1. Goldilocks syndrome.

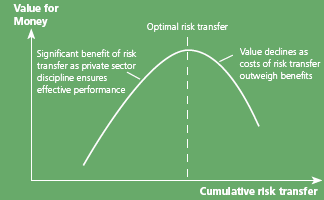

There can be a tendency in partnership structures to transfer either too much or too little risk. Because the public sector can be risk averse, with public sponsors often looking to PPPs to save up-front or total project costs, there are times when too much risk is transferred to the private sector. The result is a project that is difficult to finance, which in turn reduces the quality of partners willing to bid on it and ultimately increases costs of delivery. While the public sector must be vigilant in protecting its own interests, the point of risk transfer that will cause private partners to walk away from a deal can often be difficult to predict. Consequently, the public sector should be cognizant of the private sector's risk capacity constraints when structuring the initial bid documents, and be open to further negotiations on some items when the preferred bidder is selected. Optimal risk transfer ensures that there are enough high-quality bidders to reap the benefits of robust competition and that the public sector does not "overpay" to transfer risk that it is better suited to retain (see figure 3). Figure 3. Optimizing risk transfer to maximize Value for Money

|