Will it Make Financial Sense?

The U.S. market provides PPPs with some key financial tools not available in other PPP markets around the world. The first tool is the availability of tax exempt financing through the use of tax exempt structures such as those that a 501(c) (3) or 63-20 type of vehicle would provide. More recently, Congress has provided for the use of Private Activity Bonds. Each of these mechanisms must be considered in light of whether the facility is a federal aid highway or not; which tolling provisions of Title 23 would apply; and which Title 23, tax or return limitations may be associated with the specific project design. In the case of a concession-type approach, Title 23 requirements may greatly influence project and financial scheme design.

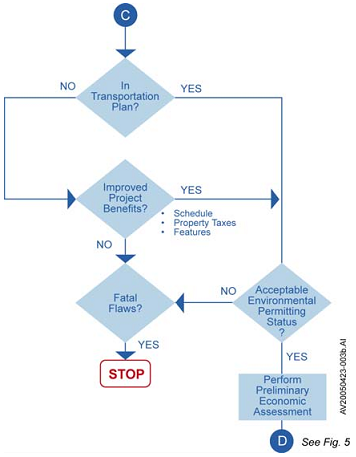

Figure 4. Are There Any Fatal Flaws?

Issues related to subsidy requirements or anticipated concession payments, timing and limitations, if any, on use of proceeds are similarly key considerations in overall project design and economic feasibility. States, today, are clearly on the learning curve and a key question for the Contractor/Developer is "does the public sector have the tools it needs to broadly evaluate the financial offerings it receives in the PPP process, especially where there are competing offers with different risk structures and time frames?"

For the public sector, these models are more than pure financial models in that they must allow the regulator to consider broader economic and specific user impacts. Government must be a sophisticated seller of rights which traditionally (at least since about the 1920's) have been its purview only. A successful PPP industry in the United States cannot be built just on headlines.

The PPP proposal process itself now becomes a key hurdle to be addressed. Unsolicited proposals afford the Contractor/Developer the greatest opportunity to create a feasible and profitable project. It maximizes the opportunity for creativity in solving the "project problems" which the public sector has not yet been able to solve. Several key issues exist that are still evolving in the PPP market place today. These issues relate to protection of intellectual property, especially in the case of seeking competitive proposals in response to an unsolicited proposal, and the timing of freedom of information provisions dealing with information, especially when competitive offers are determined by economic valuation or best-value approaches. The unknowns that exist with regard to client financial evaluation methodologies introduce a degree of risk into the PPP process that must be addressed.

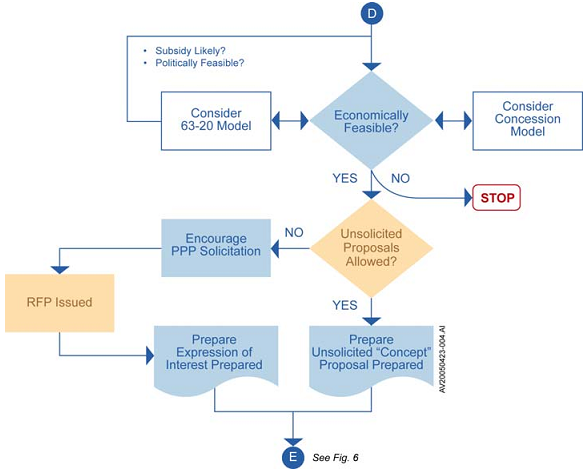

Depending on the client's processes, the Contractor/Developer now is providing its first formal proposal of a concept that has been previously "shopped" to the various stakeholder groups. Figure 5 illustrates the stages involved in determining the financial feasibility of such a concept.

Figure 5. Will It Make Financial Sense?