6. Risk and Optimism Bias

The cost of procuring an infrastructure project cannot be calculated with certainty during the procurement process, as such risk should be considered and analysed to provide realistic estimates for both the CPAM and the shadow bid model. There are three types of risk to be considered:

• Quantified Risk - risks which can be identified and valued;

• Risk Premium - the cost associated with transferring risk to the private sector; and

• Optimism Bias - covers all risks that cannot be quantified.

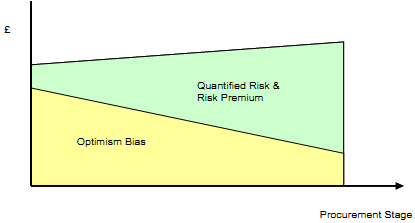

All project risks should be captured by the risk management process in place and considered under one of these headings. At the outset of a procurement it is expected that Optimism Bias will account for most of the risk attributed to the project. As the procurement progresses, detailed risk analysis is performed and the level of confidence in the capital / time assessments increases, thereby allowing some risks to transfer from the unquantified Optimism Bias category to Quantified Risk.

Figure 5: Development of risk analysis

The following section describes how these three categories of risk should be identified through a robust risk management process and incorporated into the quantitative value for money assessment.