VI. Conclusion: Unique Challenges Require Unique Solutions

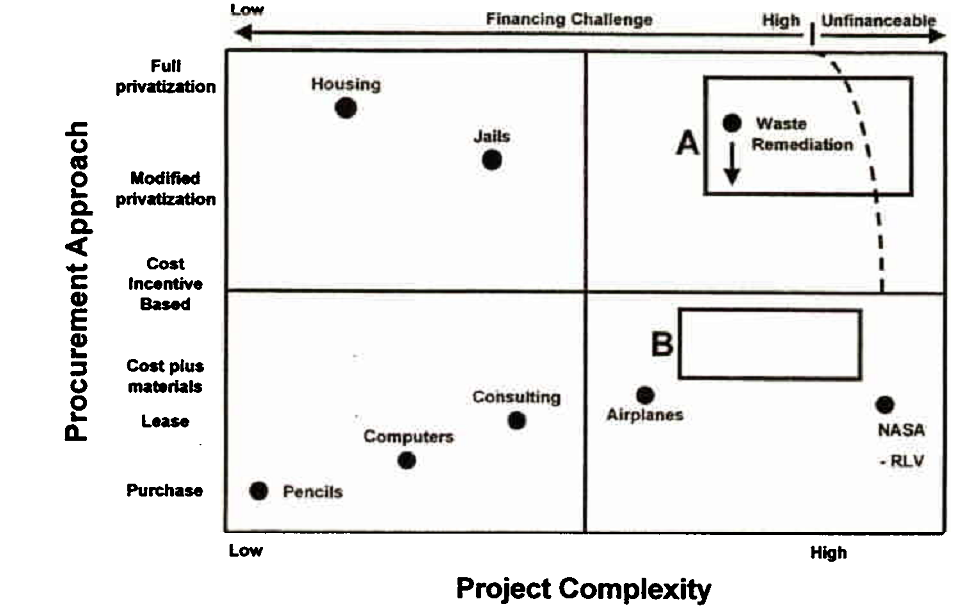

Often the complexity of the project requires innovative thinking that does not necessarily conform to a particular federal procurement approach. For example, Figure 7 plots various procurement approaches against the complexity of the project. In many cases, traditional procurement approaches are easily applied and are well tested in the marketplace (e.g., purchase of materials, consulting services, etc.). In other cases, the traditional options have not served the federal government well and other options have been explored that move a significant portion of the risk to the private party. For example, the development of housing and/or prisons lend themselves to a "full privatization" approach because these projects are not overly complex and the risks are easy to identify and quantify.

In more complex cases, such as waste remediation, the government needs to determine if the private sector will accept technology, performance, and schedule risks and, if so, pass those risks in whole or substantially to the private entities. If investors and lenders are not comfortable with that risk profile, the government might still be able to achieve a significant portion of its objectives by entering into additional risk sharing and financing strategies. As shown in Figure 7, the government can move within Box A to craft a risk allocation and financing strategy that maintains the procurement's objectives. Before reverting to a procurement type as shown in Box B, where the government enters into to a cost-plus risk profile, the government should exhaust all options that keep the private entity at risk for important aspects of the project and keep the final transaction description close to the parameters or Box A. Although the result may look different from the original design, it will represent an improvement over a scenario where the government assumes 100% of the costs, the uncertainties, and risks.

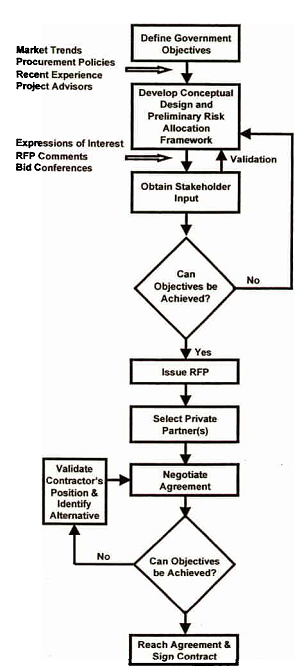

Figure 6. Procurement Process

Figure 7. Procurement Approach and Project Complexity

Although proponents of progress payments or other forms of government financing point to simple comparisons of the cost of money under differing financing approaches and declare government financing to be less costly, comparisons of the cost of money ignore the principal objective of privatization: shifting risk to the private sector. As described in detail above, this process is often challenging, but it is not unattainable. By analyzing market trends and being aware of the opportunities and constraints of private markets, government managers can craft creative solutions, which include an appropriate mix of private and government financing and which maximize the project's efficiency. This approach will allow the project to proceed in a way that meets the government's objectives for privatization.