2.2. Recover Texas' Full Contribution to the Federal Highway Trust Fund

The Federal Highway Trust Fund was formed in 1956 as part of the legislation creating the interstate highway system. In FY 2006, revenues nationwide amounted to $38.6 billion. The FHTF derives 85 percent of its revenues from federal gasoline and diesel taxes, currently 18.4 cents and 24.4 cents per gallon respectively. Another 10 percent comes from truck, bus and trailer taxes, with the remainder derived from a tire tax, heavy vehicle usage fees and taxes on alternative fuels.18 Federal motor fuel taxes were last raised in 1993, and are not adjusted for inflation.19

Texas' representatives in Congress have long argued that the state receives less than it contributes to the FHTF. They are correct. Since the Fund's inception, Texas has ranked dead last in receipts vs. contributions.20

FEDERAL HIGHWAY TRUST FUND CUMULATIVE (SINCE 1956) DONOR-RECIPIENT POSITION BY STATE $ IN '000S

| State | Recepits/Contributions | State | Net$ |

| Alaska | 6.43 | New York | 7,167.455 |

| Dist. of Col. | 4.15 | Alaska | 7058.675 |

| Hawaii | 3.11 | Pennsylvania | 5.228.706 |

| Montana | 2.38 | Massachusetts | 5.182.277 |

| Rhode Island | 2 32 | Connecticut | 4.539.045 |

Top 10 | Vermont | 2.13 | West Virginia | 4.401.432 |

| South Dakota | 2.12 | Montana | 3;929.686 |

| North Dakota | 2.12 | Washington | 3.768 500 |

| West Virginia | 1.95 | Hawaii | 3243.828 |

| Wyominq | 1.73 | Maryland | 2,832.902 |

| California | 0.97 | Oklahoma | (728,039) |

| Florida | 3.94 | South Carolina | (819.446) |

| Ohio | 0.94 | Georgia | (1,492 712) |

| Georgia | 0.93 | Michigan | (1 558.835) |

| Oklahoma | 093 | Ohio | (1 588.417) |

Bottom 10 | Michigan | 0.93 | North Carolina | (1.659 728) |

| South Carolina | 0.92 | California | (1 666 640) |

| North Carolina | 0.91 | Indiana | (1 691.555) |

| ndiana | 0.90 | Florida | (1,746.624) |

| Texas | 0.89 | Texas | (5,632.043) |

Unfortunately, correcting this unfairness would add little new revenue to Fund 6. The amounts involved are simply too small. For instance, recovering Texas' full FHTF contribution in FY07 would have added only $131 million to the state's coffers, a tiny percentage of the overall highway funding gap. The ratio of receipts to contributions to the FHTF also varies between years. For instance, in FY02, Texas actually received $15.6 million more than it contributed.

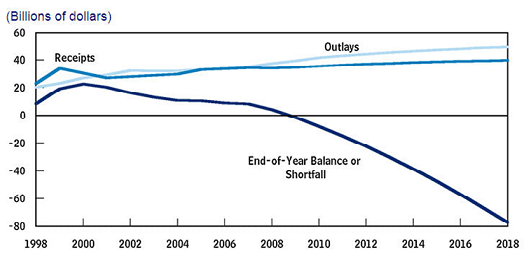

In addition, both the Federal Highway Trust Fund and the federal government itself suffer from their own well-publicized financial problems. But for an emergency $8 billion allocation, the FHTF would have run out of money in this year,21 and the Congressional Budget Office has projected that outlays will exceed revenues every year during the upcoming decade, unless federal fuel taxes are raised.

While the scale of the federal government's budgetary difficulties are outside the scope of this report, we do note that annual projected federal on-budget deficits have run in the $400-500 billion range since FY03 and that the ratio of U.S. debt to GDP is now at a post-World War II high.22 Projections for the next several years do not provide much hope for improvement, and the as-yet undetermined cost of preserving the solvency of the U.S. banking and financial system will only add to this burden.

Actual and Projected Highway Account Receipts, Outlays, and

Balances or Shortfalls, 1998 to 2018

_______________________________________________________________

In addition, the failings of the current federal highway funding system are exacerbated by the misallocation of transportation resources for political or special purpose spending.23 The number of earmarks in federal highway legislation has grown enormously in the past two decades.24 While these earmarks may not be bad in and of themselves, they do make it more difficult to create a unified federal transportation plan.

Other programs of federal assistance will face the same difficulty.

