Risk Allocation and Management

All public agencies visited emphasized effective risk allocation as an important aspect of a PPP project. If significant risks throughout the project's life cycle are not transferable to the private sector, then the project is likely not an appropriate candidate for delivery via PPP. This general point was made in the previous discussion about project selection and analysis, but its significance cannot be overemphasized. The basic risk allocation philosophies in each country (or state) differ, particularly on market or demand risk and its impact on the private partner's ultimate financial situation. Further, practices related to changes in conditions throughout a project's life cycle are also markedly different.

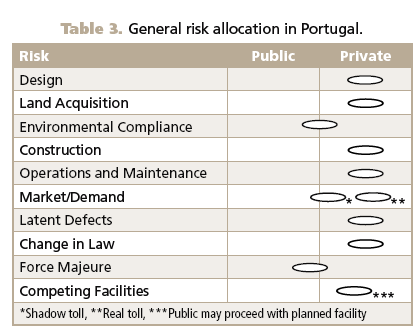

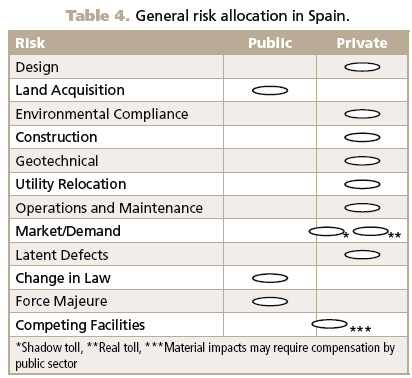

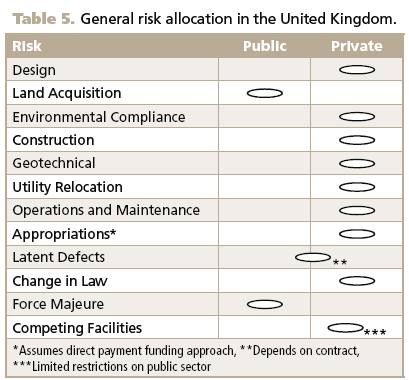

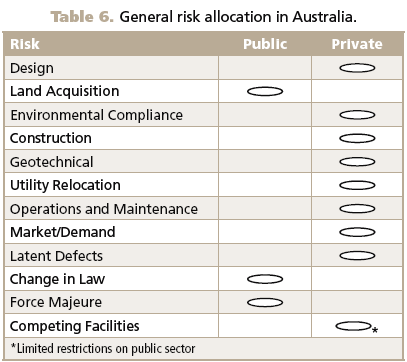

Tables 3 through 6 illustrate the general risk allocation approaches for PPP projects in each country. As they

indicate, the areas of greatest difference relate to the treatment of market risks and risks associated with changes in conditions over a project's life cycle, such as latent defects or a law change. Another area of interest is how the countries handle the issue of competing facilities. In general, this risk is borne by the private sector subject to certain conditions. "Example: Competing Facility Provisions" provides an example of contract provisions related to competing facilities from a recent concession deed.

The sections that follow address these issues in each country, but a more detailed discussion of changes in conditions is provided in a subsequent section.