1. Transportation Infrastructure Finance and Innovation Act of 1998 - the TIFIA Credit Program

| The TIFIA Program provides Federal credit assistance to large-scale projects of regional or national significance that might otherwise be delayed or not constructed at all because of risk, complexity, or cost. There are three forms of credit assistance available - secured (direct) loans, loan guarantees, and standby lines of credit - for surface transportation projects of national or regional significance. These credit instruments may offer more flexible repayment terms and more favorable interest rates than would be available from other lenders. The fundamental goal of the TIFIA Credit Program is to leverage Federal funds by attracting substantial private and other non-Federal co-investment in critical improvements to the nation's surface transportation system. In general, public or private entities seeking to finance, design, construct, own, or operate an eligible surface transportation project may apply for TIFIA assistance. | Examples of TIFIA projects include: • Central Texas Turnpike (Austin, TX) • Miami Intermodal Center (Miami, FL) • State Route 125 South (San Diego, CA) • Reno Transportation Access Corridor (ReTRAC) (Reno, NV) |

=> How does TIFIA assistance leverage existing Federal funds?

Credit assistance can provide an efficient means of utilizing scarce Federal budget authority. The cost to the Federal government of providing credit assistance is a function of the perceived risk of the loan. Congress has generally provided TIFIA budget authority amounting to five percent of the face amount of the credit assistance. Since the program's inception in 1999, TIFIA has provided more than $3.6 billion in credit assistance to projects representing more than $16 billion in infrastructure investment, at an initial cost to the Federal government of less than $200 million.

=> What are the benefits of TIFIA credit assistance?

TIFIA credit assistance has many features that make it attractive to private investors:

• Revenue leverage. TIFIA can enhance funding available for a project by leveraging revenue streams that otherwise might be considered too risky to obtain needed capital market financing. This factor often benefits user-backed financings that involve start-up facilities with uncertain revenues expected to grow over time.

• Senior Debt Enhancement. The TIFIA credit on projects can be subordinated to those of senior lenders. With TIFIA holding a junior lien on part of the credit, the creditworthiness of the remaining senior-lien capital markets financing is enhanced. This credit structure can move a senior debt from a borderline rating to an investment grade rating.

• Interest Cost Savings. TIFIA's interest rate can result in cost savings compared to the likely rates on alternative financing instruments. For projects that must access the taxable debt markets, borrowing rates are typically well above the comparable U.S. Treasury yield. Because the DOT lends TIFIA funds at the U.S. Treasury's borrowing rate, with no premium for credit risk, it can provide an attractive interest cost. Even for projects able to access the tax-exempt municipal market, TIFIA direct loans may prove cost-effective.

• Payment Flexibility. TIFIA can significantly benefit the project financing through its flexible payment features. TIFIA provisions aim to facilitate financings backed by user charges by allowing debt service to be structured according to project cash flows. Often this entails deferral of interest not only during construction but also during the project's ramp-up of operations, which private investors may be hesitant to accept. In addition, the TIFIA program allows borrowers to prepay at any time without penalty. This same flexibility, through the municipal bond market, could add as much as ½ percent to the borrowing cost, depending on market conditions.

• Project Acceleration. TIFIA can expedite the financing and accelerate the public benefits flowing from a completed facility. This factor essentially reflects the cumulative effects of the other factors. In some cases, TIFIA assistance is viewed as essential in advancing the project in its current form. In others, while the project likely would have been financed eventually, TIFIA assistance helps advance the project more quickly and at a lower cost.

• Long Terms of Maturity. The final maturity date of TIFIA credit can be as much as 35 years after the date of substantial completion of the project.

The advantages and characteristics of each type of TIFIA program are summarized in Figure 2 below:

