Private Companies Often Engage in Risky Financial Schemes

| Private Companies Often Engage in Risky Financial Schemes |

Toll road deals are based on upfront payments to the states or construction companies and a contract for the long term maintenance and upgrading of the highway. This relationship assumes the private operator will have the available funds to meet these obligations. But what happens if it does not and cannot keep its part of the bargain? This is not a merely theoretical question.

If these business models prove unsustainable, the public may be left with a road operator in bankruptcy who will not invest in maintenance and upkeep, or who will collapse at an untimely moment, leaving government to figure out how to continue to operate the highway amidst a cloud of litigation. Private toll operators in both Texas and Virginia have already faced bankruptcy, leading to the foreclosure of Texas' private road and subsequent auction. Unfortunately, the purchaser of the road in Texas immediately closed the road to traffic, forcing the state to purchase it at an inflated price one year later.

Like the mortgage industry, the private infrastructure industry often relies on heavily leveraged debt and the trading of long-term risk. Some infrastructure investors such as Australia's Macquarie have followed the mortgage broker model by repackaging infrastructure deals into shares of listed infrastructure funds. Financial firms such as AIG and Goldman Sachs have followed suit.

Public watchdogs are increasingly wary of this trend. As James L. Oberstar and Peter DeFazio, the chairmen of the U.S. House Transportation and Infrastructure Committee and the Subcommittee on Highways and Transit, respectively, warned, "The dependence of these firms on debt and asset inflation rather than in-come or cash flows to finance acquisitions and pay dividends to shareholders raises questions concerning the sustainability of this model."91

Typically, firms that have invested in toll roads acquired their investments with large amounts of borrowing. The peak of these acquisitions occurred several years ago when credit was cheap. A few firms even used credit to pay dividends to their stockholders. Some of the biggest deals are financed with interest rates that start low and balloon upwards over time, like those infamous mortgages with low teaser rates. Jim Chanos, an early critic of Enron, warned in Fortune magazine about the strategies used by the largest infrastructure firm, Macquarie, "Borrowing future growth to pay investors today bears the hallmarks of a Ponzi scheme."92

Regardless of whether such dire warnings

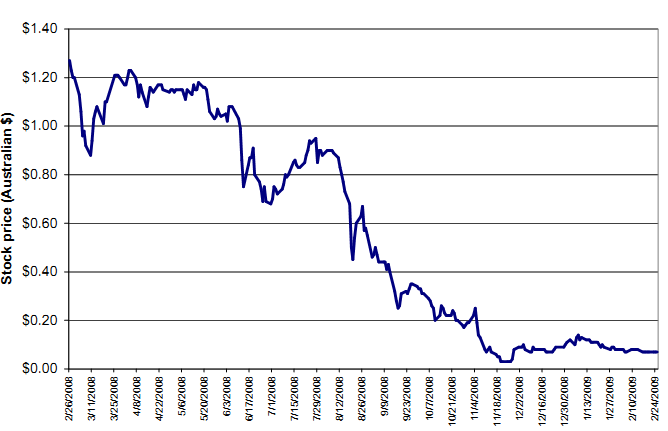

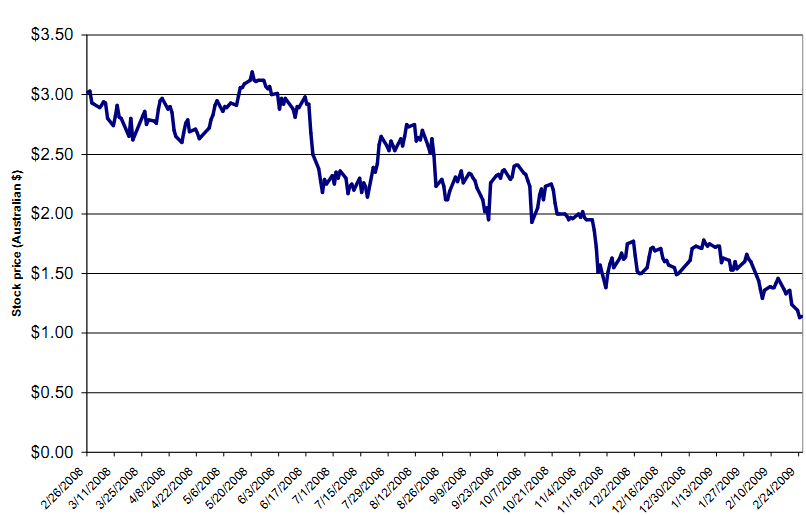

Figure 2, a-b. Stock Prices for Private Infrastructure Companies (in Australian dollars)94

Babcock & Brown Infrastructure

Macquarie Infrastructure Group

are overstated, more expensive credit has certainly hurt private toll operators' bottom lines. Most heavily hit on the private side are the Australian infrastructure financing groups, Babcock & Brown and Macquarie. These firms are leaders of Australia's well-developed infrastructure finance market. Stock prices for the two Australian firms fell dramatically in the past months as investors began to worry that these firms had far less liquidity than they suggested, shown by the graphs on the previous page. The price of stock in the Babcock & Brown Infrastructure Fund had dropped to just 7 cents per share (Australian) by February 2009.93 Many infrastructure funds have been downgraded by rating agencies and analysts have posted warnings regarding these liquidity concerns.