Assessment of options

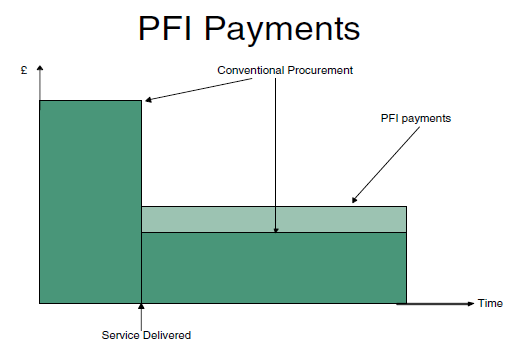

1. PFI contracts are generally long term arrangements involving public expenditure over extended periods, often for 30 years or more. The public sector does not have to find the money up-front to meet the initial capital costs. But the cash payments thereafter will generally be higher than in an equivalent conventionally-financed project (Figure 1). The PFI approach can enable departments to undertake projects which they would be unable to finance conventionally since they do not need to find all the money for the capital asset during its construction. PFI deals can therefore be attractive in the short term. But there is a risk that this attractiveness may distort priorities in favour of those projects which are capable of being run as PFI projects.

Figure 1: Timing of payments under the PFI and conventional procurement

Note: In conventional contracts the private sector is paid for the construction of the asset and the public sector makes separate arrangements for the ongoing maintenance and operation of the asset. In PFI contracts the private sector is paid on the basis of the service provided over the lifetime of the contract. The regular unitary charge paid to the contractor is intended to cover the cost of construction, maintenance and operation of the asset.

Source: National Audit Office

2. Since the Government can borrow money at lower interest rates than private companies, PFI deals will generally cost more to finance than publicly funded projects. For the PFI route to be worthwhile, the higher financing costs and any other potential disadvantages need to be more than outweighed by the benefits achieved. Such benefits might include a better allocation of risk between the public and private sectors; improved delivery as a result of the incentives offered to private contractors through the payment mechanism; and closer integration between design, construction and operation. Some of the potential benefits and disbenefits of PFI deals are shown in Figure 2.

Figure 2: Potential benefits and disbenefits of PFI deals

Benefits | Disbenefits |

There can be greater price certainty. The department and contractor agree the annual unitary payment for the services to be provided. This should usually only change as a result of agreed circumstances. | The department is tied into a long-term contract (often around 30 years). Business needs change over time so there is the risk that the contract may become unsuitable for these changing needs during the contract life. |

Responsibility for assets is transferred to the contractor. The department is not involved in providing services which may not be part of its core business. | Variations may be needed as the department's business needs change. Management of these may require re-negotiation of contract terms and prices. |

PFI brings the scope for innovation in service delivery. The contractor has incentives to introduce innovative ways to meet the department's needs. | There could be disbenefits, for example, if innovative methods of service delivery lead to a decrease in the level or quality of service. |

Often, the unitary payment will not start until, for example, the building is operational, so the contractor has incentives to encourage timely delivery of quality service. | The unitary payment will include charges for the contractor's acceptance of risks, such as construction and service delivery risks, which may not materialise. |

The contract provides greater incentives to manage risks over the life of the contract than under traditional procurement. A reduced level or quality of service would lead to compensation paid to the department. | There is the possibility that the contractor may not manage transferred risks well. Or departments may believe they have transferred core business risks, which ultimately remain with them. |

A long-term PFI contract encourages the contractor and the department to consider costs over the whole life of the contract, rather than considering the construction and operational periods separately. This can lead to efficiencies through synergies between design and construction and its later operation and maintenance. The contractor takes the risk of getting the design and construction wrong. | The whole life costs will be paid through the unitary payment, which will be based on the contractor arranging financing at commercial rates which tend to be higher than government borrowing rates. |

Source: National Audit Office

3. Before embarking on the PFI route, departments need to consider the available options for financing their projects. As well as the PFI, the options may include other types of partnership arrangements with the private sector and various forms of conventional finance. The assessment should include a realistic and comprehensive analysis of costs, benefits and risks. Such appraisals are not always being done adequately, however, with the PFI option too often being seen as the favoured route before a proper assessment has been carried out.

4. The question also arises as to whether the benefits of the PFI approach-particularly the use of private sector skills and the more appropriate allocation of risk-are sufficient to justify the extra cost of using private finance. One of the valuable features of private sector financing of PFI projects is the extensive due diligence that private sector risk-takers carry out. But the returns to financiers need to be commensurate with the risks that they are actually taking and this in turn depends on the market being well informed and truly competitive. External financing of PFI projects could be good value if the extra costs are justified by the risks transferred and if due diligence serves to manage those risks more effectively. But it is also possible that these benefits could be obtained more cheaply through alternative forms of financing. A thorough evaluation of the advantages and disadvantages of possible alternative financing structures for PFI deals is needed.