Breakdown of bid costs

There is a similarity between design related costs, for social infrastructure projects, in Australia (c. 55%), the UK (about 65%) and Canada (about 50%) with about 50% to 70% of design related costs spent before announcement of a preferred bidder. Therefore, any strategies adopted that might reduce bidders' design costs should have a significant impact on the level of bidders' costs 'at risk'.

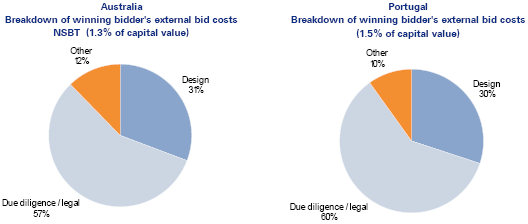

For road projects, there appears to be a similarity between Australia and Portugal in terms of the level of costs incurred and the breakdown, as depicted in the graphs below.

|

| |

| Source: Presentation by Peter Hicks from Leighton Holdings Limited - Overseeing Queensland's largest PPP project (27 February 2007) | Source: KPMG research |

Protracted and uncertain procurement process (specifically in respect of procurement milestones)

Canada (using in essence the same procurement process as Australia) has been able to reduce the time from release of EOI to financial close over the last three years (from an average of about 18 months to about 16 months). Canadian market participants consider the interactive tender process as instrumental in enabling Canada to emerge as a leader in PPP, with projects regularly closing with little to no scope creep post-selection and with little use of additional bid stages. Canada has offered the bidding community clarity on timeline, and recent projects have reached financial close an average of four months or less from RFP submission.

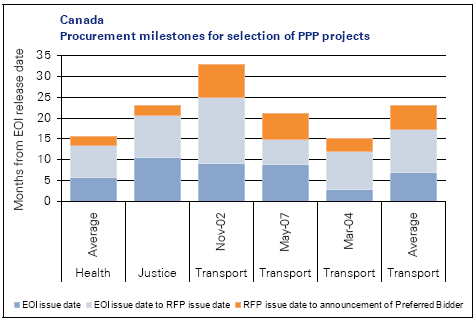

The graph below depicts the procurement timelines for PPP projects closed in Canada (based on a random sample of projects 20 ).

Source: KPMG research, based on a random sample of projects from the Infrastructure Journal database

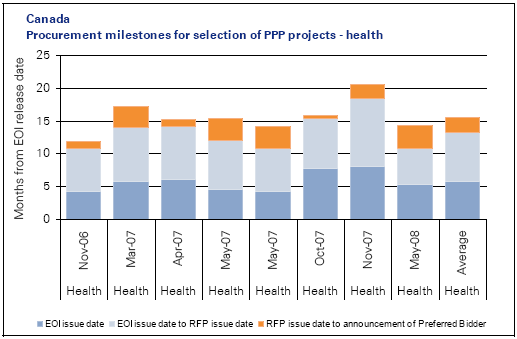

Source: KPMG research, based on a random sample of projects from the Infrastructure Journal database

The above graphs show that Canada has been able to close its latest health PPP projects on average within 16 months, without significant variations, but with a significant longer period used for transport projects.

Australia's recent average social infrastructure PPP procurement times (of 14 to 19 months) are significantly shorter than those in the UK, where procurement timeframes averages between 18 and 60 months21; and are comparable to Canada (with both these countries using effectively the same procurement processes as Australia).

Our review of international jurisdictions suggests that several strategies are important to achieve tighter timeframes, reducing the need for more than one priced bid stage while maintaining good value for money:

• obtaining commitment to the project from all key stakeholders at an early stage

• developing better output specifications, including greater dialogue with potential bidders about the design of assets, before approaching the market

• having detailed guidance on the Interactive Tender Process and regularly disseminating lessons learnt and "good practices", enabling a structured process of learning and sharing

• ensuring that probity processes, while appropriately conducted, allow the effective working of the interactive tender process

• identifying lessons from recently closed PPP projects of relevance to subsequent projects, revising sector-specific guidance and standard specifications where new issues recur

• considering how to facilitate the retention of existing skills in complex procurement across the public sector, promoting an attractive career path backed by a structured training and development programme

• undertaking good forward planning in the procurement phase, including early risk assessment, thorough due diligence, and robust output specifications

• only using a further bid stage where absolutely necessary because of changed market conditions or where no bidder has made an acceptable proposal.

Some Australian Governments already undertake these actions to a greater or lesser extent, but there are variations between jurisdictions and projects.

PPP procurement processes are shorter (and less complex) in Spain (5 - 8 months) and Portugal (about 12 months) than in Australia, but are not directly comparable, as their Governments' aims for PPPs differ from those in Australia. Shorter procurement timeframes are not desirable in Australia if they are at the expense of the overall value for money and innovation achieved by projects.

__________________________________________________________________________________

20 Source: KPMG research, based on a random sample of projects from the Infrastructure Journal database

21 Tendering periods in the UK average about 34 months (25 months average for PPP schools, 38 months for PPP hospitals and 47 months for other PPP projects). Source: Report by the National Audit Office - Improving the PPP tendering process (8 March 2007)