3.8 Conclusions

Most road authorities in this survey are outsourcing a major portion of their routine maintenance activities except for a few states in the USA, with Florida DOT (FDOT) being the main exception. Maintenance via some form of contract varies between countries and activities included in the contracts. Cultural and local differences appear to be the single most apparent deviation for using different approaches to maintenance contracting. Next, there are two forms of maintenance models that seem to be the most commonly practiced and these are the "Cold Climate Model" (routine maintenance activities) and the "Anglo-Saxon model" (more integrated maintenance contracts). These were discussed in detail in Section 3.3 and Table 12 shows the main characteristics. Also, many countries can simultaneously use several types of models, depending upon the advantages and better value for money.

For those other countries that are not outsourcing performance-based maintenance contracts it will be a significant challenge, on how to open the market to contract maintenance. It would be wise to investigate the progression of successful and advanced countries, and learn those practices, potential pit-falls, the lessons learned, and by having a deliberate process in achieving the vision set forth.

One significant finding is that there have been no new 10-year Performance Specified Maintenance Contracts (PSMC) type contracts in New Zealand or other Anglo-Saxon countries. Based upon the observations during the interviews these types of contracts have not produced successful results as expected. Otherwise, if they were successful they may have continued the progression and influence elsewhere. We believe that this may be due to integrating periodic maintenance with routine maintenance into one contract, and not the duration of the contract. Apparently the affect on the supply chain management is not as beneficial when using the "Anglo-Saxon model".

Another significant trend is that most countries have extended the contract period duration with most agreements being between 7-10 years. In the progression of advanced countries, the trend started at three year agreements, and then progressed toward 5 years. The next phases of contracts are seen between 7-10 years, and a few are contemplating longer agreements, but it may take time to implement them. These agreements seem to be favorable both to the road authority and service providers/contractors. In Pakkala (2003) it was anticipated that there might be a future potential to increase the duration of maintenance contracts to 25 years or even more. However, this has not occurred even though there is some consideration of longer term arrangements. After all PPP contracts already include a provision for about 20 years or more for both the routine and periodic maintenance.

A new model called "Alliance model" (called E-MAC in England) has been recently utilized in England. This is seen as the potential replacement for the PSMC model, as several "Anglo-Saxon" countries are discussing the feasibility of implementing the "Alliance model". This new model appears to be promising and lots of equitable features have positive characteristics, but there are no results to date or data that support any conclusions. The alliance model may be seen as a replacement for the PSMC where results are not as expected.

Most of the maintenance models can be characterized with the following:

• Savings in these contracts during the early years of adaptation vary from 10-40%

• Most are performance based or contain Levels of Service (LOS)

• Contract durations are now about 7-10 years (BC, Canada is now at 10 year duration)

• Most contracts are "lump sum" or "hybrid"

• There is a split in the contractor selection criteria between lowest price and "best value"

• Bundling of activities varies, but routine maintenance seems to be the most common

• Equipment and project management innovations appear to be the most dominant

• Partnering and trust are still important throughout the supply chain

• Writing clear and concise contracts is difficult (especially when including public values & ethics)

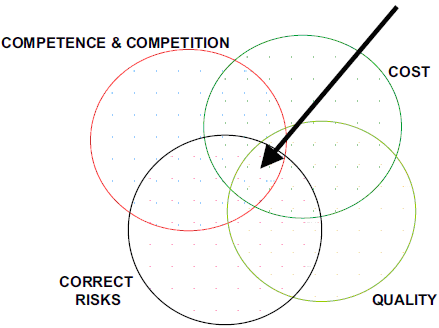

One final thought relating to maintenance contracting can be seen in Figure 17. It is difficult to get all the aspects perfectly correct during the first stages of outsourcing and implementation of maintenance contracts. It is a learning process that needs to find the "Sweet Spot" for effective maintenance. Finding this "Sweet Spot" requires wisdom, good management, understanding the maintenance market, and the ability to determine and apply a balanced risk.

| CONCLUSIONS |

| Finding the "Sweet Spot" for Effective Maintenance Contracting |

|

|

Source: Pakkala (2006)

Figure 17 Sweet Spot from Effective Maintenance