State Transportation Funding

States provide nearly half of all surface transportation funding.41 The main source of highway funds in about half the states is the state motor vehicle fuel tax, which in seven states is indexed to the consumer price index, average wholesale price or another index (see Table 6 and State Profiles). The rest of the states rely on federal funds, motor vehicle and motor carrier taxes, or bond proceeds (for more abut debt financing, see the section on Innovative Finance starting on page 31).42 States also provide about 20 percent of the funding for transit systems nationwide, largely from general funds, fuel taxes, the general sales tax and other sources.43 Other revenues for surface transportation are drawn from additional sales taxes on gasoline or diesel, sales taxes on vehicles or rental cars, registration and other fees, vehicle or truck weight fees, and tolls, among others (see Table 6). States also help fund aviation, ports and other elements of the transportation network.

Table 6. State-by-State Revenue Sources for Roads, Bridges, Rail and Transit

|

State/Jurisdiction |

Fuel Taxes |

Sales Taxes on Gasoline or Diesel |

Motor Vehicle or Rental Car Sales Taxes |

Vehicle Registration, License or Title Fees |

Vehicle or Truck Weight Fees |

Traffic Camera Fees |

Tolls |

General Funds |

Interest Income |

Other |

|

• |

|

|

• |

• |

|

|

• |

|

Vehicle inspection fees; advertising revenue; impact fees; misc. revenues |

|

|

• |

|

• |

• |

• |

|

• |

• |

• |

Licenses, permits or fees |

|

|

• |

|

• |

• |

• |

|

|

|

State lottery/gaming; transportation excise tax in Maricopa County; impact fees; board funding obligations |

||

|

• |

|

• |

• |

• |

|

|

• |

• |

Ad valorem tax; impact fees |

|

|

• |

|

|

• |

|

• |

Locally implemented sales tax; impact fees (local level only) |

||||

|

• |

|

|

• |

• |

• |

• |

• |

Sales tax; state lottery/gaming; congestion pricing; impact fees |

||

|

• |

• |

• |

• |

• |

|

|

• |

• |

Vehicle inspection fees; oil company taxes |

|

|

• |

|

|

• |

|

• |

• |

• |

• |

Fares |

|

|

|

• |

• |

|

• |

• |

|

|

Documentary stamp revenue; congestion pricing; impact fees |

||

|

• |

• |

|

|

• |

• |

• |

• |

• |

Impact fees |

|

|

• |

• |

• |

• |

• |

|

|

|

|

Vehicle inspection fees; impact fees |

|

|

• |

|

• |

• |

|

|

|

|

|

Impact fees |

|

|

• |

|

|

• |

• |

• |

• |

• |

Licenses, permits or fees; logo signing; impact fees |

||

|

• |

• |

|

• |

|

|

• |

|

|

Sales tax; situs tax; rail service funds; railroad property tax; Indiana Toll Road lease proceeds; impact fees |

|

|

|

• |

• |

|

|

|

• |

Use tax on mobile homes and other vehicles; casino taxes; licenses, permits or fees |

|||

|

• |

|

|

• |

• |

|

• |

• |

|

Sales tax; compensating use tax |

|

|

|

• |

• |

• |

|

|

• |

• |

Licenses, permits or fees; weight-distance tax |

||

|

• |

|

|

• |

• |

• |

• |

• |

• |

Licenses, permits or fees |

|

|

|

• |

• |

• |

|

• |

|

• |

Off-road fuel tax; licenses, permits or fees; fines; impact fees |

||

|

• |

|

• |

• |

• |

• |

|

• |

Licenses, permits or fees; sales tax; corporate income tax; fares and operating revenues; congestion pricing (Maryland Transportation Authority only); container fees |

||

|

• |

|

|

• |

|

• |

• |

• |

|

Sale of excess land; advertising revenue; sales tax; service city and town payments; fares and operating revenues |

|

|

• |

• |

|

• |

|

|

|

|

Sales tax on auto-related products (includes gasoline and diesel) |

||

|

• |

|

• |

• |

|

|

• |

• |

Licenses, permits or fees; fines; congestion pricing |

||

|

• |

|

|

• |

• |

|

|

|

• |

Contractors' tax; lubricating oil tax; locomotive fuel tax |

|

|

• |

|

• |

• |

|

• |

• |

Rail regulation fees |

|||

|

• |

|

• |

• |

• |

|

|

|

• |

Impact fees |

|

|

|

• |

• |

|

|

|

• |

• |

Licenses, permits or fees; investment income; train-mile tax for grade separation projects |

