Tax Adjustment

Where the difference in tax treatment between options are material, they must be stripped out to ensure a like-for-like comparison of resource costs.

HMT Green Book guidance provides information on the approach which should be taken to develop the necessary adjustments.

The main objective of the guidance is to:

• Estimate the difference in tax liabilities between the CPAM and the private finance / DBFO (via NPD) procurement route for the same project; and therefore to

• Provide a better estimate of the net present cost of the CPAM.

The Procuring Authority should use the HM Treasury Green Book Guidance to determine the percentage adjustment to be made to the net present cost of the CPAM. Further details regarding the application of this guidance are available online.

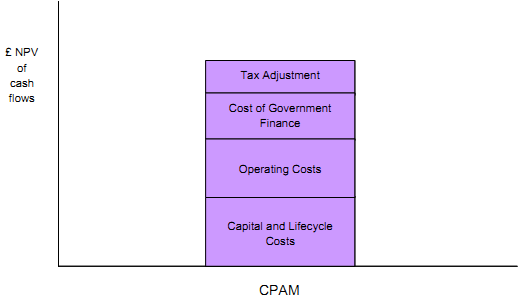

Figure 3: CPAM step 1: quantify project costs