Figure 2: Characteristics of TIFIA Credit Instruments

| Characteristics | Direct Loan | Loan Guarantee | Line of Credit |

| Use of Proceeds | To finance eligible project costs, or To refinance interim construction financing of eligible costs (no later than one year after substantial completion). | To finance eligible project costs, or To refinance interim construction financing of eligible costs (no later than one year after substantial completion). | To pay debt service on obligations (but not the TIFIA credit instrument) issued to finance eligible project costs, extraordinary repair and replacement costs, operating and maintenance expenses, and/or costs due to unexpected environmental restrictions. Available only after substantial completion. |

| Interest Rate | Equal to or greater than the yield on marketable U.S. Treasury securities of comparable maturity on date of execution of credit agreement. | Negotiated between the guaranteed lender and the borrower, subject to consent from the DOT. Interest payments on a guaranteed loan are subject to Federal income taxation. | Interest rate on a direct loan resulting from a draw on a line of credit will be equal to or greater than the yield on a 30-year marketable U.S. Treasury security on the date the line of credit is obligated. |

| Disbursements | As frequently as monthly, as costs are incurred for eligible project purposes. | In event of borrower default, guaranteed lender receives payment from the DOT for guaranteed payment due. DOT's payment then becomes a direct TIFIA loan to the borrower. | A draw may be made only if revenues are insufficient. A maximum of 20% of total principal amount of line of credit may be drawn in a single year. Available for 10 years after substantial completion. |

| Repayments | Based on cash flow forecasts, but must commence no later than five years after date of substantial completion of project. | Based on cash flow forecasts, but must commence no later than five years after date of substantial completion of project. | Based on cash flow forecasts, but must commence no later than five years after the end of the 10-year period of availability. |

| Deferrals | When revenues are insufficient to meet scheduled TIFIA loan payments within 10 years after substantial completion, DOT may allow payment deferrals. | When revenues are insufficient to meet scheduled TIFIA loan payments within 10 years after substantial completion, DOT may allow payment deferrals. | Not addressed in TIFIA statute. |

| Prepayment Conditions | May be prepaid in whole or in part at any time without penalty. | Negotiated between lender and borrower. | May be prepaid in whole or in part at any time without penalty. |

See TIFIA Report to Congress, Chapter 4, June 2002, for a more extensive discussion of the benefits of the TIFIA program, available at http://tifia.fhwa.dot.gov/.

=> What projects and what costs are eligible for TIFIA assistance?

Highway, transit, passenger rail, and intermodal projects may receive credit assistance through the TIFIA program. Eligible highway facilities include interstates, State highways, bridges, toll roads, and any other type of facility eligible for grant assistance under title 23, the highways title of the U.S. Code (23 U.S.C.). Eligible transit projects include the design and construction of stations, track, and other transit-related infrastructure, purchase of transit vehicles, and any other type of project that is eligible for grant assistance under the transit title, chapter 53 of 49 U.S.C. Additionally, intercity bus vehicles and facilities are eligible to receive TIFIA assistance. Rail projects involving the design and construction of intercity passenger rail facilities or the procurement of intercity passenger rail vehicles are eligible for TIFIA assistance. Publicly owned intermodal facilities on or adjacent to the National Highway System are also eligible for TIFIA assistance, as are projects that provide ground access to airports or seaports. Finally, surface transportation projects principally involving the installation of intelligent transportation systems are eligible for TIFIA assistance.

Eligible project costs are those expenses associated with the following:

• development phase activities, including planning, feasibility analysis, revenue forecasting, environmental review, permitting, preliminary engineering and design work, and other pre-construction activities;

• construction, reconstruction, rehabilitation, replacement, and acquisition of real property (including land related to the project and improvements to land), environmental mitigation, construction contingencies, and acquisition of equipment; and

• capitalized interest necessary to meet market requirements, reasonably required reserve funds, capital issuance expenses, and other carrying costs during construction.

Any deferrals of interest during the construction period may not be included as an eligible project cost. Likewise, if TIFIA credit assistance is provided for a project financing, capitalized interest may not be included as an eligible project cost.

=> What are the major conditions for TIFIA assistance?

The major requirements for TIFIA program include:

• Application Submission. Each project sponsor must submit a project application. (An application package is included in DOT's TIFIA Program Guide, available at http://tifia.fhwa.dot.gov.)

• Total Eligible Costs. The project's eligible costs must be reasonably anticipated to total at least $50 million, or, alternatively, at least one-third of the State's Federal-aid highway apportionments for the most recently completed fiscal year, whichever is less. For projects that principally involve Intelligent Transportation Systems (ITS), eligible project costs must be reasonably anticipated to total at least $15 million.

• Transportation Planning Process. In metropolitan areas, the project must be reflected in the financial plan that accompanies the Metropolitan Planning Organization's (MPO) long-range transportation plan and Transportation Improvement Program (TIP). In addition, the project must be included in the approved Statewide Transportation Improvement Program (STIP).

