FUTURE USE OF PPPs FOR U.S. SURFACE TRANSPORTATION PROJECTS

A number of factors will influence the extent to which PPPs will be part of the solution of addressing the fiscal and service delivery challenges facing surface transportation sponsors in the future. These include the following:

• Lack of robust tax-based Transportation Trust Fund will encourage more PPPs by states;

• PPPs' potential to deliver projects faster and cheaper, with quicker access to capital markets and new technology; and

• While PPPs can leverage scarce public resources and improve the efficiency of project delivery and operations, alternative funding sources will be needed to meet the needs.

The PPP market is estimated to grow significantly over the next 10 years as traditional transportation funding sources are expected to become scarcer. The primary types of PPPs for delivering surface transportation projects in the U.S. are expected to be:

• DB - medium to large new or reconstructed highways; transit facilities

• DBOM - new tolled or non-tolled roads; transit facilities

• DBFO - primarily new toll roads

• Concession - primarily existing and new toll roads

• Joint Development Agreement - new highways and transit facilities

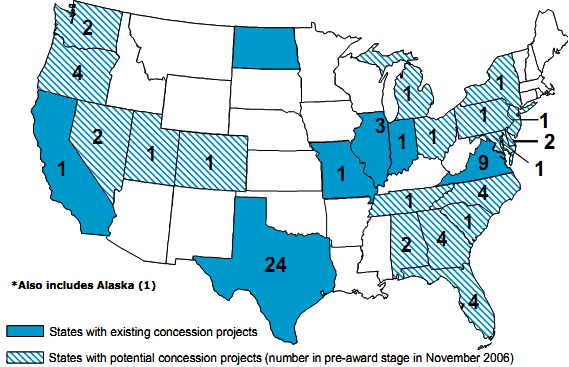

It is projected that up to $40 billion in surface transportation concession projects could be awarded in the U.S. during the next few years.18 By the end of 2006, there were at least 74 highway and transit projects in the U.S. being considered for development using the concession approach, with the number of prospective projects in the pipeline shown in Exhibit 41 by state. Many of these are located in the states of Texas, Florida, Virginia, North Carolina, and Oregon.

Exhibit 41 - States with Existing and Pre-Award Concessions*

(figures indicate total number of pre-award concessions as of November 2006)

|

Source: Infranews and Public Works Financing, Data valid through November 2006 |

____________________________________________________________________________________

18 State of New Jersey Asset Evaluation Program - Phase 1 Report. UBS Investment Bank, November 15, 2006, p. 54.