||

|

• |

|

• |

• |

• |

• |

|

• |

• |

Ad valorem taxes; recovery surcharge fees |

|

|

• |

|

|

• |

• |

|

• |

• |

• |

Surcharge on registration fees (2011 sunset) |

|

|

• |

• |

• |

• |

• |

• |

• |

• |

• |

Sales tax; petroleum products tax; contractual contributions; state lottery/gaming |

|

|

• |

• |

• |

• |

• |

• |

|

|

• |

Impact fees; weight-distance tax |

|

|

• |

• |

• |

• |

• |

• |

|

Oil company taxes; regional payroll tax; weight-distance tax |

|||

|

|

• |

• |

• |

• |

|

• |

|

|||

|

• |

|

• |

• |

• |

|

|

• |

• |

Net obligated balance |

|

|

• |

|

|

• |

• |

• |

• |

Right-of-way; logo signing; service concessions (turnpike only); tax on fuel sold at turnpike gas stations (turnpike only); loan repayments; loan servicing fees; private contributions; licenses, permits or fees |

|||

|

• |

|

|

• |

|

|

• |

• |

|

|

|

|

• |

|

|

• |

• |

• |

|

• |

• |

State lottery/gaming; tobacco tax revenue; the mass transit tax; safety inspection and rail regulation fees; licenses, permits or fees; weight-distance tax; vehicle-miles traveled fees (pilot project); container fees; impact fees |

|

|

• |

• |

• |

|

• |

• |

• |

Sales tax; state lottery/gaming; tire tax; impact fees |

|||

|

• |

|

|

• |

|

• |

• |

• |

|

Impact fees |

|

|

• |

|

|

• |

|

|

• |

• |

|

Impact fees |

|

|

• |

• |

• |

• |

• |

|

|

• |

• |

Licenses, permits or fees; Railroad Board fund |

|

|

• |

• |

|

• |

• |

|

|

|

|

|

|

|

• |

|

|

• |

• |

• |

• |

• |

Sales tax on lubricants; vehicle inspection fees; licenses, permits or fees; impact fees |

||

|

• |

|

• |

• |

• |

|

• |

• |

• |

Sales tax; impact fees |

|

|

• |

• |

• |

• |

• |

|

|

• |

Impact fees |

||

|

• |

• |

• |

• |

• |

• |

• |

Sales tax; congestion pricing; impact fees |

|||

|

• |

|

• |

• |

• |

• |

|

• |

Licenses, permits or fees; sale of DOT property and other business-related revenues; congestion variable tolling; photo tolling (beginning 2011); impact fees (local level only) |

||

|

• |

• |

• |

• |

|

|

• |

• |

|

Highway litter control fund; impact fees |

|

|

• |

|

• |

• |

• |

|

|

• |

Licenses, permits or fees; taxes on other modes |

||

|

• |

|

|

• |

• |

|

|

• |

• |

State-distributed mineral royalties and mineral severance taxes; container fees |

|

|

• |

|

|

|

|

|

|

• |

• |

Rights-of-way; master equipment lease/short-term borrowing; public space revenue; parking meter revenues |

|

|

• |

• |

|

• |

|

|

• |

|

• |

Excise taxes on petroleum products; impact fees |

Key:

SP - See State Profiles for clarification or more information

V/I - Variable or indexed fuel tax rate

Note: This chart includes all state-level revenue sources for roads, bridges, rail and transit, not just those revenues that are administered by DOTs.

Sources: NCSL-AASHTO Survey Data, 2010 - 2011, supplemented by AASHTO, 2010; Dierkers and Mattingly, 2009; FHWA, 2011; and Puentes and Prince, 2003.

State legislatures have significant power over determining state revenue sources by enacting laws that address taxation, fee schedules and appropriations. Legislatures also tend to have more influence over the allocation and appropriation of state funds compared to federal funds, given the legislature's general powers over state taxation and expenditures. Only Colorado, Hawaii, Missouri, Pennsylvania, Wyoming and the District of Columbia reported that any state funds flowed directly from a revenue source to the DOT without being subject to legislative appropriation. Even in states such as Michigan where distribution of state transportation funds is determined by statutory formula, the legislature still appropriates the funds. Almost all legislatures appropriate state transportation funds either at the agency, program, category or project-specific level or through approval of a DOT transportation plan.

