Cost Efficiencies in New Construction Projects Can Offset PPPs' Cost Disadvantages

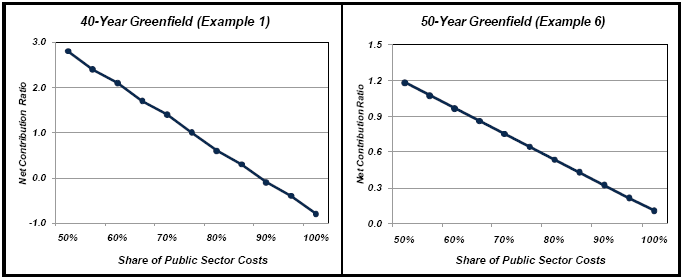

Private-sector efficiencies in new construction can sufficiently increase the valuation of a project undertaken with a PPP to make the PPP financing preferable. PPPs could be particularly preferable for greenfield projects due to the magnitude of new construction costs and the fact that these costs occur during the greenfield project's' early years.5 Figure 3 on the next page illustrates these effects.6 For each project shown, Figure 3 maps the changes in the net contribution ratio of the PPP alternative against the percentage of the public sector alternative's construction costs incurred by the PPP. The greater the construction cost efficiencies associated with the PPP, the smaller the percentage of the public sector alternative's construction costs it incurs, and the higher the PPP's net contribution ratio. The 40-year greenfield project of Project Example 1 is shown to achieve a net contribution ratio of one-which means it provides the same value as the public sector alternative-when its construction costs are 75 percent of the public sector alternative's construction costs.

Figure 3. Sensitivity of PPP Valuation to Construction Cost Efficiencies

Source: OIG analysis

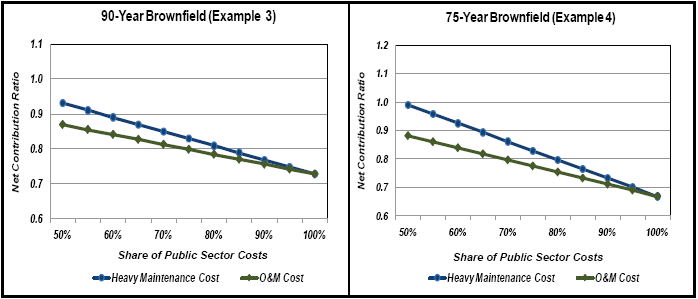

Interestingly, private sector operating cost efficiencies, even when large as a share of total O&M, are not major value drivers for PPP projects because heavy maintenance7 and O&M costs are small relative to total project costs and revenues, and occur over time rather than in the early years. Consequently, O&M cost efficiencies have little effect on bottom line net contributions, as illustrated by the analyses of two brownfield PPPs shown in Figure 4 on the next page.8 The net contribution ratios change very little as operating cost efficiencies increase and, in any case, fail to achieve a value of one over the range of efficiencies examined. Even the reduction of heavy maintenance or O&M costs to half their levels in the public sector alternative is insufficient to raise PPP valuations to equal the value of the public sector alternative.

Figure 4. Sensitivity of PPP Valuation to Heavy Maintenance and O&M Efficiencies

_________________________________________________________________________

5 The costs' occurrence in early project years means they are not significantly discounted.

6 The difference between the public sector alternative and the PPP alternatives in this Figure results from the assumption that the PPPs face a total tax rate of 35 percent. The cost of capital is assumed not to differ between the public and private alternatives.

7 Heavy maintenance costs are costs that are typically not part of routine maintenance costs, such as the costs of resurfacing a road.

8 The difference between the public sector alternative and the PPP alternatives in this Figure results from the assumption that the PPPs face a total tax rate of 35 percent. The cost of capital is assumed not to differ between the public and private alternatives.