2.1 Eliminate the Diversions from the Motor Fuels Tax.

One suggestion for increasing Texas highway funds is to eliminate the diversions from the motor fuel tax. According to a constitutional amendment passed by Texas voters in 1946, one quarter of the motor fuels tax is allocated to Fund 7, the Available School Fund.16 In FY07, the motor fuels tax brought in a total of approximately $3 billion ($2.3 billion from the gasoline tax, $750 million from the diesel tax); thus, $750 million passed to Fund 7.

The Committee does not believe that either the Legislature or the voters would approve the elimination of this diversion in today's contentious environment for school finance. Moreover, diversions are ultimately a zero sum game - any money saved for Fund 6 would have to be made up from other state funds. No new money would enter the state's funding system.

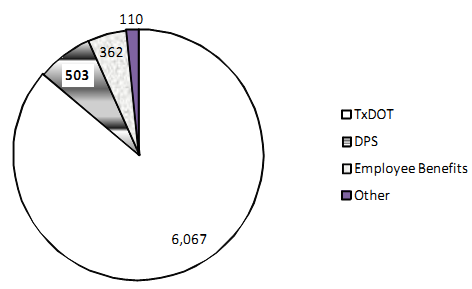

The same reasoning would apply to eliminating the current diversions from Fund 6 itself, though the Committee believes that these proposals may carry more Legislative support. For FY 08-09, these diversions account for approximately 14 percent of the State Highway Fund, or roughly one billion dollars per annum.

STATE HIGHWAY FUND APPROPRIATED AMOUNTS FY08-0917 ($ MILLION, ANNUALIZED)

While the accounting may be cleaner if the funding for the Department of Public Safety, Employee Benefits and miscellaneous other expenditures come out of General Revenue rather than Fund 6, the Committee heard no suggestions that these expenses could be dispensed with entirely. Thus, as with the portion of motor fuel tax revenues diverted to education, elimination of the Fund 6 diversions ultimately become more of a zero-sum accounting exercise rather than a source of new money for highway funding.

__________________________________________________________________________________

16 The gasoline and diesel taxes are allocated in slightly different ways. In both cases, the Comptroller takes one percent off the top for collections and enforcement, and 25 percent goes to public education. The remainder from the diesel tax is allocated entirely to Fund 6. Of the remaining gasoline tax revenues, the Tax Code §162.503 allocates $7.3 million to County and Road Districts. The remainder goes to Fund 6, with the provision that a quarter of the gasoline tax revenues be used for the Farm to Market road network.

17 Source: Legislative Budget Board, Overview of State Highway Fund 0006, Revenues and Allocations, the Texas Mobility Fund, and the Texas Rail Relocation and Improvement Fund , April 2008, p. 14.