The Private Sector Pays Taxes That the Public Sector Does Not

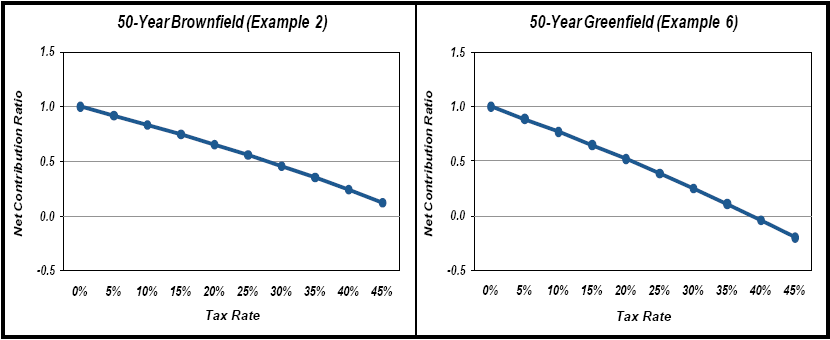

The Federal, state and local taxes on certain assets and net revenues that the private sector must pay constitute another cost disadvantage for PPP financing compared to traditional financing. The public sector is typically exempt from such taxes. In Figure 1 on the next page, we illustrate the impact of different tax rates on the values of two PPP projects compared to the values of their publically-financed alternatives. To do this comparison, we use a measure called the net contribution ratio. We calculate this ratio by dividing each PPP's value by the value that we would obtain using the public sector financing alternative. A net contribution ratio greater than one for a PPP means that the PPP yields greater value than the public sector option, whereas a net contribution ratio of less than one indicates that the PPP yields less value than the public sector option. Figure 1 shows that the PPP projects' net contribution ratios, and consequently their relative values, decline rapidly as tax rates increase.

Figure 1. Private Tax Rate Sensitivity

Source: OIG analysis

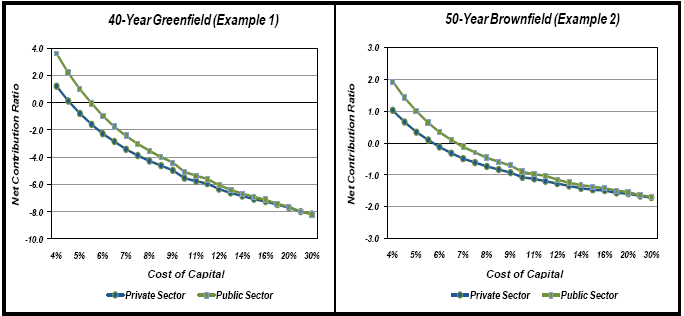

The PPP tax disadvantage is greater at lower costs of capital. Taxes constitute a stream of expenses incurred only by the private sector. When these future costs are discounted less heavily, they contribute more substantially to the difference between the present values of the PPP and public sector alternatives. Figure 2 on the next page illustrates this effect using net contribution ratios in which the denominator is the value of a public sector alternative with a fixed cost of capital (the public sector base case). In this instance, we also calculate the net contribution ratios for public sector options with different costs of capital. As the cost of capital falls, the valuations of both the PPP and the public sector option increase relative to the public sector base case. However, the PPPs' net contribution ratios rise more slowly than those of the public sector options. This slower rise is caused by an increase in the impact of the tax streams on the PPP project's valuations, an increase that results from the decline in the discount rate. This effect visibly expands the wedge between the relative valuations of each project undertaken with the different financing methods.

Figure 2. Cost of Capital Sensitivity

Source: OIG analysis

Note: Figure 2 assumes a 5% base cost of capital and residual cost of capital for the public sector base case, and a 35% total tax rate on private sector taxable income.