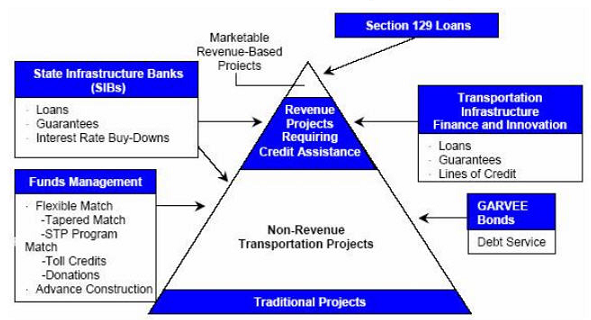

Federal Finance Tools for Surface Transportation Projects

GARVEE bonds (Grant anticipation bonds) are issued in the anticipation of receiving federal grants. Texas has (wisely in our view) rejected Garvee bonds as states that use these bonds are "betting on federal dollars that aren't going to be there any more."25

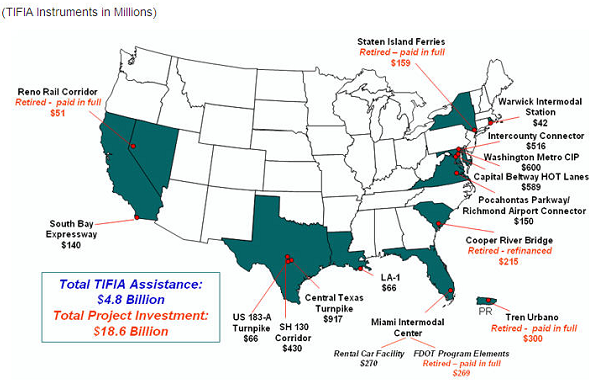

TIFIA, the Transportation Infrastructure Finance and Innovation Act of 1998, enacted as part of the Transportation Equity Act for the 21st Century (TEA-21), established a new federal program under which the U.S. Department of Transportation provides credit assistance to major surface transportation projects of national or regional significance. TIFIA provides three forms of credit assistance - secured (direct) loans, loan guarantees, and standby lines of credit. The program's fundamental goal is to leverage federal funds by attracting substantial private and other non-federal co-investment in critical improvements to the nation's surface transportation system.

TIFIA Projects

Projects in Central Texas have benefited from TIFIA,26 but the program has fundamental limitations - mainly the $10.6 billion (national) limit in the amount of credit instruments issued.

State Infrastructure Banks (SIB) were authorized in 1995 to accelerate mobility improvements through a variety of financial assistance options made to local entities through state transportation departments. Texas was chosen as one of the ten states to test the pilot program, and the Texas Legislature authorized TxDOT to administer the SIB program in 1997. SIBs are capitalized by federal funds plus state matching contributions.

To date, the Texas Transportation Commission has approved 67 loans totaling more than $294.9 million from the SIB program. These loans have helped leverage more than $2.03 billion in transportation projects in Texas.27 The SIB operates as a revolving loan fund, where the account balance grows through the monthly interest earned and repaid principal and interest payments.

However, the SIB program, like all other programs depending on federal dollars, will compete for increasingly scarce resources, especially given that the ongoing economic turmoil has decimated the finances of a number of our sister states - some of whom have already gone hat in hand to Washington for an emergency loan to pay for basic state operating expenses.28

______________________________________________________________________________________________________________________

18 FHWA Table FE-210, Status of the Federal Highway Trust Fund, Fiscal Years 1957-2006.

19 Congress reinstated a 0.1 cent/gallon motor fuel tax in 1997 to fund the Underground Storage Tank Trust Fund.

20 FHWA, Table FE-221.

21 HR 6532, signed by the President on 15 September 2008.

22 US Treasury, Bureau of Economic Analysis

23 US Department of Transportation, "Innovation Wave: An Update on the Burgeoning Private Sector Role in US Highway and Transit Infrastructure," 18 July 2008, p. 43.

24 The 1987 highway bill had fewer than 200 earmarks. The 2005 bill contained over 6,000.

25 Steve Simmons, TxDOT deputy executive director, cited in Texas Contractor, 21 April 2008.

26 A TIFIA loan and credit assistance formed part of the financing packages for the Central Texas Turnpike, US 183-A, and SH 130 segments 5 & 6.

27 Source: TxDOT

28 "Schwarzenegger to U.S.: State may need $7-billion loan," Los Angeles Times, 3 October 2008.