• Dedicated Revenue Sources. Project financing must be repayable, in whole or in part, from "tolls, user fees and other dedicated revenue sources." Federal policy precludes a pledge of Federal funds as repayment for a TIFIA credit instrument.

• Credit Rating: Projects selected for TIFIA assistance must receive an investment grade rating BBB from Standard & Poor's, Fitch Ratings or Dominion Bond Rating Service, or Baa3 from Moody's on their senior debt obligations.

• Amount of TIFIA Credit Assistance: The principal amount of TIFIA credit assistance, in any combination of the instruments above, cannot exceed 33 percent of the reasonably anticipated eligible project costs.

• Nonsubordination of Lien in Event of Bankruptcy. Although the TIFIA claim on project revenues can be subordinated to those of senior lenders, it cannot be subordinated in the event of bankruptcy, insolvency or liquidation of the obligor. In such an instance, the TIFIA lien would be on parity with senior creditors.

=> What Federal requirements apply to TIFIA projects?

Elements of a project receiving TIFIA credit assistance include complying with the requirements of Federal laws that apply to federally-assisted projects. These requirements are discussed more extensively in Section III of this Manual. Nonetheless, the application of Federal construction requirements under the Federal-aid Highway Act is limited to the specific activity or contract carried out with Federal funds. They do not apply to other parts of the project not financed with Federal funds. These construction requirements include:

• Procurement. Procedures related to procurement of engineering, design and construction services, and the purchase of materials.

• Construction. Labor and employment rules apply to all workers involved in constructing a Federal-aid project.

Other Federal requirements outside of the Federal-aid Highway Act, such as Federal environmental laws, the Uniform Relocation Assistance and Real Property Acquisition Policies Act, and Federal non-discrimination laws still apply to the entire project.

However, if a project sponsor wishes to advance specific contracts without following Federal requirements, then the costs associated with the particular contracts may not be taken into account in meeting the TIFIA cost threshold, and such costs would be treated as TIFIA ineligible costs. Further, such costs would not be eligible for reimbursement with TIFIA funds. The application of Federal construction requirements on a contract basis may serve to foster Public-Private Partnership initiatives that combine TIFIA assistance with capital markets financing, one of the goals that Congress established for the TIFIA program.

=> How does a project sponsor apply for TIFIA assistance?

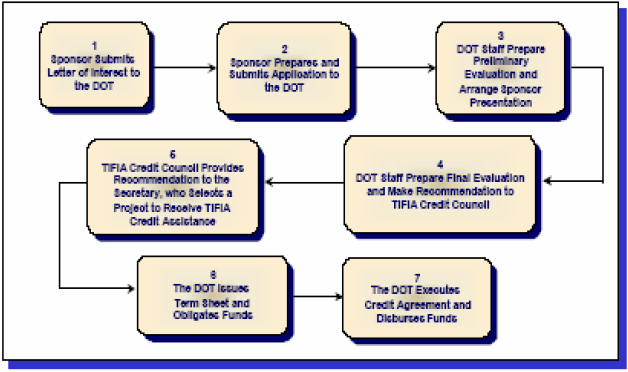

Each project sponsor must apply to the U.S. DOT first by submitting a Letter of Interest, and then completing a TIFIA application form. Application forms can be obtained at http://tifia.fhwa.dot.gov. U.S. DOT will evaluate the project based on selection criteria (see Chapter 5 of the TIFIA Program Guide for more information on the selection criteria). The TIFIA office encourages potential project sponsors to contact the office directly for informal discussions prior to submitting a Letter of Interest.

If selected, appropriate contractual documents will be prepared and executed to establish the TIFIA credit and to disburse funds. See Figure 3 below describing the process for applying for TIFIA assistance. The TIFIA Program Guide is available at http://tifia.fhwa.dot.gov/pguide.htm.

Figure 3: Process for TIFIA Application

More information on the TIFIA program can be found in the TIFIA Report to Congress, June 2002, at http://tifia.fhwa.dot.gov, and in Chapter 2 of the U.S. DOT Report to Congress on Public-Private Partnerships, at http://www.fhwa.dot.gov/reports/pppdec2004/index.htm#2cv3.