequent impact on affordability and balance sheet outcomes.

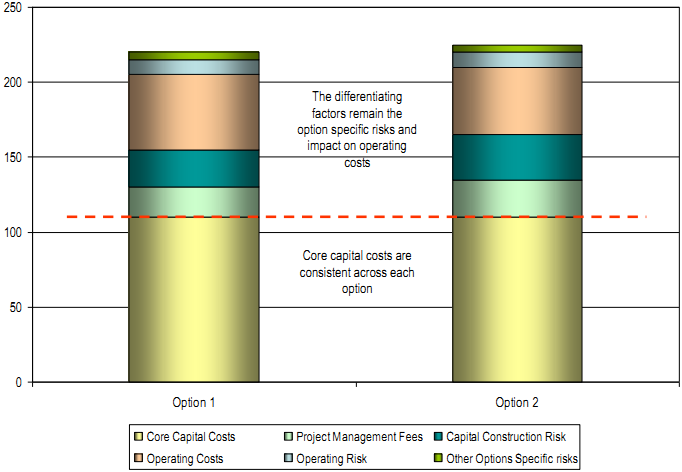

The diagram below highlights that the emphasis when comparing the detailed procurement options must be based upon the differentiating factors, i.e option specific risks and price impacts.

E.10.4 Apply any other Directorate guidance requirements, for example:

• Economic appraisal

• STAG

• Business case requirements

E.10.5 Procurement management and best practice should be considered in the assessment of procurement routes, for example:

• future VfM reviews (reapplying the processes detailed in this guidance at key procurement stages)

• Gateway Assessments

• ongoing internal risk management and ownership

• single point contract co-ordinating all delivery elements

• project management in private sector and public sector delivery

• robust tendering processes and private sector competition

• governance arrangements

The diagram below provides a summary of the process to be followed.