Payment Mechanism

Since the payment mechanism is an essential part of the private finance component, it is necessary to discuss this point. Since private finance is involved, this means that loans will be required from the private sector as well as large infrastructure banks, or possibly the European Investment Bank (EIB). Since the payment mechanism is the main form to capture all expenses, overheads, Return on Investment (ROI), and profits, it should be designed to favor the least amount of risks so that the most favored interest rate can be obtained. It should also be understood that these financial sources do not accept many risks. The risks within a project also determine what financial rating will be applied to a project. This leads to the next issue of determining what types of risks are associated with the payment mechanism used and if they are associated with market risks or non-market risks. The concessionaire or "DBFO Company" that wins the contract award needs to obtain private financing from the private sector, other consortium partners, and borrowing money from financial institutions. Even a small fraction of a percentage rate has a significant impact on the Value for Money (VfM) or costs over the life of the concession.

The main types of payment mechanism are as follows:

• Availability Payments

• Shadow Tolls

• Real Tolls (heavy vehicles or all vehicles - market risks)

• Performance based payments (England - A1 Darrington-Dishforth PPP project)

Also, the financial ratings in a country can determine the rates at which the borrowing risks are determined by the financial sources. These can have a great impact and sometimes can determine who will provide the best Value for Money (VfM) and eventually lowest Net Present Value (NPV) and eventual winner for the PPP project. Thus the financial partners have a large influence upon the entire project and the optimum payment mechanism should be achieved. If tolls are used then they are considered as a market-based risk and can incur higher interest rates, if the risks to the financial partners cannot be minimized. Shadow tolls were used quite often during the earlier PPP contracts as the risks were capped based upon "the bands" in the shadow toll calculations. Recently the "availability payment mechanism" seems to be the favored mechanism as it incurs less risk to the financiers. In other words the "Availability Payment Mechanism" has significantly more favorable financial impacts as opposed to a toll road which has some market risks because it is difficult to forecast the actual usage and is thus part of the financial impacts and affects the overall VfM. This report does not cover the details of each payment mechanism and generally summarizes the main ones.

Therefore it is important to consider choosing market type risks versus non-market type risks and how they affect the VfM of a project. On the other hand is it important to find a funding stream to pay back for the investment and some form of toll for roads seems to be one of the options for reimbursement. Fortunately, there are financial advisors to assist the client to determine the best situation for that country's project as most road authorities have not needed this expertise as funding has typically come from the governmental allocation system.

One strong criticism that has been raised by many contractors is that it is a difficult development process to find strong financial packages. Many medium and even some larger contractors cannot qualify for the best financial packages while often very large/global contractors find the best financial rates. However, these smaller contractors are able to become sub-contractors to the winning contractor if desired, but this is not the preferred choice by most contractors.

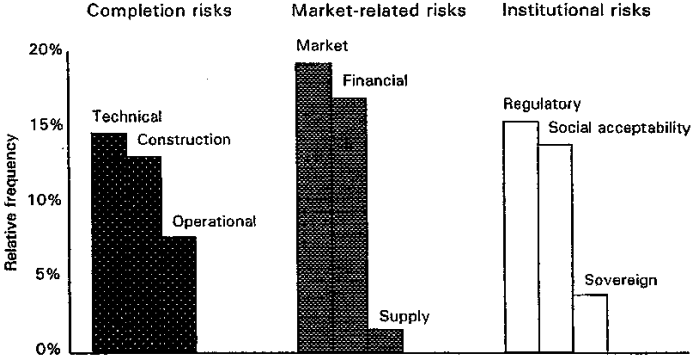

Figure 3 from Miller & Lessard (2000) displays the different types of risks that can be encountered in large construction projects. This figure shows that the greatest risks to be encountered are those from market based risks. These should be optimized in order to receive the best possible payment mechanisms so that VfM can be achieved. It is interesting to note that the next highest risk is financial. The main point is to reduce or minimize the greatest potential risks in order to achieve the overall best for any project. It is wise to consider the greatest risks first, and the lesson to be learned is that market and financial are more important than technical and construction risks. One simple choice could be to reduce market based risks altogether, and choose the availability payment mechanism.

