5.4. Concern: What are the Mechanisms to Control Toll Rate Increases?

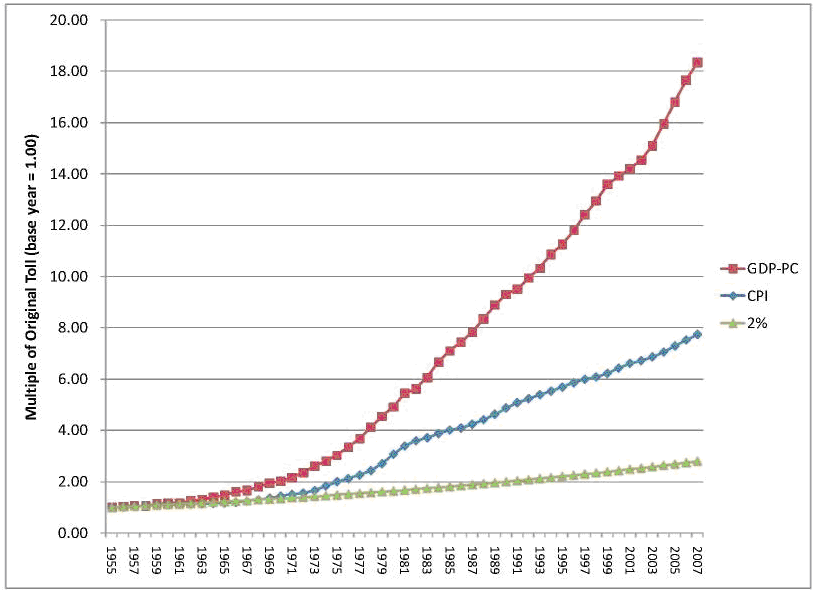

PPPs generally provide for toll rate escalation based on either an inflation index (usually the CPI) or an economic growth index (GDP per capita). Some also specify a minimum increase (i.e., 2%), while others allow the private party to choose the maximum of certain specified variables.114

As with any compounding variable, small changes at the beginning can have an enormous impact on values in later years.

Impact of Toll Increase Mechanisms over 52 Years115

The above chart illustrates hypothetical toll increases from several common measures over the Texas statutory maximum term of 52 years, using inflation figures from the past 52 years.116

As a practical matter, increases tied to per capita GDP remove any practical limits on toll increases in a project's later years. However, this does not necessarily mean that a private concessionaire would raise tolls to that level, since excessive toll increases will have the effect of driving away traffic and thus, past a certain point, will lower net revenues.

The subject of toll rate increases is inextricably tied to the policy choices of the relevant state or local authorities regarding cross-subsidization of other parts of the highway system. Certain jurisdictions may choose, as a matter of public policy, to keep toll increases low - to use the tolls from a project to fund that particular project and no more (or relatively little more). Others may choose to extract the maximum value from the few highly profitable projects in order to fund other highway infrastructure.

In either case, PPP contracts have the advantage of permitting toll increases that are sufficient to ensure that the purchasing power of the tolls remains high enough to maintain the highway asset. Unlike the case of public-sector toll roads, the increase mechanism for a PPP toll road is set by contract and is thus, after contract approval, not subject to the same political pressures that make motor fuel tax financing and some public sector toll financing so problematic.

New Jersey, for instance, has not raised toll rates on the New Jersey Turnpike since 2000, and Garden State Parkway fees haven't risen since 1989 - two years before the last increase in the Texas motor fuel tax.117 Today, New Jersey struggles to meet debt obligations, much less cover a $9.7 billion capital plan, yet the state's governor threatened to veto legislation doubling tolls over 15 years, citing the need to "minimize [the toll burden] given the current difficulties we face in the economy."118

Like the motor fuel tax, tolls lose their purchasing power over time. If too many years pass before rates increase, the increases required to recover lost purchasing power can generate intense political opposition. Hence, a policy of small annual increases is generally the wiser course.

_______________________________________________________________________

114 The Indiana Toll Road and the Chicago Skyway allow the private concessionaire to raise the tolls by the greaterof a) 2%; b) the CPI; or c) the increase US GDP per capita. Note that many PPPs fix toll rates for a short initialperiod (usually one to five years).

115 GDP and CPI from the Department of Commerce (Bureau of Economic Analysis).

116 Figures for the past 75 years display a similar picture; though the Depression of the 1930s skews those early years, the long run trend is nearly identical.

117 Dopp, Terrence, "New Jersey's Corzine Seeks Smaller Increase in Tolls," Bloomberg, 1 October 2008.

118 Ibid.