Innovative Financing Can Also Reduce PPPs' Cost Disadvantages

Innovative financing programs, which have been developed to fill market gaps and reduce the costs of capital associated with private investment in transportation projects, can reduce PPPs' cost disadvantages. The programs provide private sector entities with tools to raise additional funds and increase the flexibility with which they can use these funds. Possibilities for innovative financing exist under two Federal programs-the options available under TIFIA, and PABs, which are tax-exempt bonds that public entities issue to provide low-cost financing for private projects that serve public purposes.

TIFIA offers a number of different financing options that can help the private sector reduce its cost of capital, including secured direct loans, loan guarantees, and lines of credit. A line of credit, unlike a direct loan, allows its holder to borrow funds as needs arise. A loan guarantee secures a promise from a third party that the party will assume a debt obligation if the borrower defaults. These guarantees reduce investors' risks and, consequently, the interest rates they require. However, TIFIA credit assistance is limited to 33 percent of project costs. To increase private sector investment in U.S. infrastructure, the PAB program provides access for private developers and operators to financial products that offer the same tax advantages as municipal bonds, which ultimately reduce the private entities' costs of capital.

These innovative financing mechanisms can significantly improve a project's net earnings through their access to capital on more favorable terms. For example, in the 80-year greenfield project in Project Example 7, which incorporated the use of innovative finance techniques, the PPP's cost of capital fell to 6.28 percent compared to 7.61 percent without innovative financing. In this instance, the PPP financing alternative's capital structure included 25 percent TIFIA loans, 25 percent PABs, 25 percent long-term corporate debt, and 25 percent equity. In comparison, the public sector alternative without innovative financing had a cost of capital of 6.29 percent.

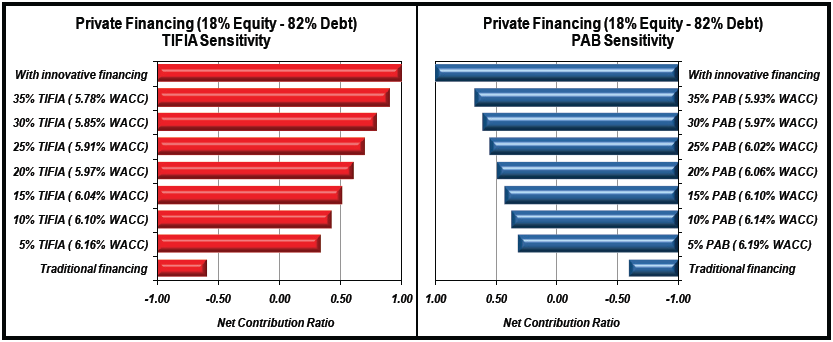

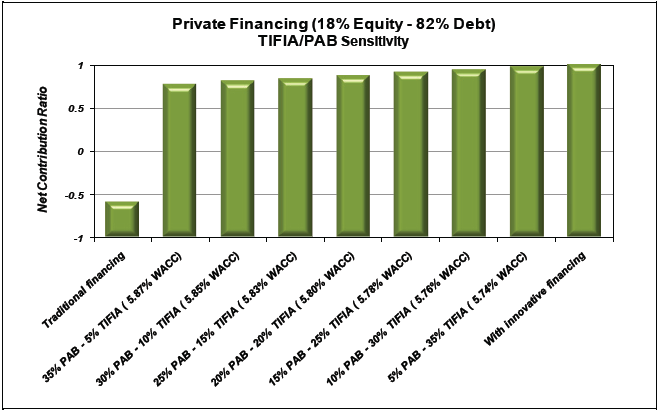

Figure 5 on the next page illustrates the potential impact of innovative financing on the net contribution ratio of PPP financing compared to traditional private financing for Project Example 7. The two charts show that progressive increases of either TIFIA or PAB financing as part of overall project financing can significantly increase the net contribution ratio. Moreover, as shown in Figure 6, also on the next page, use of TIFIA financing and PABs together increases the asset's valuation even more.

Figure 5. TIFIA/PAB Sensitivity: 80-Year Greenfield (Example7)

Source: OIG analysis

Note: Base case debt composition: TIFIA-37%; PAB-37%; senior debt-26%. In other words, we use the full innovative finance option as our base to illustrate the effects of decreasing amounts of innovative finance. We recognize that TIFIA financing cannot exceed 33% of project costs and it does not in our analysis. 37% TIFIA in our base case means 37% of the 82% of total financing comprised of debt, resulting in 30% TIFIA assistance in terms of total project financing costs (i.e. 37% of 82%).

Figure 6. Combined TIFIA/PAB Sensitivity: 80-Year Greenfield (Example 7)

Source: OIG analysis

Note: Base case same as in Figure 5