|

|

Source Miller & Lessard (2000)

Figure 3 Market Based Risks

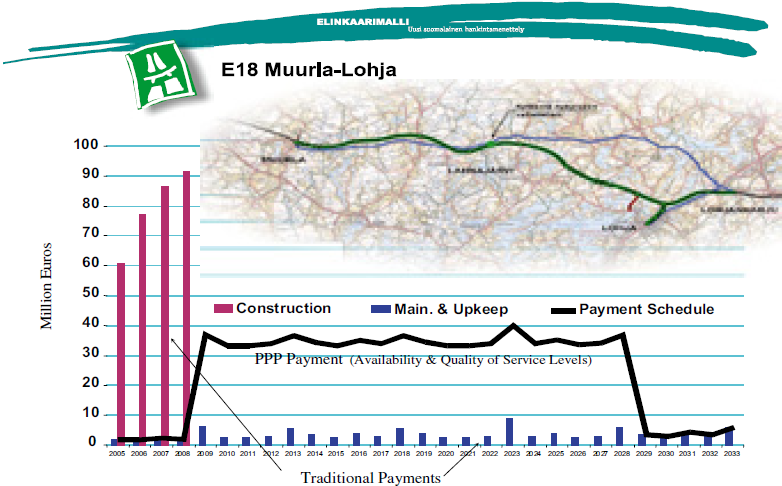

As an example of the availability payment mechanism, Figure 4 compares a traditional payment scheme to the availability payment for the recently tendered E-18 PPP project in Finland. The figure attempts to show the difference between the payments in a traditional project versus that from a typical PPP project. In a traditional project, the client or government would be responsible for the capital costs of the project during the construction phase, plus all maintenance costs throughout the life of the project. This can be seen by large vertical bars on the left side of the figure (year 2005 to 2009) which represents the capital payments. The smaller vertical bars (shown by the traditional payments arrows - years 2010 to 2030) showing the maintenance costs required for each year of operation.

On the other hand the PPP payment begins after the project is completely constructed and approved. Then the payments start and remain relatively horizontal across the contract duration depending upon the quality of service and availability (shown by the PPP payment text around the 35 level) of the road to public use. The PPP payments begin form the year 2009 (proposed completion date) through to 2029, when the contract period ends and the road project is completely returned to the client.

|

|

Source: Finnra (2003)

Figure 4 Finland E-18 Availability Payment Mechanism

Some countries have established or created a PPP team within the client or road authority organization. England has implemented many PPP projects that have justified the need for the creation of a PPP team to carry out the due diligence from the early planning phases throughout project completion. The benefit of having a PPP team is the continuity and competence does not have to be recreated if the project is in another jurisdiction or region. PPP projects require different skills and expertise, so that a PPP team within the road authority would be beneficial as the tendering aspects require a different level of expertise. This also helps retain a knowledge center within the organization when another PPP is proposed. If only one or two projects are being developed then a PPP team probably will not be necessary.

England has also developed sophisticated and modern practices in their PPP management of contracts. One organization called Partnerships UK establishes the feasibility and business cases and they also have a "Gateway Review Process". These are very advanced stages and features and are mainly used in the UK as they have developed a formal process. These are not needed by most countries until a significant amount of PPP projects, but demonstrate that a commitment or scheme similar to the Private Finance Initiative could be worthy.

Despite the many issues and complications involved in PPP projects, a report by Koppinen & Lahdenpera (2004) shows that the economic efficiency of PPP projects are better as compared to DBB and DB models. Hughes e. a. (2006) also indicates that partnering and collaboration in PPP can be viable despite the increased tendering cots associated with private financed projects. "Value for Money" (VfM) will probably be the ultimate test of the PPP project delivery method. PPP can be successful if used wisely, and will probably account for a minor portion of the project delivery methods used for road projects. There is also a limit to the amount of PPP projects that can be sustained from the finance ministry or treasury departments.