4.3. Advantages of using PPPs

Aside from bringing in new money, the PPP approach conveys a number of other important advantages. These include:

• Greater time and budgetary certainty

• Lower life cycle costs

• Risk transfer from the state to private parties

• Access to new pools of capital not available to public sector toll agencies

• Ability to raise larger sums due to less conservative financing models. While direct comparisons are difficult due to differences between individual projects, an

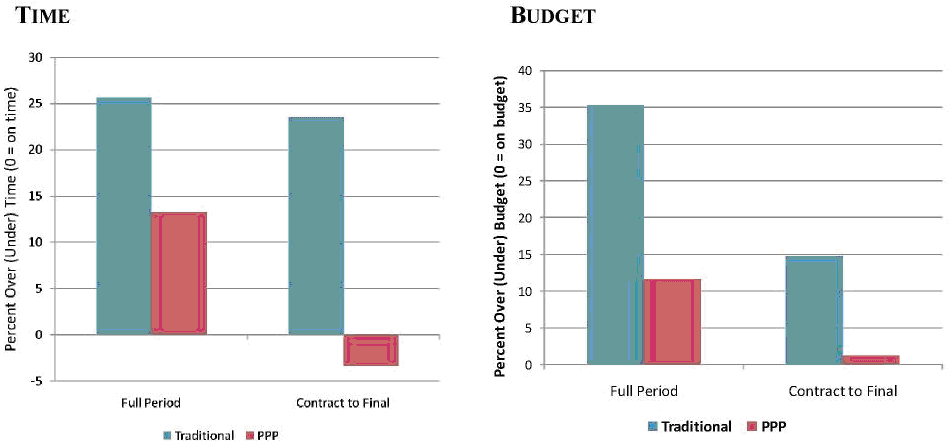

extensive Australian study found that PPPs performed significantly better than traditional contracts in bringing in projects on time and within budget.91

The study divided projects into four phases: initial approval; budget approval; award of contract; and project completion. For the full period, traditional projects averaged roughly 25 percent late and 35 percent over budget. Moreover, traditional projects had a much wider dispersal of outcomes - a greater unpredictability. Moreover, the study found that the PPP advantage grew with the size and complexity of a particular project, a result which squares with the findings of the U.S. FHWA study of Design-Build Contracts compared to traditional Design-Bid-Build.92

Two factors stood out in the Australian analysis: incentives and "scope creep." The efficiency of private companies is driven in large part by the fact that they have much more to lose from time and cost overruns than do their public counterparts. In addition, public projects were plagued with politically driven scope changes, even after work had commenced. PPPs, by contrast, had the terms fixed by contract, so that once the contract was awarded, the private company could get on with the job of providing the agreed-upon product or service.

Another important advantage of PPPs concerns life cycle versus initial cost sensitivity. While public agencies such as TxDOT are cognizant of the advantages of life cycle costing, they face conflicting demands from multiple constituencies, each pressing for the maximum funding for its particular priority - a situation that compels a focus on up-front costs today rather than long-run costs tomorrow.

Compounding this problem, public agencies suffer from the "ribbon versus the broom" problem - the fact that ribbon-cutting is exciting (and provides local photo-ops), while daily maintenance is away from the public view and unheralded.

A private entity, by contrast, must consider a project's whole life, even at the expense of higher initial costs. For instance, use of a higher grade of concrete can cut maintenance costs significantly. Maintenance savings also lower the externalities imposed on motorists by lane closures, which come out of no agency's budget but impose high costs on individual drivers in terms of both lost time and wasted fuel.

Recent federal guidelines also incorporate this concept,93 and the fact that lane closures carry a high cost is amply demonstrated by lane-rental charges imposed by reconstruction contracts. For instance, the recent "High Five" project in Dallas carried lane rental charges of up to $110,000 per hour, depending on the number of lanes blocked and the time of day.94

__________________________________________________________________________________________

91 Performance of PPPs and Traditional Procurement in Australia: Final Report. The University of Melbourne and the Allen Consulting Group, 30 November 2007. Note: not all projects were highway projects.

92 See FHWA Design-Build Effectiveness Study, January 2006.

93 The FHWA's Economic Analysis Primer, found on the agency's web site, states that "best practice life cycle cost analysis should reflect work zone user costs along with agency costs."

94 Source: Innovative Strategies on the Dallas High Five Project, TRB Annual Meeting, 15 January 2004.http://info.ctr.utexas.edu/innovativeDH5.pdf