The Money: Sources of Financing for PPPs

The third key characteristic of a PPP is the money, meaning which elements of the project are financed by the public or private partners, and how. In some PPPs, the public sector pays for construction, improvement, operation and maintenance of an asset using public funds from taxes, direct user fees or tolls, borrowed funds (typically bonds or related instruments) or grants from other levels of government. In others, the public sector seeks to attract the private sector to finance part or all of a project with private resources that may come from direct user fees or tolls, funds borrowed from private capital markets (typically bonds or other debt) or private equity21

If the private sector provides financing, it will need to cover costs and also make a return on investment, either from a revenue stream generated by the facility (such as tolls) or from public sector compensation. Some compensation arrangements-such as availability payments and shadow tolls-allow the public sector to make regular payments to a private partner based on a facility's available capacity, traffic levels or other performance measures as defined by contract. Privately financed transportation PPPs using these models often do not involve any direct user fees or tolls.

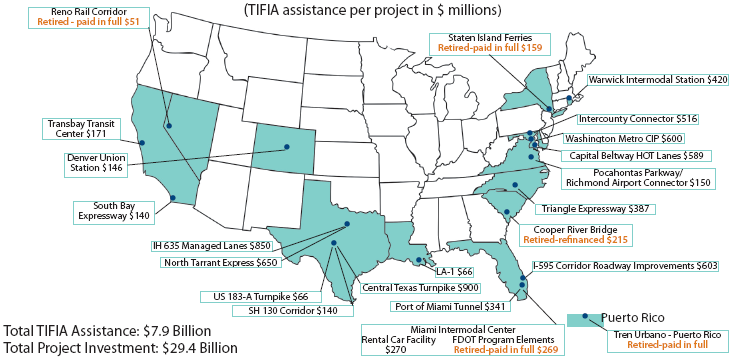

Figure 3. Innovative Finance Mechanisms that Can Support PPPs23 | In addition to user fees and the standard financing mechanisms available in general capital markets, other innovative financing tools exist that can facilitate PPP projects (Figures 3 through 5 and Table 2). Transportation Infrastructure Finance and Innovation Act (TIFIA) federal credit assistance, private activity bonds and state infrastructure banks, for example, provide access to low-interest or tax-exempt debt to private sector entities for transportation projects. These tools can reduce financing costs for private entities to levels that are more competitive with tax-exempt state and municipal financing rates.22 (See Glossary for more on these and other innovative financing methods.)

| |

Federal-Aid Fund Management Tools • Advance Construction (AC) and Partial Conversion of Advance Construction (PCAC) • Federal-Aid Matching Strategies Flexible Match Tapered Match Toll Credits (Soft Match) Program Match Third-Party Donations Using Other Federal Funds as Match Federal Debt Financing Tools • Grant Anticipation Revenue Vehicles (GARVEEs) • Private Activity Bonds (PABs) | Federal Credit Assistance Tools • Transportation Infrastructure Finance and Innovation Act (TIFIA) • State Infrastructure Banks (SIBs) • Section 129 Loans Public-Private Finance Mechanisms • Pass-Through Tolls / Shadow Tolling • Availability Payments Other Innovative Finance Mechanisms • Non-Federal Bonding and Debt Instruments • Value Capture Arrangements such as Tax Increment Financing (TIF) | |

Table 2. Projects Using Private Activity Bonds (PABs) as of January 201026 | |

PROJECT | PAB ALLOCATION |

BONDED ISSUED |

|

Capital Beltway HOT Lanes, Virginia (issued 6-12-08) | $589,000,000 |

North Tarrant Express, Texas (issued 12-17-09) | $400,000,000 |

Subtotal | $989,000,000 |

ALLOCATIONS |

|

IH-635 (LBJ Freeway), Texas | $2,650,000,000 |

RidgePort Logistics Center, Will County, Illinois | $554,800,000 |

CenterPoint Intermodal Center, Joliet, Illinois | $1,340,000,000 |

Knik Arm Crossing, Alaska | $600,000,000 |

Mississippi DOT Jackson Airport Parkway | $200,000,000 |

Subtotal | $5,344,800,000 |

TOTAL PAB ALLOCATIONS | $6,333,800,000 |

|

The Transportation Infrastructure Finance and Innovation Act (TIFIA) program provides federal credit assistance to public or private sponsors of eligible major surface transportation projects. See Glossary for more information. |

|

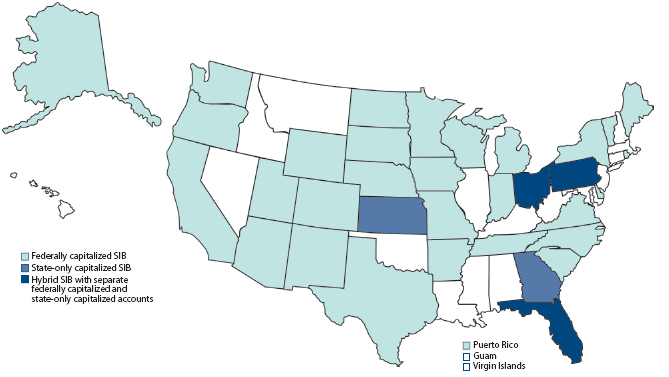

A state infrastructure bank (SIB) is a state-administered revolving fund that provides credit assistance to public and private sponsors of federal-aid highway projects. See Glossary for more information. |