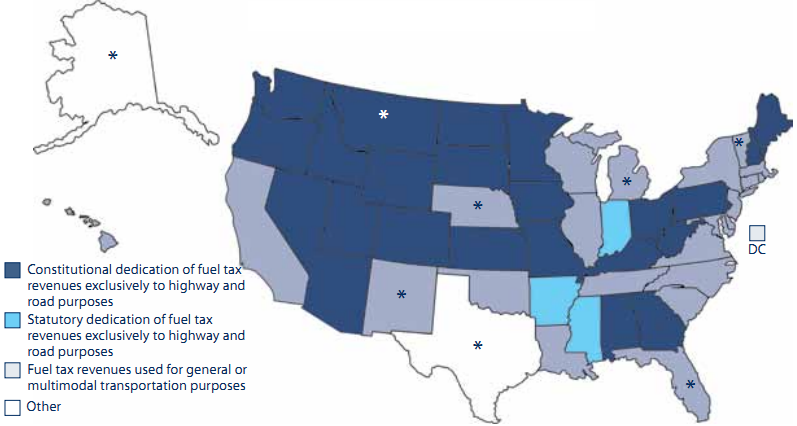

The real power of legislatures-or DOTs-to allocate state funds, however, is bounded by constitutional and statutory restrictions on the use of transportation revenues. For example, 23 states now have provisions in the constitution-and three in statute-that restrict use of state fuel tax revenues exclusively to highway and road purposes (Figure 5). Most other states restrict or dedicate use of fuel tax receipts and other transportation-related revenues to general or multimodal transportation purposes, with a few limited exceptions. Texas is unique in that it allocates one-fourth of its gas tax revenues to schools. Only Alaska constitutionally prohibits dedicating state revenues, unless federally required or dedicated prior to statehood.44 Other common provisions that limit use of transportation-related revenues are those that restrict their use to the same modes from which they were collected; for example, by dedicating use of aviation fuel tax proceeds to airport projects (see State Profiles).

|

Figure 5. State Uses of Fuel Tax Revenues

* Notes: • The Alaska constitution prohibits any dedication of revenues. • The Michigan constitution dedicates motor fuel taxes and vehicle registration taxes to transportation purposes. At least 90 percent must be used for roads, streets and bridges, and the balance for comprehensive transportation purposes as defined by law. • The Montana constitution requires highway user fee revenues including fuel taxes to be used as authorized by the legislature for specific road and bridge funding purposes. Such revenue may, however, be appropriated for other purposes by a three-fifths vote of the members of each house of the legislature. • Nebraska statute generally dedicates fuel tax and other revenues to highway construction and maintenance, with limited exceptions including transit aid. • The Texas constitution restricts use of fuel taxes to roadways and administration of traffic laws; a quarter of the revenues, however, are allocated to the Available School Fund. • Florida, New Mexico and Vermont use fuel tax revenues mostly for transportation purposes, with limited exceptions (see State Profiles). Sources: NCSL-AASHTO Survey Data, 2010 - 2011; original research using Westlaw; Puentes and Prince, 2003; and Sundeen and Reed, 2006. |

In all states except Alaska, transportation-related revenues are deposited into funds that often are subject to additional requirements. Thus, many states restrict both transportation-related revenues and the funds to which they are deposited. This provides protection for transportation revenues and programs but also can constrain funding and finance decisions of both the executive branch and the legislature. At least 19 states and the District of Columbia deposit transportation revenues into a trust fund for highways, mass transit, aviation or transportation generally;45 otherwise, states-except Alaska-use designated accounts that are not called trust funds for these purposes. Maryland and Wisconsin place all transportation revenues from all modes into one consolidated, dedicated multimodal fund. At least 35 states46 report constitutional or statutory provisions that direct the use of transportation funds or accounts.

Constitutional or statutory restrictions on the use of state transportation funds and revenue can include explicit prohibitions on the diversion or transfer of this money to other purposes. States with such restrictions include California, Delaware, New Hampshire, Pennsylvania, Tennessee and Wisconsin. In 2010, California's Proposition 22 strengthened the state's prohibitions on diversions and transfers of transportation funds and revenues by eliminating the state's authority to borrow state fuel tax revenues for cash flow or budget-balancing purposes. In contrast, the Montana constitution outlines a process to appropriate restricted highway funds for other purposes, by three-fifths vote of the members of each house of the legislature.47 Virginia law allows diversion by the legislature or the governor in the budget bill if language is inserted that sets out a plan for repayment of the diverted funds within three years.48

Dedications, restrictions and prohibitions on the transfer of funds are not always effective. Arizona, Florida, Kentucky, Minnesota, New Jersey, North Carolina and Wisconsin report recent legislative diversions of transportation funds to other purposes, notwithstanding existing constitutional or statutory restrictions. In New Jersey, the annual appropriation act has precedence over any other dedication language found in general statute, but not over the constitution; the legislature has chosen not to fully appropriate statutorily dedicated transportation revenues eight times since 1985.